Bitcoin ETFs extended their bullish run to nine consecutive days with $403 million in net inflows, while ether ETFs not only gained $192.33 million but also set a new record trading volume of $1.62 billion.

Bitcoin ETFs Record $403 Million in Inflows for 9th Consecutive Day, While Ether ETFs Set New Record

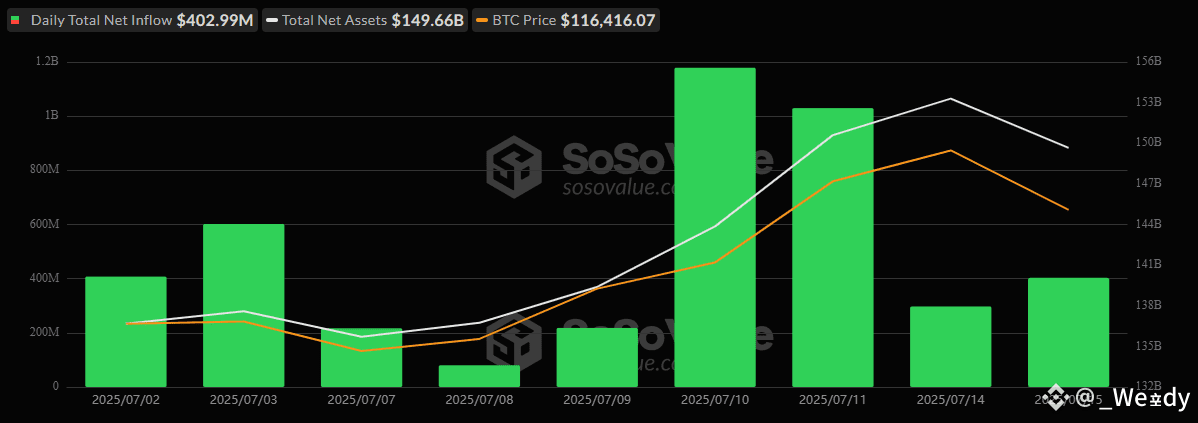

The momentum refuses to break. Institutional interest in crypto exchange-traded funds (ETFs) stayed red-hot as bitcoin ETFs logged a 9th consecutive day of inflows, pulling in $402.99 million. The heavy lifter once again? Blackrock’s IBIT, which absorbed $416.35 million, effectively powering the entire segment on its own.

Smaller gains followed: Vaneck’s HODL and Grayscale’s Bitcoin Mini Trust pulled in $18.99 million and $18.56 million, while Bitwise’s BITB and Franklin’s EZBC brought in $12.70 million and $6.76 million, respectively.

Not everything was green, though. Grayscale’s GBTC shed $41.22 million, with Fidelity’s FBTC and ARK 21Shares’ ARKB losing $22.93 million and $6.21 million, respectively. Still, the market remained firmly in the green, with total trading volume hitting $6.70 billion and net assets closing at $149.66 billion.

Source: Sosovalue

Meanwhile, ether ETFs continued their impressive streak with an 8th straight day of inflows, totaling $192.33 million. Blackrock’s ETHA was again the dominant player, raking in $171.52 million. Fidelity’s FETH added $12.22 million, and Grayscale’s Ether Mini Trust chipped in $8.59 million.

Perhaps more striking than the capital was the activity: total trading volume hit an all-time high of $1.62 billion, and net assets rose to $14.22 billion. For both bitcoin and ether ETFs, it’s not just consistency, it’s acceleration.