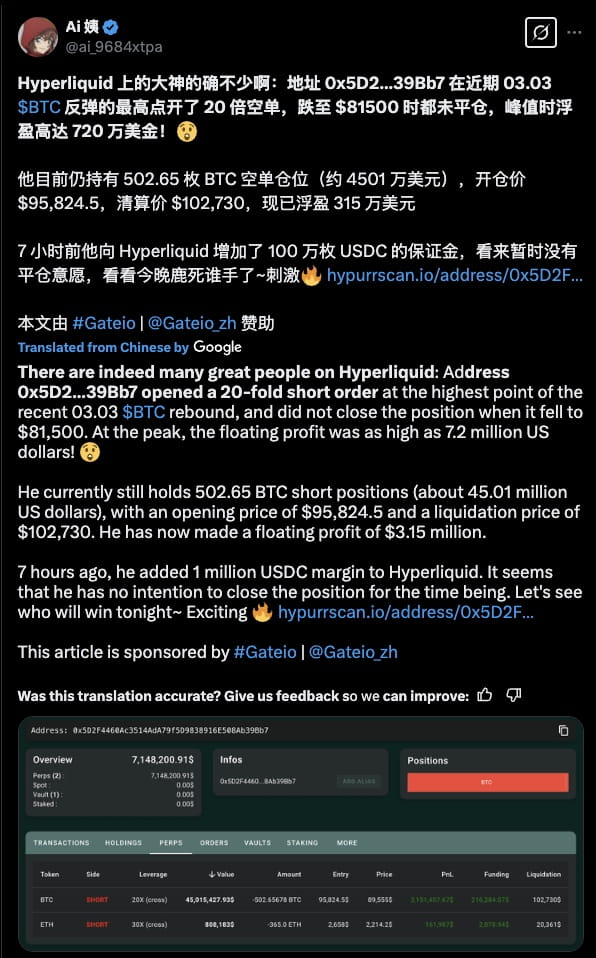

On March 3, a large BTC trader ("whale") opened a 20x leveraged short position at $95,824.5 on Hyperliquid, betting on a market downturn.

The trade initially generated a floating profit of $7.2 million at its peak when BTC dropped to $81,500, though the position remains open.

Current Status:

The whale’s short position is still active, with a current profit of $3.15 million.

The position size is 502.65 BTC (~$45.01 million nominal value).

The liquidation price is $102,730, meaning a BTC rally beyond this level would force the position to close at a loss.

Whale Adds 1 Million USDC in Margin – Risk Management or Extended Play?

Approximately 7 hours ago, the whale injected 1 million USDC into Hyperliquid, likely to:

Lower the risk of liquidation if BTC spikes above $100K.

Maintain margin requirements to keep the short position open longer.

Potentially add to the short position if BTC attempts another rally.