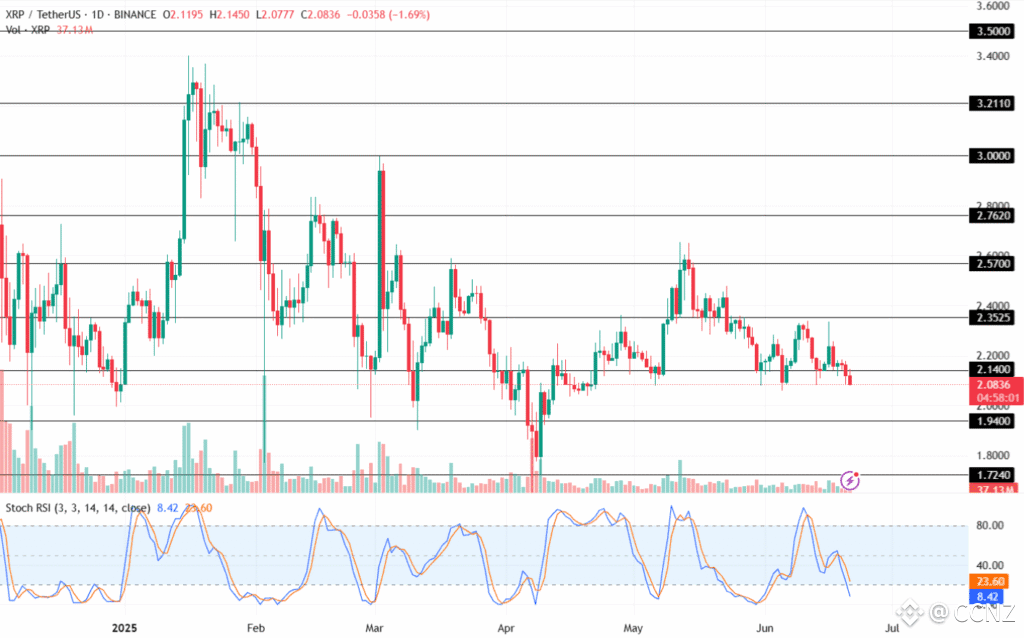

XRP is currently consolidating just below the pivotal $2.08 resistance level. A decisive close above this point, especially on the 12-hour chart, could trigger renewed bullish momentum.

Technical analysis shows a symmetrical wedge pattern forming, indicating potential for a breakout. If buyers regain strength, the next targets are $2.30–$2.33, with $2.65 as a longer-term bullish objective.

Intraday data reveals persistent sell pressure, with XRP unable to reclaim $2.03. The formation of lower highs and volume imbalance suggests vulnerability, with a risk of retesting $1.90 or even dropping toward $1.47 if support fails.

XRP has completed a retest of its previously defined support zone, aligning with the technical expectations outlined in early June. The price respected the lower boundary of the zone near $1.90 and has since recovered slightly, positioning itself just below the $2.08 resistance. This level now stands as a critical pivot point for XRP’s near-term direction.

A close above $2.08 within the upcoming trading sessions, particularly within a 12-hour timeframe, could signal the re-emergence of bullish momentum. Technical indicators and chart structures suggest that such a move may open the path toward a stronger recovery phase. On the other hand, if XRP fails to regain this level, it may revisit the support zone around $1.90, which could place additional pressure on market sentiment and price action.

Chart Structure Highlights Key Breakout Zones

The latest 12-hour chart analysis identifies a symmetrical wedge formation, with XRP consolidating near the lower trendline. The price currently trades around $2.03, marginally beneath the $2.08 resistance. The symmetrical wedge pattern generally precedes a decisive price move, and in this case, the breakout direction remains uncertain.

Should bulls regain control and push the asset above $2.08, the next resistance zone lies between $2.30 and $2.33. A breakout into this narrow band may indicate a continuation of positive momentum. Beyond that, the macro resistance at $2.65 remains a longer-term target that would signify a potential reversal in broader trend structure.

The recent session intraday data indicate that XRP started the previous day at 2.0761, and it has moved downwards to 2.0145. The session was marked by steady selling pressure and low recovery power, as seen in price action as well as in the down movement of the MA deviation values. Volume was certainly high, however, at over 2 million, but of a greatly skewed nature on the sell side.

The fact that it has failed to retake the 2.03 region and also that there are new low highs indicates that the short-term mood is quite weak. When buyers got decimated, a new challenge of the $1.90188 occurred, and more dangers are in extending up to 1.47 in case more extensive support breaks.

<p>The post XRP Bulls Eye $2.30 After Critical Retest but Downside Risks Remain first appeared on Coin Crypto Newz.</p>