The last week of May has seen a noticeable shift in tone across the crypto market. We’re coming off a euphoric, headline-rich month – Bitcoin smashed through all-time highs, institutional ETF flows dominated the narrative, and altcoins were beginning to show signs of rotation. But this past week was more about digestion. Momentum slowed, price action turned sideways or dipped, and sentiment cooled – not catastrophically, but enough to make traders recalibrate. So let’s go through the major moves, coin by coin.

Bitcoin (BTC)

Bitcoin had a clear directional shift this week. After topping out around $111,000 late last week, price steadily declined and then found a temporary floor just above $104,500 – a level many technical analysts have flagged as a make-or-break area for maintaining bullish structure. We’re currently hovering around $105,000, and the candles are getting smaller. RSI on the 4H chart remains below 50, suggesting the bulls are, for now, out of breath.

So what changed? For starters, BlackRock’s IBIT ETF broke its 31-day inflow streak, logging its biggest outflow ever. Naturally, this came as a mood-killer for anyone watching institutional sentiment.

That was followed by renewed macro uncertainty as Fed minutes quashed hopes for near-term rate cuts. The post-conference profit-taking only solidified the current consolidation mood.

UPDATE: Markets now pricing in just 2 Fed rate cuts in 2025, down from 4 earlier this year, as uncertainty builds ahead of today’s Fed minutes. pic.twitter.com/vAYLJGJjwF

UPDATE: Markets now pricing in just 2 Fed rate cuts in 2025, down from 4 earlier this year, as uncertainty builds ahead of today’s Fed minutes. pic.twitter.com/vAYLJGJjwF

— Cointelegraph (@Cointelegraph) May 28, 2025

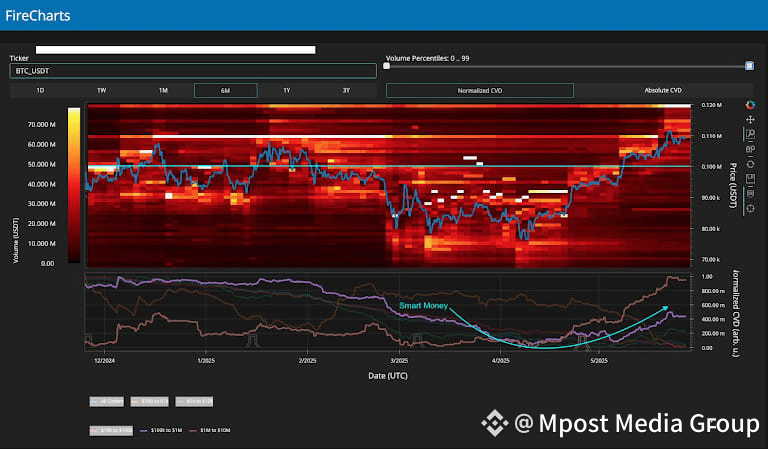

But don’t mistake this for fear. Onchain data shows whales are still adding on dips, and long-term holders haven’t blinked.

The prevailing tone is more “let’s wait and see” than “run for the exits.” Analysts are still calling for $180K, $200K, even $250K by cycle top – but the consensus now seems to be: it’s going to take longer than some were hoping two weeks ago.

If you’re trading short-term, keep an eye on that $104.5K weekly close level. If that’s decisively lost, we’re probably looking at testing $100K again. But if it holds, the current dynamics becomes a healthy pause before another leg up.

Ethereum (ETH)

Ethereum, meanwhile, has had a somewhat frustrating end of month. After a strong start to May, ETH cooled off alongside BTC, slipping from its $2.7K high down to around $2,495. It’s tried to bounce a few times (RSI flirts with recovery) but for now, nothing’s stuck. Why? Well, that’s mostly collateral damage. Even with all its post-Pectra momentum in mind, Ethereum continues to mimic Bitcoin’s major moves.

That said, the underlying ETH story remains strong. The big one this week was that SharpLink Gaming unveiled plans for a $1 billion Ethereum treasury. Pretty much the reflection of Michael Saylor’s Bitcoin strategy – but for ETH. But the way, after the announcement, SharpLink Gaming’s stock surged a whopping 400%.

We also saw signs that ETH and SOL staking ETFs could launch soon, with bullish commentary from ETF analysts saying the approval process looks “imminent.” These developments didn’t move price this week, but they’re accumulating in the background.

Technically, ETH is still in its range. It hasn’t broken down ($2.44K is the level to hold) and if Bitcoin regains momentum, Ethereum could quickly find itself back in the $2.6–$2.7K zone. Don’t sleep on it.

Toncoin (TON)

If Bitcoin and Ethereum spent the week exhaling, TON held its breath – and then burst upward like crazy. On May 28, TON spiked to $3.70 with a massive up candle that can be traced back to an entire flood of Telegram ecosystem news.

First, TON celebrated its 4th birthday, then the fireworks started: Telegram announced a $1.5B bond sale, which later swelled to $1.7B via convertible debt, with BlackRock, Citadel, and Mubadala named as buyers.

Not stopping there, Pavel Durov revealed a strategic partnership with Elon Musk’s xAI, integrating Grok into Telegram and bringing $300M in upfront funding plus 50% of subscription revenue. That’s a pretty momentous alliance if you ask us.

But there was more: Arkham launched its app inside Telegram, USDe from Ethena integrated into the TON wallet, a former Visa exec joined TON, and Telegram Premium hit 15 million users.

So yeah, no wonder the price popped. And just as quickly, it pulled back, landing near $3.14, where it seems to be digesting. But that rally didn’t seem like pure speculation – it packed a serious ecosystem punch. TON is now firmly positioned as the transactional backbone of Telegram’s growing fintech and AI suite.

From a technical perspective, $3.00 is key support to watch. If price holds above that, another breakout isn’t off the table – especially if Telegram delivers on Durov’s teased “good news in June.”

The post Late May Market Mood: BTC Breathers, ETH In Limbo, TON Steals The Show appeared first on Metaverse Post.