$BTC $ETH here's today's crypto Market Update 22 June 2025.

Market Summary

Overall market cap dropped to around $3.14 trillion, down ~2.4% in the past 24 hours .

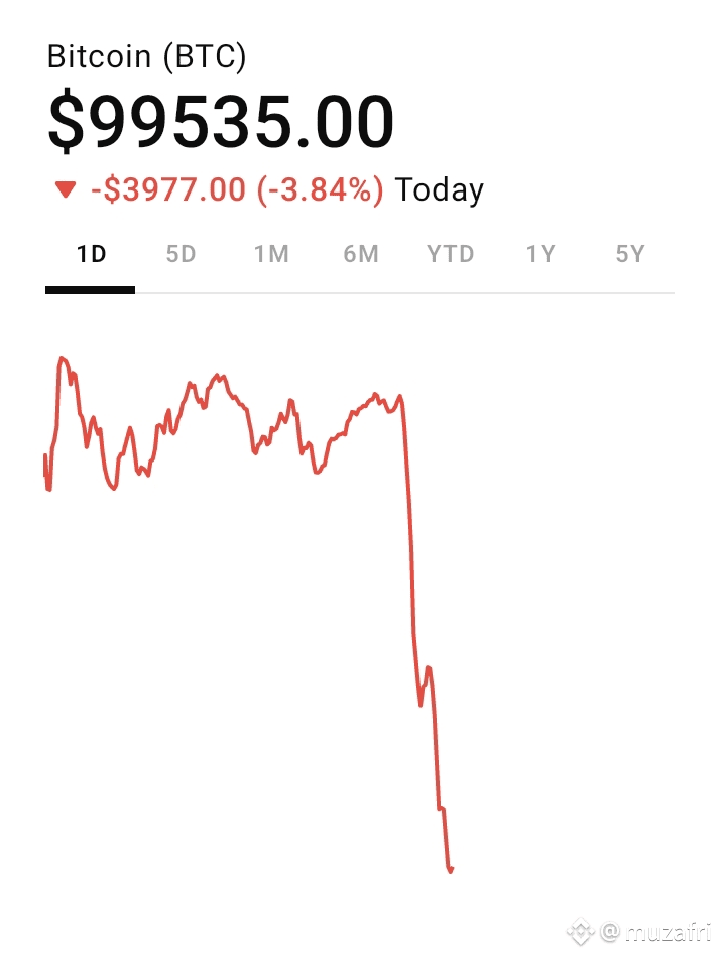

Bitcoin (BTC) fell amidst geopolitical concerns—U.S. strikes on Iran, fears of broader conflict—testing the critical $100 K support level .

Ethereum (ETH) is also down 7–10%, currently trading near $2,200, pressured by the same risk-off sentiment .

Altcoins like XRP, Solana, Cardano, and Dogecoin are off by 7–15%, led by XRP’s ~9% drop following the geopolitical turmoil .

Liquidations across crypto exchanges have been significant—hundreds of millions wiped out as automated stop-losses kicked in .

Key Drivers

1. Geopolitical Risk Surge

U.S. airstrikes on Iranian nuclear sites on June 22 triggered risk-off mode, boosting safe-haven assets (gold, USD) at the expense of crypto .

2. Technical Breakdown

BTC dipped to test its 20‑day lower Bollinger Band (~$101K), with MACD and RSI oversold—signaling a possible short-term rebound unless support fails .

Analysts caution that a failure below $100 K could spark deeper corrections .

3. Sentiment & Institutional Signals

Influential traders and institutions (e.g., AltcoinGordon, Liquidity Doctor) report increased volatility and shifting market psychology—this week may be pivotal .

⏳ Outlook & Watch‑Points

Key support zones:

**$100 K for BTC**, $2,200–$2,300 for ETH. A break below could intensify selling.

Potential bounce:

If markets stabilize, expect short-covering rallies. Watch for trade volume and technical oversold signals signaling a reversal.

Institutional influence incoming:

Volatility hints from BlackRock-linked sources may presage further moves depending on ETF or policy developments .

Geopolitical news & macro correlations:

Crypto remains tied to global risk sentiment—renewed Iran tensions or a stock market slump (notably Nasdaq) could amplify moves .

🔍 Actionable Insights

Traders:

Monitor liquidation heatmaps and order-flow. Consider entering on technical oversold bounces, with tight risk controls if $100 K breaks.

Long-term investors:

If you’re holding Bitcoin or Ethereum near support and can weather volatility, dips could

present accumulation opportunities—especially if geopolitical tensions ease.