Welcome to follow our dealer dynamics analysis tool! This tool is designed to help you track the behavior of market dealers, identify trading opportunities, and manage your positions rationally. Whether you are a short-term trader or a long-term investor, you will gain valuable information from it.

💡 About data sources and principles If you are interested in the data sources and working principles of the tool, you are welcome to click on 'Data Source Disclosure' on the console page to learn more.

🔍 1. Query function description

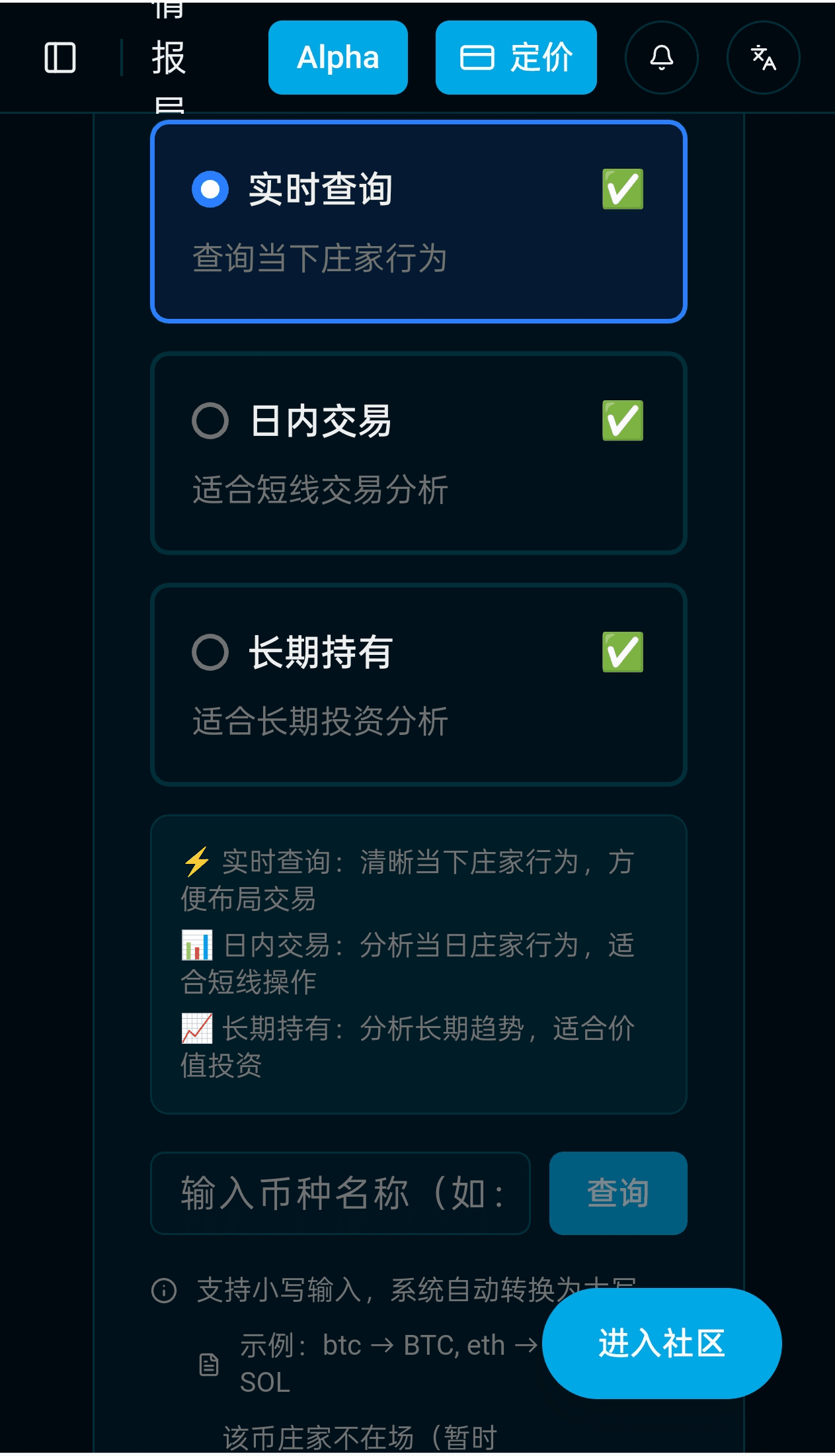

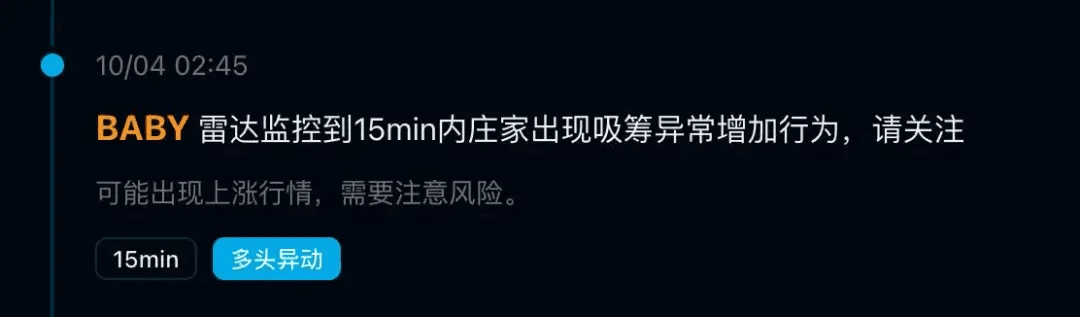

Real-time query (high-frequency dynamics)

Features: Real-time updates, suitable for quickly capturing dealer actions.

Purpose: Help judge intraday trading direction, suitable for short-term operations.

Corresponding K-line: 15 minutes

Intraday Trading Inquiry (Overall Trend)

Features: Reflects the dealer's overall actions within a day.

Purpose: As a reference for intraday trading direction.

Corresponding K-line: 1 hour

Long-term Holding Inquiry (Large-Level Layout)

Features: Track dealer's long-term actions, suitable for long-term investors.

Purpose: Used for large-level position layouts.

Corresponding K-line: Daily and above

🧭 Two, How to Use This Tool?

Look for trading opportunities

Input the cryptocurrency you are interested in to view dealer trends and judge whether it is suitable to enter based on real-time or intraday data.

Position Exit Decision

If your position has floating profits, you can refer to dealer trends to judge whether to liquidate, helping to choose a rational exit timing and avoid emotional decisions.

Risk Management and Stop Loss

If you have floating losses, checking dealer trends can help you determine whether the market is in a washout phase, avoiding premature stop-losses or blind holding due to emotions.

