Whether you are a newcomer to the crypto world or an experienced player, mastering these [10 Rules of Trading] combined with the White Three Soldiers Strategy can achieve excess returns that are not out of reach!

My Practical Experience

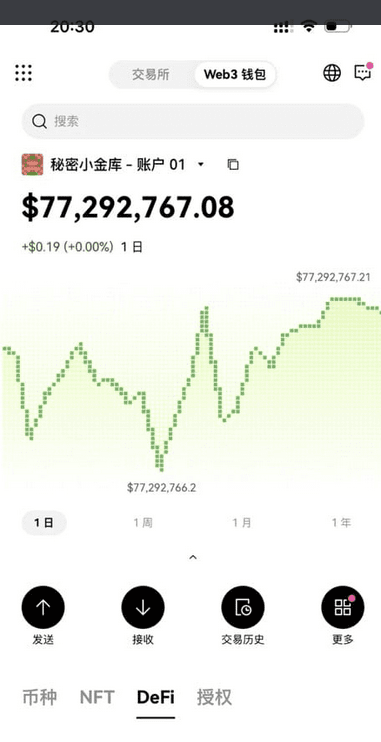

Currently residing in Guangzhou, owning two properties (one for residence, one for family) and two luxury cars (Maserati and Mercedes GLS). All of this comes from my accumulation in the crypto world: starting with a principal of 300,000, dipping to 60,000 at the lowest, and ultimately achieving tens of millions in assets by strictly adhering to trading discipline. The most brilliant achievement was a 400-fold return within 4 months, earning a profit of 40 million!

10 Rules of Trading

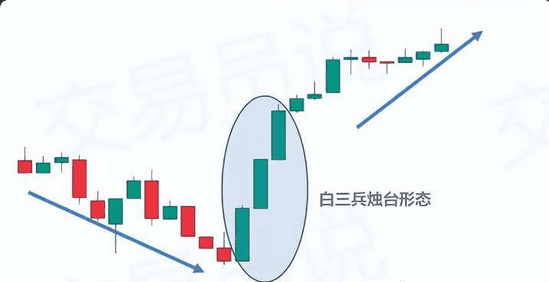

Trend Reversal Signals: In a downtrend, three consecutive bullish candles rebound, or in an uptrend, the bearish candle pullback does not exceed three consecutive bearish candles; these require special attention

Volatility Breakthrough Strategy: Prepare for a breakthrough when volume increases and price stabilizes; plan ahead when two bullish volumes exceed bearish volume

Holding Discipline: Firmly hold as long as the daily line does not break the rising moving average; do not be disturbed by indicators

Candlestick Combination: Medium Bullish Candle + Two Doji Candles = Continuation Signal

Contrarian Thinking: The market often moves against consensus; maintain independent thinking

KDJ Application: J Line < -12 indicates a short-term rebound, wait for confirmation signals

Breakthrough Characteristics: A bullish candle turnover rate of around 8% is a healthy attack volume

