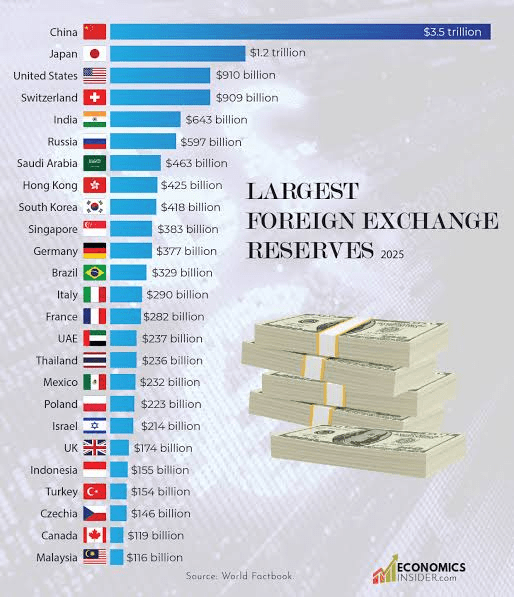

Hey, crypto fam! 📊 As we dive into 2025, let's break down the power players in global economics—the top 25 countries with the largest foreign exchange reserves! 💸 These reserves act as a financial safety net, influencing currency stability, trade strategies, and geopolitical clout. Here's the rundown:

1. China 🇨🇳

- Reserves: ~$3.45 Trillion USD

- Why: The world’s manufacturing hub and largest exporter, China hoards reserves to stabilize the Yuan and fuel Belt & Road investments.

2. Japan 🇯🇵

- Reserves: ~$1.38 Trillion USD

- Why: Heavy reliance on energy imports and aging population push Japan to maintain massive buffers.

3. Switzerland 🇨🇭

- Reserves: ~$1.04 Trillion USD

- Why: Safe-haven status and robust banking system attract global capital, boosting reserves.

4. India 🇮🇳

- Reserves: ~$680 Billion USD

- Why: Rapid growth and strategic import management (oil, tech) drive RBI’s aggressive hoarding.

5. Russia 🇷🇺

- Reserves: ~$650 Billion USD

- Why: Sanctions pressure and energy exports push Russia to prioritize financial defense.

6. Saudi Arabia 🇸🇦

- Reserves: ~$620 Billion USD

- Why: Oil wealth + Vision 2030 diversification = fortress-like reserves.

7. Taiwan 🇹🇼

- Why: Tech dominance and geopolitical risks mean bulking up reserves is non-negotiable.

- *Reserves:* ~$570 Billion USD

8. South Korea 🇰🇷

- Reserves: ~$530 Billion USD

- Why: Export powerhouse + North Korea tensions = high preparedness.

9. Brazil 🇧🇷

- Reserves: ~$380 Billion USD

- Why: Aggressive agri/energy exports and currency stabilization tactics.

10. Singapore 🇸🇬

- Reserves: ~$370 Billion USD

- Why: Global trade hub + MAS’s smart reserve management.

11. Germany 🇩🇪

- Reserves: ~$360 Billion USD

- Why: Eurozone anchor + industrial export might.

12. Italy 🇮🇹

- Reserves: ~$340 Billion USD

- Why: High debt levels make reserves a critical cushion.

13. France 🇫🇷

- Reserves: ~$330 Billion USD

- Why: Eurozone clout and colonial-era financial networks.

14. Thailand 🇹🇭

- Reserves: ~$320 Billion USD

- Why: Tourism + manufacturing = steady forex inflows.

15. Mexico 🇲🇽

- Reserves: ~$310 Billion USD

- Why: Nearshoring boom and oil exports lift reserves.

16. Indonesia 🇮🇩

- Reserves: ~$290 Billion USD

- Why: Commodity exports (palm oil, coal) + policy buffers.

17. Poland 🇵🇱

- Reserves: ~$270 Billion USD

- *Why:* EU integration + rising manufacturing sector.

18. Turkey 🇹🇷

- Reserves: ~$260 Billion USD

- Why: Strategic trade bridge (Europe-Asia-Middle East).

19. Malaysia 🇲🇾

- Reserves: ~$250 Billion USD

- Why: Tech exports and palm oil dominance.

20. Israel 🇮🇱

- Reserves: ~$240 Billion USD

- Why: Tech prowess + regional security risks.

21. Canada 🇨🇦

- Reserves: ~$230 Billion USD

- Why: Energy (oil, gas) + USMCA trade ties.

22. Australia 🇦🇺

- Reserves: ~$220 Billion USD

- Why: Iron ore, gold, and tourism inflows.

23. UAE 🇦🇪

- Reserves: ~$210 Billion USD

- Why: Oil wealth + Dubai’s global trade hub.

24. South Africa 🇿🇦

- Reserves: ~$200 Billion USD

- Why: Gold, diamonds, and critical minerals.

25. Philippines 🇵🇭

- Reserves: ~$190 Billion USD

- Why: OFW remittances + growing BPO sector.

🔍 *Key Takeaways for Traders & Investors:*

- USD Strength: Countries with higher USD reserves (like China/Japan) can manipulate currency pairs like USD/JPY or USD/CNY.

- Commodity Ties: Oil exporters (Saudi, Russia, UAE) vs. tech hubs (Taiwan, S. Korea)—diversify your plays!

- Emerging Markets: India, Indonesia, and Mexico are quietly amassing war chests—watch for policy shifts.

💡 Crypto Angle: Countries with weaker reserves might explore CBDCs or crypto adoption faster (e.g., El Salvador’s Bitcoin move).

📈 Stay Sharp: Forex reserves =/= national wealth, but they signal economic intent. Monitor geopolitical risks, inflation trends, and central bank moves for alpha!

_Data estimates as of Q1 2025. Dive deeper into charts, trade smart, and HODL tight! 🚀_

👉 Got a country you’re bullish on? Drop it in the comments! 🔥

#forex #Reserves #BinanceSquareFamily #CryptoMacroTrends #globaleconomy