Key Takeaways

ETH surpasses $4,000 for the first time in eight months, up 3.5% in the past 24 hours.

ETH/BTC ratio nears yearly highs as Bitcoin dominance drops to 60.7%, with analysts warning of a possible long-term breakdown toward 40%.

Whale and institutional purchases — including $40.5M OTC buys and a $5B ETH treasury shelf filing — signal renewed confidence.

Altcoin rally widens: XRP +9%, SOL +3.5%, DOGE +5.3%.

Ether treasury stocks rise, with Bitmine Immersion +13% and Sharplink Gaming +4%.

ETH Hits Key Milestone Amid Altseason Strength

Ethereum’s native token ETH surged above $4,000 on Friday, its highest level since December 2024, according to Cointelegraph Markets Pro and TradingView. The move marks a 3.5% daily gain, lifting ETH’s year-to-date performance to +25% and its year-over-year return to +112%.

The rally comes as Bitcoin (BTC) trades flat near $116,800, pushing the ETH/BTC ratio up 3% in the past hour and 42% over the last month.

Whales and Institutions Accumulate ETH

Market observers point to growing whale and institutional activity:

A 10.4K ETH ($40.5M) OTC purchase by a large holder.

Fundamental Global Inc filing a $5B shelf offering to buy additional ETH.

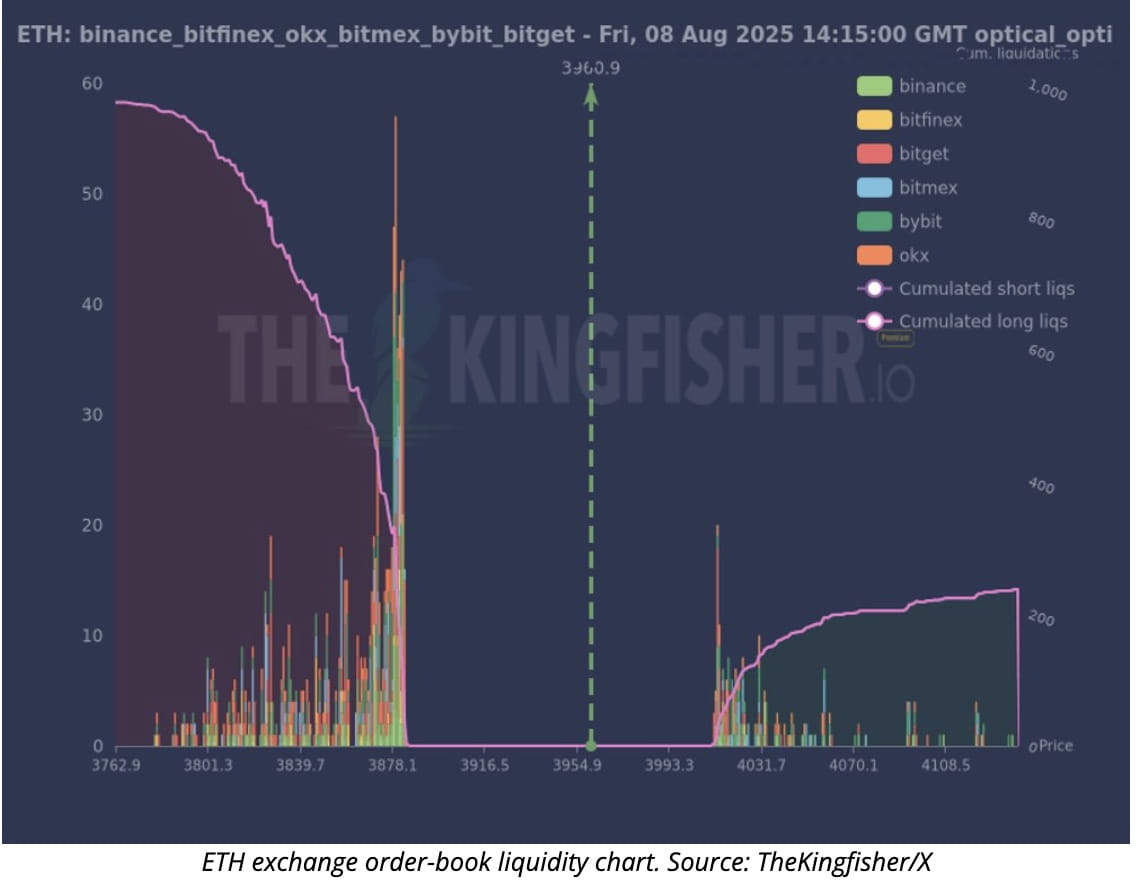

Blockchain tracker Lookonchain reported a whale leveraging ETH positions via Aave to acquire more ETH at the $4,000 level.