Position Management: Always keep spare funds and control risk

Mind Adjustment: Stay rational, do not be influenced by emotions

Continuous Learning: Open communication, draw from others' experiences

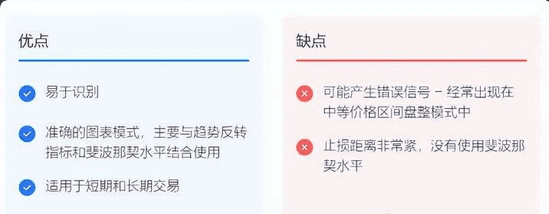

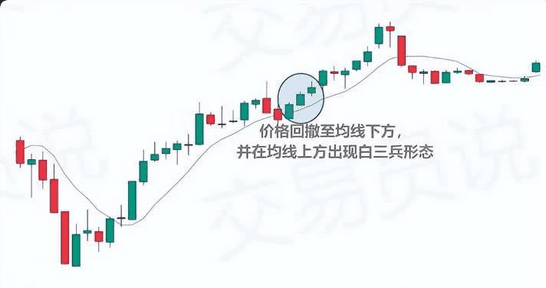

Detailed Explanation of the White Three Soldiers Strategy

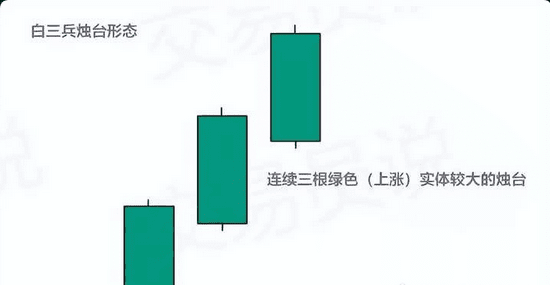

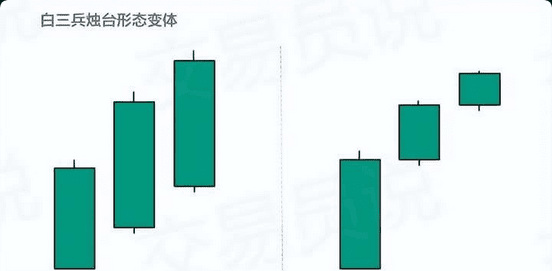

Pattern Characteristics:

Three consecutive bullish candles at the end of a downtrend

Long body, short shadow

Presenting the prototype of a "V"-shaped reversal

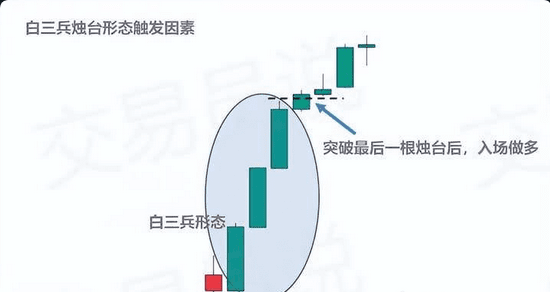

Trading Strategy:

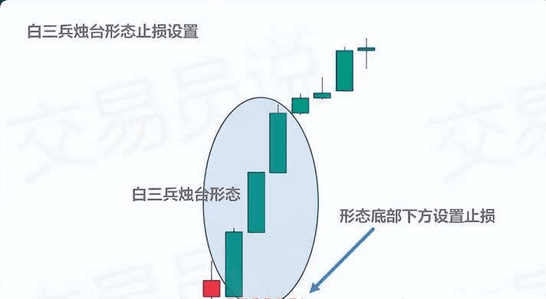

Basic Version: Enter at the high point of the third bullish candle, set stop-loss at the low point of the first bullish candle

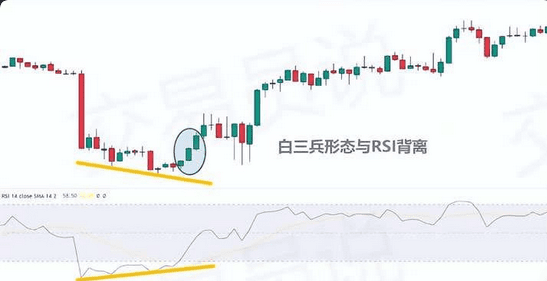

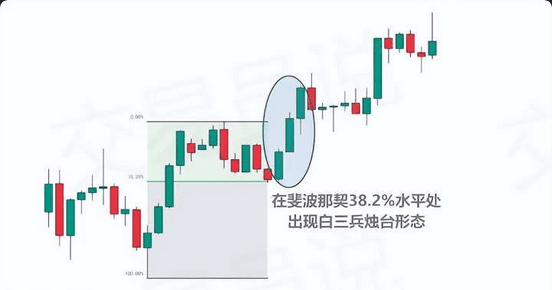

Enhanced Version:

Combine RSI/KDJ Oversold Signals (RSI<30, KDJ<20)

Fibonacci Retracement Levels (61.8%, 78.6%) appearing with patterns are more reliable

The success rate of patterns near moving average support levels (such as 30/60-day moving averages) is higher

Notes:

The historical win rate of this pattern is 84% (Bulkowski Data)

Must be verified with volume (higher volume during a breakout is better)

Avoid blind usage in a volatile market

Trading Mindset

The market is like a battlefield, requiring discipline akin to "Wind, Forest, Fire, Mountain":

Swift as Wind (Quick Execution)

Stable as Forest (Steady Layout)

Swift as Fire (Decisive Take Profit)

Still as Mountain (Strictly Adhere to Discipline)

Remember: Excellent traders are like seasoned fishermen, knowing to rest during stormy seasons and wait for the best opportunity to strike. After mastering these methods, it is recommended to first verify with small funds in a simulated environment before applying them in real practice.

(Disclaimer: The market has risks, and investment must be cautious. This article is only a sharing of experiences and does not constitute investment advice.)#GENIUS稳定币法案 #币安HODLer空投C #山寨币突破 #ETH突破3600 #美国众议院通过三项加密货币法案