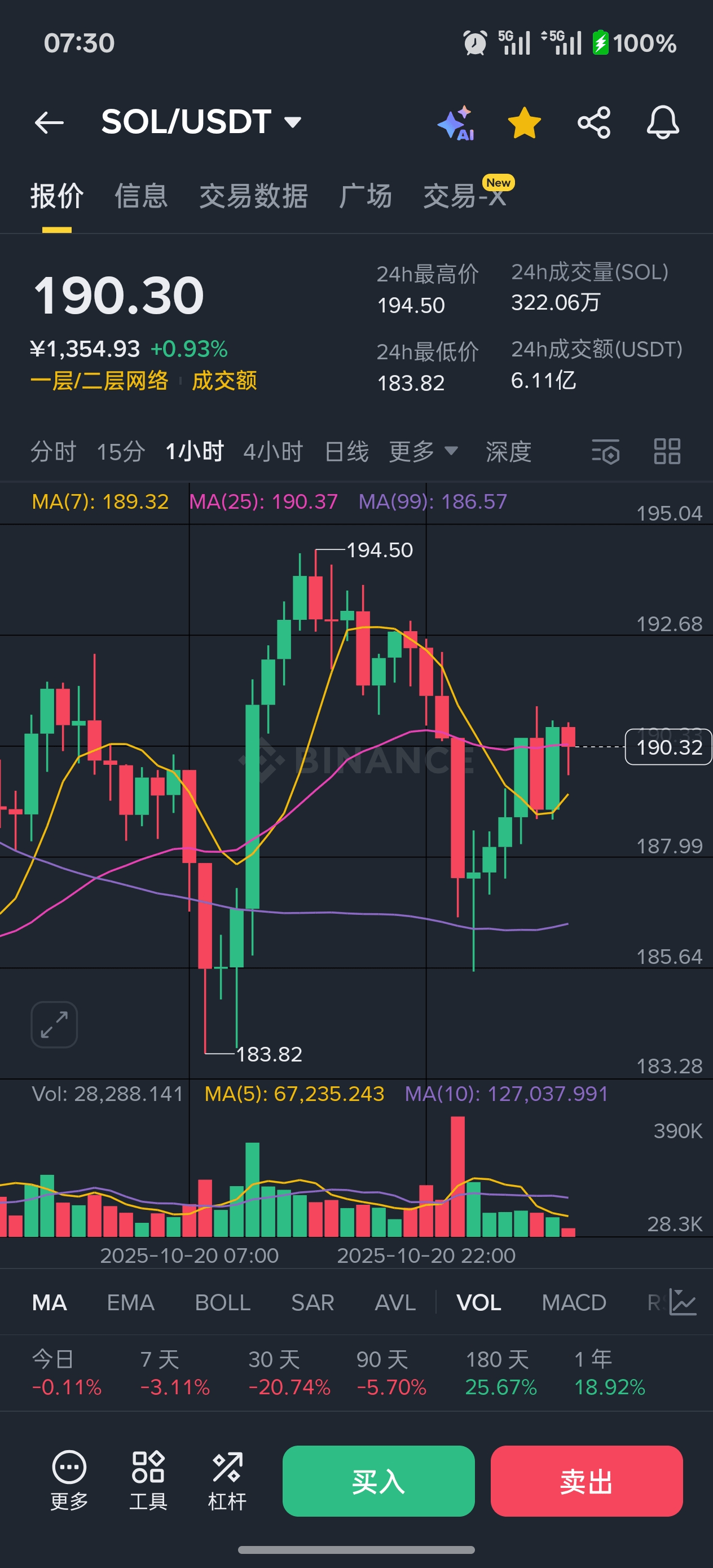

The current $SOL market gives a sense of calm before the storm. The price is repeatedly testing key areas, but if you feel carefully, the market sentiment is already different from a few days ago.

Several intriguing points:

1. Whether it is strong or not is seen as weak: In an atmosphere of generally expected positive developments, the price has struggled to rise several times, and the confidence of high-level buyers is clearly lacking. At such times, the script that most people expect often does not play out.

2. The breakdown of the long-short consensus: Previously, everyone believed that a pullback was an opportunity to buy, but now there are more and more people on the sidelines. This loosening of consensus itself is a signal.

3. Key Game Point: The most important thing right now is not how high it can rise, but how much support there is at the 190 level. If this is broken by a bearish candlestick, sentiment is likely to turn instantly.

In this ambiguous stage, my principle is not to shoot until I see the rabbit.

· I will not bet on that possible rebound, nor will I chase high during a low-volume rebound.

· I will patiently wait for the market to give its own directional choice. Upwards, we need to see a substantial breakout in volume; downwards, we must be alert to acceleration after support is lost.

· The core is summed up in one sentence: let the bullets fly for a while, don't earn the last penny, and don't take the first blow.

There are always opportunities in the market, provided you stay at the table. Control your position and restrain your hands; sometimes, waiting is the best strategy.