On Wednesday, leading cryptocurrency BTC broke above the psychologically significant $110,000 price level for the first time. This triggered a surge in demand for the coin from US Bitcoin traders, both in the spot markets and in the form of associated investment products.

With a strengthening bullish bias, the king coin is poised to resume its uptrend and touch new price peaks in the near term.

Bitcoin Sees Renewed US Interest

According to CryptoQuant, as BTC’s price surged yesterday, its Coinbase Premium Index (CPI) also spiked to its highest level in 24 days, reflecting heightened demand for the coin from US traders.

Bitcoin Coinbase Premium Index. Source: CryptoQuant

Bitcoin Coinbase Premium Index. Source: CryptoQuant

BTC’s CPI measures the difference between the coin’s prices on Coinbase and Binance. When its value climbs above zero, it suggests significant buying activity by US-based investors on Coinbase.

Conversely, when it declines and drops into negative territory, it signals less trading activity on the US-based exchange.

The jump in BTC’s CPI to a 24-day high reflects growing bullish sentiment in the market. It indicates that traders are willing to pay a premium to buy BTC on Coinbase. In the short term, this surge in demand can help drive up the coin’s value.

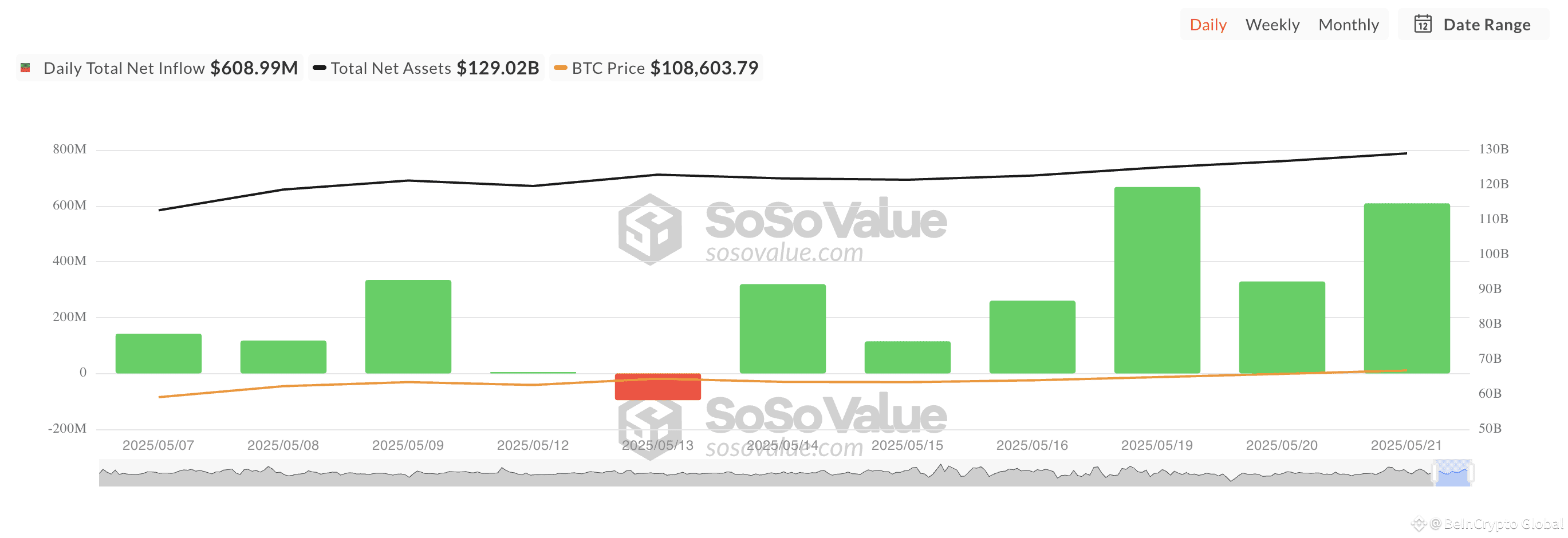

Adding to this bullish momentum, BTC spot exchange-traded funds (ETFs) recorded a significant spike in inflows yesterday, totaling $609 million. This marked an 85% increase from the $329.02 million recorded in inflows on Tuesday and represented the sixth consecutive day of net positive flows into these funds.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

Together, these trends suggest a surge in interest in BTC from retail and institutional investors based in the US, as demand grows across spot markets and regulated investment vehicles.

BTC Trades Near Record High With Strong Buying Pressure Intact

At press time, BTC trades at $111,139. While it has noted a 1% dip from its new all-time high of $111,888, bullish pressure persists.

On the technical side, BTC’s Chaikin Money Flow (CMF) on the daily chart remains firmly in positive territory, signaling continued buying pressure. At press time, this indicator, which measures money flow into and out of the coin, is at 0.30.

If the momentum holds, the coin may soon revisit and surpass its newly set price record.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

On the other hand, if sell-offs strengthen, BTC’s value may dip to $103,882.