Spot Ether ETFs recorded $453 million in inflows on Friday, led by BlackRock’s ETHA, pushing total assets to $20.66B and extending their inflow streak to 16 days.

Key Takeaways

$453M poured into spot Ether ETFs on Friday, extending inflows to 16 straight days.

BlackRock’s iShares Ethereum Trust (ETHA) led with $440M, now holding $10.69B AUM.

Total net assets across Ether ETFs hit $20.66B, representing 4.64% of ETH’s market cap.

Spot Bitcoin ETFs added $130M after midweek outflows, bringing cumulative inflows to $54.82B.

Ether ETFs Hit $9.33B Cumulative Inflows

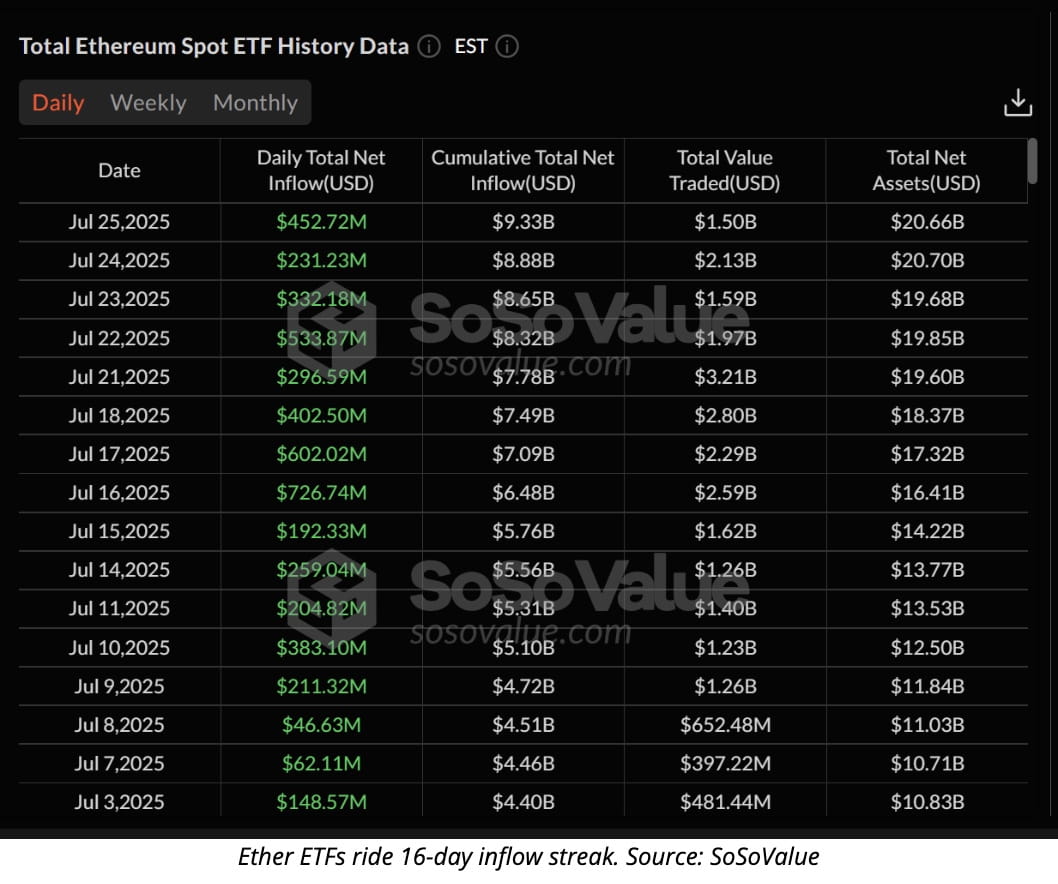

Spot Ethereum ETFs continue to dominate flows, pulling in $452.72 million on Friday, according to SoSoValue. The streak now stands at 16 consecutive trading days of inflows, with total cumulative inflows since launch reaching $9.33 billion.

BlackRock’s ETHA: $440.10M inflows (now $10.69B AUM)

Bitwise ETHW: $9.95M inflows

Fidelity FETH: $7.30M inflows

Grayscale ETHE: ‑$23.49M outflows (largest cumulative loss: $4.29B)

Ether ETF total net assets climbed to $20.66 billion, equal to 4.64% of ETH’s market cap.

Why Investors Are Pouring Into ETH

The streak — peaking with $726.74M in a single day on July 16 — reflects rising institutional demand for Ethereum’s:

DeFi leadership

Staking rewards

Smart contract adoption

Matt Hougan, CIO at Bitwise, noted on X that ETH ETF demand could hit $20B in the next year, equivalent to 5.33 million ETH at today’s prices. With Ethereum expected to issue only 0.8M ETH in that time, demand could outpace supply nearly sevenfold.

Bitcoin ETFs Rebound With $130M

Spot Bitcoin ETFs saw a $130.69M net inflow Friday after a volatile week marked by three straight outflow days (totaling over $285M).

Cumulative BTC ETF inflows: $54.82B

Total BTC ETF AUM: $151.45B

Despite midweek turbulence, July has featured standout sessions, including $1.18B (July 10) and $1.03B (July 11) in single‑day inflows.