— A recent viral post on X (Twitter) has ignited debate across the XRP community, with claims that the golden age of cheap accumulation may be officially over. The message, though short, carries weight — challenging investors to face a new reality where meaningful XRP holdings might soon be out of reach for the average buyer.

The key question emerging from the discussion:

Has XRP’s price growth officially priced out retail investors?

---

⚠️ KINGVALEX Sends a Wake-Up Call

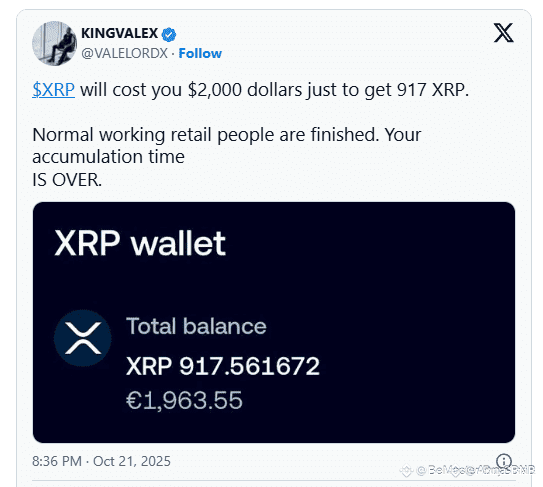

Crypto market analyst KINGVALEX sparked controversy after posting a blunt statement on X:

> “XRP now costs $2,000 for just 917 tokens. Normal working-class people are finished. The accumulation phase is over.”

The post quickly went viral, striking a chord with many holders who feel the market’s affordability window has narrowed dramatically. His comments reflect a broader sentiment — that the XRP landscape is shifting from a retail-driven market to one increasingly dominated by institutional capital.

---

📊 XRP Price Context and the Cost Shift

At the time of writing, XRP trades around $2.40, marking one of its strongest performances in recent years.

That means 917 XRP costs roughly $2,200, validating KINGVALEX’s point.

Just a few years ago, the same amount could be purchased for under $400. This price growth is bullish for long-term holders but creates new challenges for fresh entrants, who now face significantly higher capital barriers to participate.

---

🏦 Institutional Momentum and Market Dynamics

Recent data shows rising institutional involvement in the XRP market.

Transaction volumes have increased substantially, suggesting that large-wallet traders and funds are accumulating positions at higher price levels.

This influx of institutional liquidity strengthens the market but also intensifies competition for supply, reducing opportunities for small investors to accumulate sizable holdings.

With Ripple’s global partnerships expanding and optimism building across the crypto sector, XRP is now entering what many call a “professional market phase.”

---

💡 What It Means for Retail Participants

For individual investors, XRP’s rise into multi-dollar territory means that buying power now stretches thinner.

Smaller investments translate into fewer tokens, and even slight order slippage can impact returns.

Additionally, viral posts like KINGVALEX’s can spark emotional reactions — driving impulsive buying behavior that accelerates short-term volatility.

Affordability in crypto isn’t just about price per token anymore — it’s about entry timing, liquidity, and disciplined risk management.

---

🔁 Adapting to the New Market Landscape

While KINGVALEX’s warning sounds final, it’s also a reminder that markets evolve, and strategies must evolve with them.

XRP’s current price levels signal market maturity, not exclusion.

Savvy investors can still build exposure through methods like:

Scheduled buys (DCA) with defined limits

Tracking on-chain liquidity flows for accumulation zones

Managing volatility with tighter stop-loss strategies

The days of effortless, low-cost accumulation may be gone — but the era of strategic positioning has just begun.