💹 When Patience and Precision Pay Off

Trading is often seen as a quick path to profit, but in reality, it’s a slow and steady game of discipline, timing, and decision-making. What you see in the screenshot isn’t just a winning trade — it’s the result of patience, trust, and a carefully executed plan. Every successful trade tells a story, and this one shows what can happen when analysis meets action at the right time.

The trade had been open for a while — not rushed, not guessed — but built on observation and proper market understanding. When the signal came to close, it wasn’t out of fear or excitement; it was purely logical. That’s the beauty of trading with structure. You’re not reacting to the market, you’re reading it.

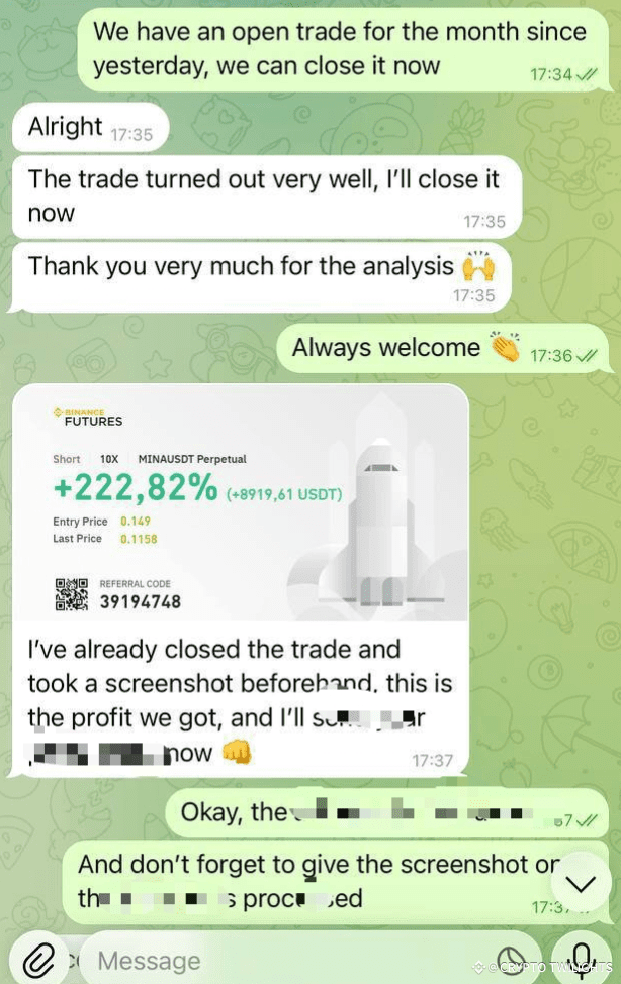

The result was a remarkable +222% gain — but the true success lies beyond the number. It’s in the calm execution, the teamwork, and the discipline shown throughout. Real traders know that profit is a byproduct of process. You don’t chase results; you build habits that naturally lead to them.

In this conversation, you can see how professionalism flows through every message. No panic, no hesitation, just confidence in the plan. That mindset separates traders who survive from those who give up too early. When you trust your analysis and stay patient, the market eventually rewards your consistency.

Every trader experiences ups and downs, but it’s the ones who can stay composed that last the longest. Emotional trading — whether it’s greed after a win or fear after a loss — always leads to mistakes. True mastery comes from emotional control. When you can stick to your plan regardless of what the chart is doing, you’ve already won half the battle.

The other half is patience. The ability to wait for the right moment to enter or exit can make or break a strategy. Many traders lose because they want instant results. But markets move in waves, and success comes to those who can ride those waves instead of fighting them. In this trade, the patience to wait for the proper closing signal made all the difference.

Behind every great trade, there’s always preparation — the kind that’s not visible on a chart. Hours of studying price movements, identifying key zones, checking liquidity levels, and confirming momentum shifts. Those quiet, behind-the-scenes efforts are what create the results that others later admire.

Trading also teaches you responsibility. You learn to own your decisions — both right and wrong. You stop blaming the market or others. Instead, you focus on refining your skills. You start to understand that consistency matters more than any single profit. That mindset is what turns trading from a gamble into a profession.

Another beautiful thing in this chat is teamwork. The appreciation shown for the analysis highlights how collaboration adds value. Two minds with one goal — identifying the best move and executing with confidence. Trading can often feel like a lonely journey, but when there’s mutual trust and respect, it becomes a shared growth experience.

And even after success, the tone remains humble — “Thank you for the analysis” and “Always welcome.” This level of communication shows maturity. Real traders celebrate success quietly and use it as motivation to keep improving. No unnecessary hype, no overconfidence, just steady progress.

If you notice closely, there’s also accountability. The trader closes the position, takes a screenshot, and confirms every step. That’s how professionalism looks in trading. Documentation, communication, and transparency — these habits separate consistent earners from impulsive risk-takers.

This trade is more than just numbers on a screen. It’s proof that a structured approach works. When you respect the process, follow your plan, and manage your emotions, you don’t need to chase trades — the profits come naturally.

To everyone reading this: success in trading doesn’t come from one big win. It comes from hundreds of small, smart decisions made over time. Every trade, whether a win or a loss, is a lesson. Every moment of patience adds strength. Every mistake, if understood properly, becomes a stepping stone toward mastery.

So, next time you open a trade, remember this: it’s not about predicting the market perfectly; it’s about reacting wisely. Set your targets, manage your risk, and stick to your rules. The best traders don’t have superpowers — they just have discipline.

This +222% wasn’t luck. It was logic, timing, and teamwork. It shows that with the right mindset, even a single position can bring massive returns when managed well. But the true reward isn’t just in the profit — it’s in the confidence you gain, the patience you build, and the trust you develop in your own process.

Stay focused, stay humble, and never stop learning. The market will test you, but every challenge will shape you into a stronger trader. The key is to stay consistent, stay aware, and always respect your analysis.

📈 Trade smart, not fast. The goal is not just to profit once — the goal is to build a system that keeps winning over time.