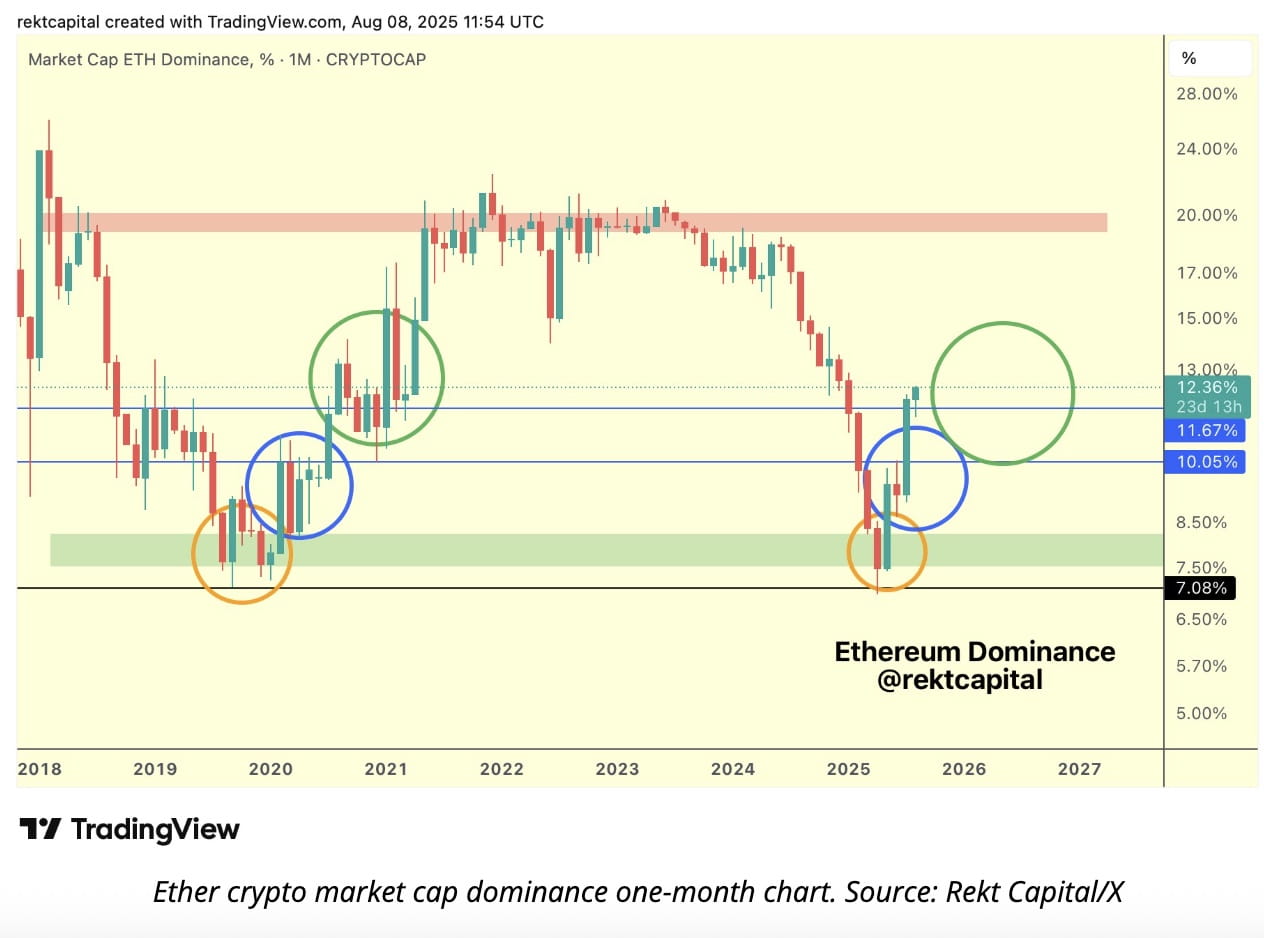

Analyst Rekt Capital noted ETH’s growing share of the total crypto market cap, estimating it is “50–60% of the way” through its macro uptrend, according to Cointelegraph.

Bitcoin Dominance Under Pressure

BTC’s market dominance fell to 60.7%, testing critical support. Analysts see potential for a short-term rebound, but warn the eventual breakdown could send dominance into the 40% range.

Altcoins and Related Stocks Rally

The broader altcoin market extended gains:

XRP rose 9%

SOL gained 3.5%

DOGE climbed 5.3%

Publicly traded companies with ETH exposure also saw a boost — Bitmine Immersion (BMNR) jumped 13%, while Sharplink Gaming (SBET) added 4%.