Calm Trading Emotions

Emotions often affect decision-making during trading. Use tools to observe dealer trends to help maintain calmness and make more rational decisions.

📈 Three, Recommended Trading Framework

High-Frequency Short-Line Framework (suitable for intraday trading)

Features: Conduct multiple trades within a day, quick entry and exit.

Suitable Audience: Traders familiar with technical analysis and able to monitor the market.

Risk Control: Strict stop loss, cautious operations.

Intraday Trading Framework (suitable for wave operations)

Features: Capture 1-2 intraday wave trends.

Suitable Audience: Traders who can adjust strategies based on intraday trading data.

Risk Control: Combine real-time queries and K-line structure for precise operations.

Long-Term Holding Framework (suitable for spot or long-term contracts)

Features: Focus on the market's long-term trend, avoid frequent operations.

Suitable Audience: Investors who focus on trend continuation.

Risk Control: Long-term layout, control positions, avoid frequent trading.

💡 Four, Tips for Using Tools

Data for Reference Only: All dealer trend data sources are public, but trading decisions still need to be based on personal analysis.

Trading has risks: Please control positions reasonably, set stop losses, and trade rationally.

🚀 Five, Quick Start If you are interested in market analysis and dealer behavior, you can use the tools we provide to obtain the latest trends. Whether for short-term fluctuations or long-term layouts, you can find suitable reference information.

🔔 Disclaimer

All content is for reference only and does not constitute any investment advice. Investment has risks; decisions should be based on personal analysis and risk tolerance.

If you have any questions or feedback, feel free to contact us! Wishing you smooth trading and lasting profits! 📈✨