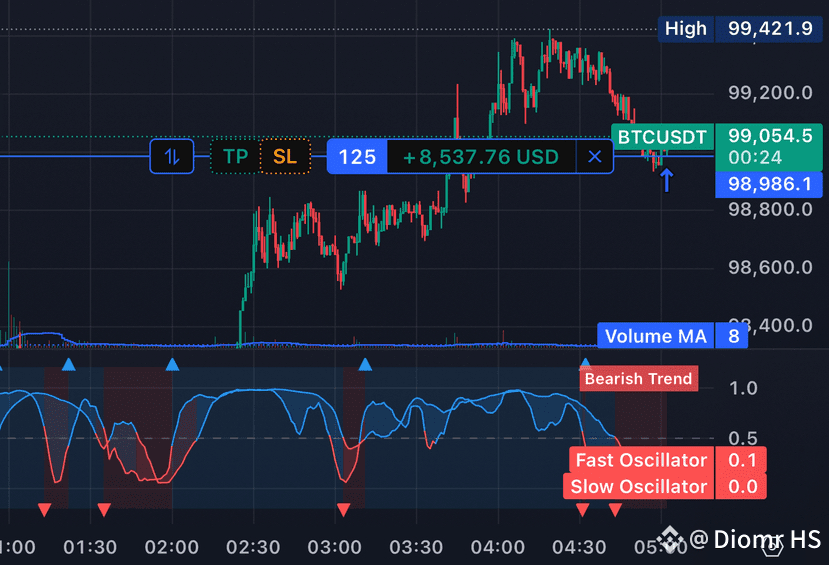

Timestamp: May 8, 2025 – 13:15 (UTC+8)

Position: Long

Entry Time: 13:02:00

Entry Price: 98,986.1 USDT

Position Size: 125 $BTC

Current Price: 99,090.0 USDT

Unrealized P&L: +12,987.89 USD

Leverage: 10x

1. Trade Rationale

After BTC experienced a sharp pullback from the 99,400 zone, price action showed signs of stabilization around 98,800. I executed a long position at 98,986.1, anticipating a technical rebound. The entry was near the lower support range, offering a favorable risk-reward setup. This was a calculated counter-trend buy targeting the short-term bounce.

2. Market Context

Trend Structure:

Following the early morning surge and subsequent pullback, BTC entered a consolidation phase. By early afternoon, bullish momentum resumed, pushing prices back toward 99,100, suggesting bulls are regaining short-term control.Technical Indicators:

The fast/slow oscillators are beginning to converge after a bearish crossover, indicating waning downward momentum. Volume is recovering modestly, though a breakout still requires stronger participation.Key Levels:

Resistance: 99,300 / 99,420 (yesterday’s high)

Support: 98,800 / 98,600 (key defense levels)

3. Active Strategy

Short-Term Plan:

Consider partial take-profit if price breaks above 99,300. Hold remaining position toward 99,420.Risk Management:

If price falls below 98,850, plan to exit and secure profits to avoid potential reversal losses.Execution Discipline:

No chasing. Stick to the plan. Manage exits in layers.

4. Summary & Reflection

This trade was based on a clear market structure and executed with precision. The position was sized appropriately with well-defined risk parameters. With unrealized gains already materialized, the focus now shifts to exit discipline and profit protection as price approaches resistance zones.