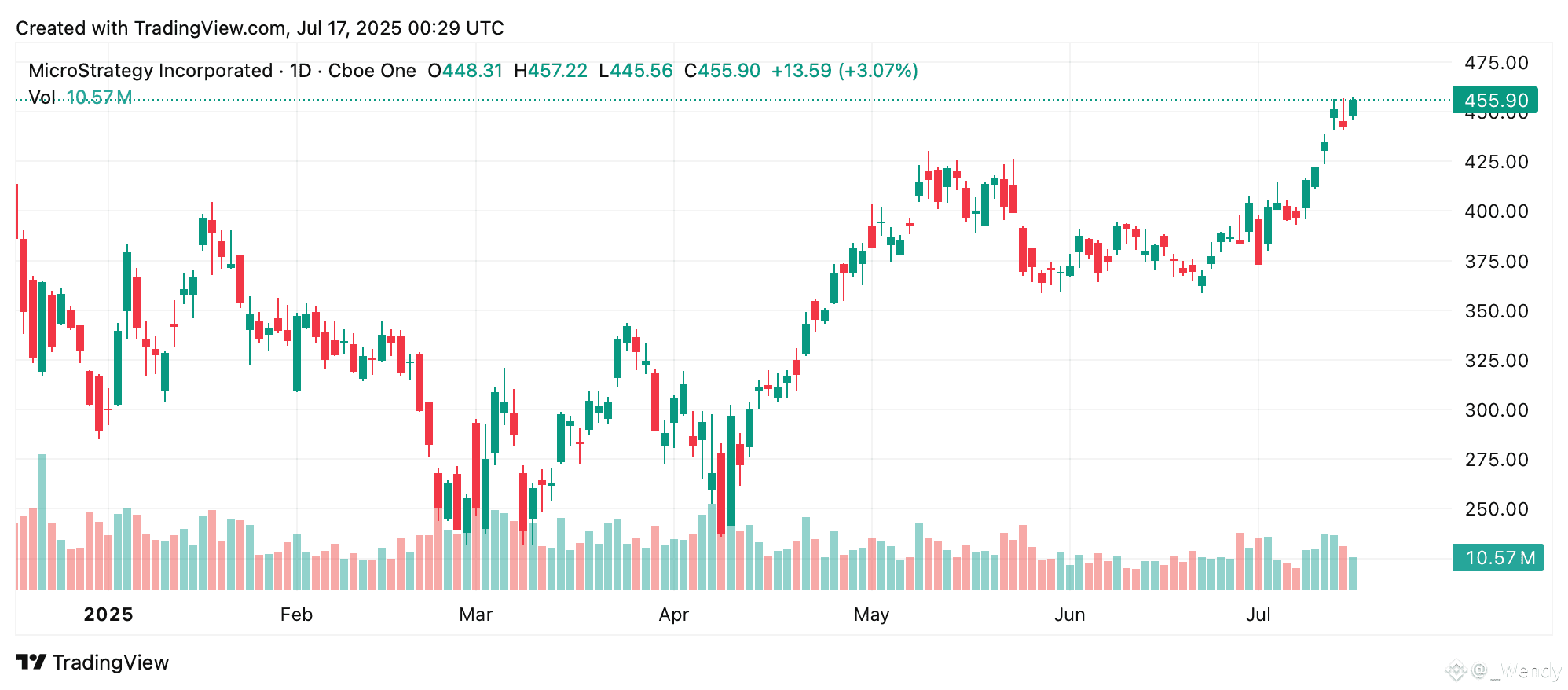

On Wednesday, shares of the business intelligence and bitcoin treasury firm Strategy climbed to a record $455.90, pushing the company’s market capitalization to a significant $124.64 billion.

Strategy’s Stock Hits New High Backed by Massive Bitcoin Treasury

Market stats reveal that Strategy’s MSTR shares on Nasdaq hit $455.90 at Wednesday’s close, rising more than 3% during the session. Over the past five trading days, MSTR gained 5.89%, with a monthly increase exceeding 17%. All-time figures show a staggering 3,699% gain since the company’s initial public offering (IPO) opening share price.

Strategy, originally known as Microstrategy Inc. before rebranding, went public on the Nasdaq stock exchange on June 11, 1998, with shares priced at $12. During the tech and internet boom of 2000, MSTR soared to $139 per share before plunging below $1 after 2001. For the following 19 years, MSTR struggled to rise above $20 and often traded below its initial $12 offering price.

In 2013, company founder Michael Saylor was widely recognized as a bitcoin skeptic, comparing it to gambling and predicting its failure. “Bitcoin days are numbered,” Saylor wrote on X at the time. “It seems like just a matter of time before it suffers the same fate as online gambling.” MSTR closed at $12.42 per share on the Nasdaq that day.

Seven years after that tweet, Saylor and his company embraced bitcoin, with him later stating he “forgot” he ever made that remark. In August 2020, the firm bought 21,454 BTC for about $250 million. Since then, it has steadily added to its holdings through dollar-cost averaging and now owns 601,550 BTC valued at $71.4 billion.

Strategy purchased the bitcoin for $43.324 billion, resulting in gains exceeding $28 billion. Thanks to this massive bitcoin accumulation, investors view MSTR as a leveraged proxy for bitcoin; when BTC rises, MSTR often outperforms thanks to both its holdings and the net asset value (NAV) premium regularly attached to the stock.

Still, not everyone is convinced—investors like Jim Chanos argue MSTR’s business model can’t last. People argue how Strategy specifically raises cash by issuing more stock or preferred shares—then using the proceeds to buy more bitcoin. Critics liken this repeated raise-buy cycle to a form of financial engineering that could spiral negatively if bitcoin drops or capital dries up. So far, MSTR’s stock has outperformed its doubters, with its bitcoin wager delivering a 65% gain.

#Binance #wendy #BTC $BTC