BitcoinWorld  Debanking Crackdown: Trump’s Bold Order for Financial Freedom

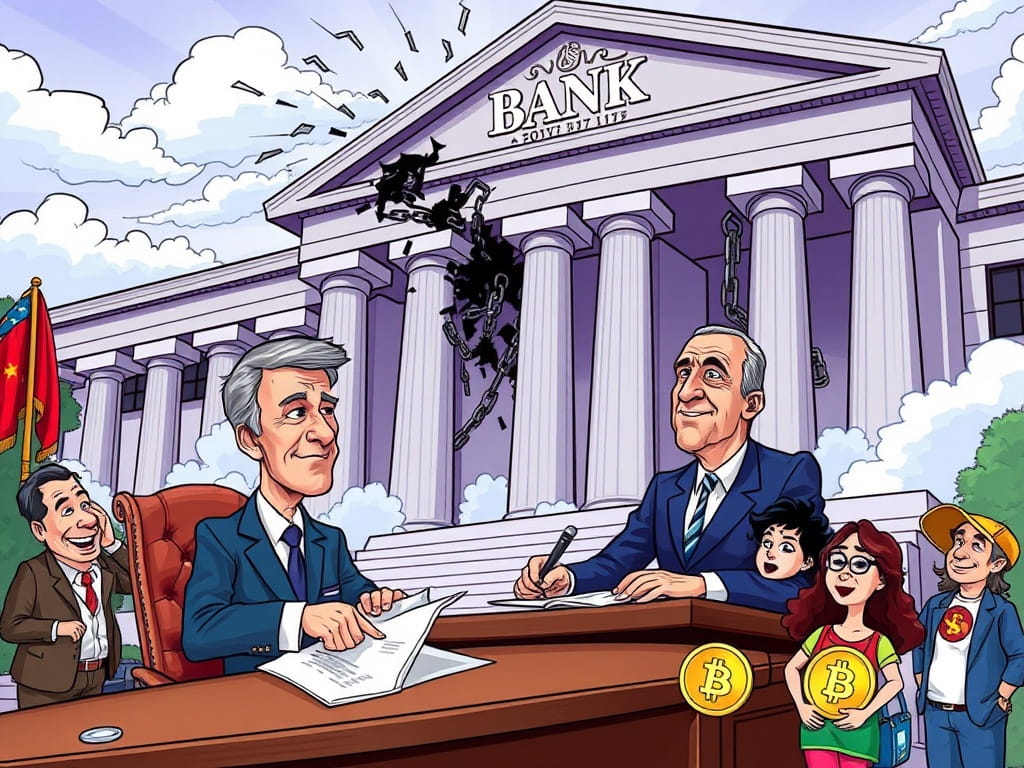

Debanking Crackdown: Trump’s Bold Order for Financial Freedom

A significant shift is on the horizon for the financial landscape. Former U.S. President Trump is preparing to sign an executive order that directly targets the practice of ‘debanking.’ This move aims to protect individuals and businesses from being denied financial services based on their political or ideological views. It represents a bold step towards ensuring broader financial inclusion and challenging what some perceive as financial censorship.

What is Debanking and Why Does it Matter?

Debanking refers to the practice where banks or financial institutions close or deny services to clients. Often, this happens without clear justification, sometimes due to ideological differences or perceived ‘reputational risk.’ This can severely impact individuals and businesses, making it difficult to operate in the modern economy.

Impact on Individuals: People might lose access to basic banking services, affecting their ability to manage finances.

Impact on Businesses: Companies, especially those in emerging sectors like crypto, face hurdles in accessing capital and processing transactions.

The Core Issue: It raises concerns about fairness, free speech, and the power financial institutions wield.

Trump’s Executive Order: A Game Changer for Regulatory Guidance?

The upcoming executive order seeks to penalize financial institutions that engage in debanking for ideological reasons. Crucially, it also aims to remove “reputational risk” as a justification for denying services from regulatory guidance. This could significantly alter how banks assess and onboard clients.

For years, financial regulators have advised banks to manage ‘reputational risk.’ However, critics argue this guidance has been misused to justify debanking clients involved in controversial but legal industries. This order could empower regulators to intervene when such practices occur.

The Crypto Connection: Ensuring Crypto Access and Fairness

This executive order comes at a critical time for the cryptocurrency industry. Major bank groups have recently urged the Office of the Comptroller of the Currency (OCC) to block banking license bids from prominent crypto firms. These firms include industry giants like Ripple and Fidelity.

The potential order could create a more level playing field for crypto businesses. If financial institutions are penalized for ideologically driven debanking, it could open doors for crypto companies to gain better access to traditional banking services. This could foster greater financial inclusion within the digital asset space.

Addressing Financial Censorship and Future Outlook

Many see debanking as a form of financial censorship, where institutions dictate who can participate in the economy. This order attempts to push back against such practices, promoting a more open and fair financial system. However, implementing and enforcing such an order will present challenges.

Regulators will need clear guidelines to distinguish legitimate risk management from ideological discrimination. The financial industry will also need to adapt to these new directives. Ultimately, this move could set a precedent for how financial services are provided, emphasizing principles of fairness and non-discrimination.

In conclusion, the impending executive order targeting debanking signifies a pivotal moment for financial freedom and the cryptocurrency sector. By seeking to penalize ideological debanking and remove ‘reputational risk’ as a blanket excuse, the order aims to foster a more inclusive and equitable financial system. This could unlock new opportunities for businesses and individuals, especially those in the crypto space, by ensuring their right to access essential banking services without undue financial censorship.

Frequently Asked Questions (FAQs)

What does ‘debanking’ mean in simple terms?

Debanking is when a bank or financial institution closes your account or refuses to offer you services, often without a clear reason or due to perceived risks that are not directly financial.

How might this executive order affect cryptocurrency companies?

This order could make it easier for cryptocurrency companies to access traditional banking services. It aims to prevent banks from denying services based on ideological reasons, which has often been a barrier for crypto firms seeking financial inclusion.

What is ‘reputational risk’ in the context of banking?

‘Reputational risk’ refers to the potential for a bank’s reputation to be damaged by associating with certain clients or industries. The order seeks to prevent this from being used as an excuse for ideological debanking.

Will this order completely stop banks from denying services?

No, banks can still deny services for legitimate reasons, such as fraud prevention or non-compliance with regulations. However, the order aims to curb denials based purely on ideological grounds or vague ‘reputational risk’ concerns.

Who benefits most from an order against debanking?

Individuals and businesses that have faced or fear facing service denial due to their views or industry (like crypto) stand to benefit. It promotes greater financial freedom and aims to reduce financial censorship.

Did you find this article insightful? Share it with your network to spread awareness about the evolving landscape of financial freedom and crypto access!

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin institutional adoption.

This post Debanking Crackdown: Trump’s Bold Order for Financial Freedom first appeared on BitcoinWorld and is written by Editorial Team