Since the beginning of 2025, many companies have chosen Ethereum as a reserve asset. These moves may trigger a domino effect, encouraging more businesses from different sectors to join.

This strategy draws inspiration from MicroStrategy, the pioneer in using Bitcoin (BTC) as a treasury asset. The market is now watching for the emergence of a “MicroStrategy for Ethereum.”

SharpLink Gaming Builds Strategic ETH Reserve, Ignites a Trend

On May 27, 2025, SharpLink Gaming, Inc. (NASDAQ: SBET) announced it had signed a securities purchase agreement in a private placement worth approximately $425 million. The funds raised will purchase Ethereum (ETH), which will become the company’s primary treasury reserve asset.

This plan is being executed with the guidance of Consensys, a blockchain technology firm led by Joseph Lubin, co-founder of Ethereum.

“This is a significant milestone in SharpLink’s journey and marks an expansion beyond our core business. On closing, we look forward to working with Consensys and welcoming Joseph to the Board,” Rob Phythian, Founder and CEO of SharpLink, said.

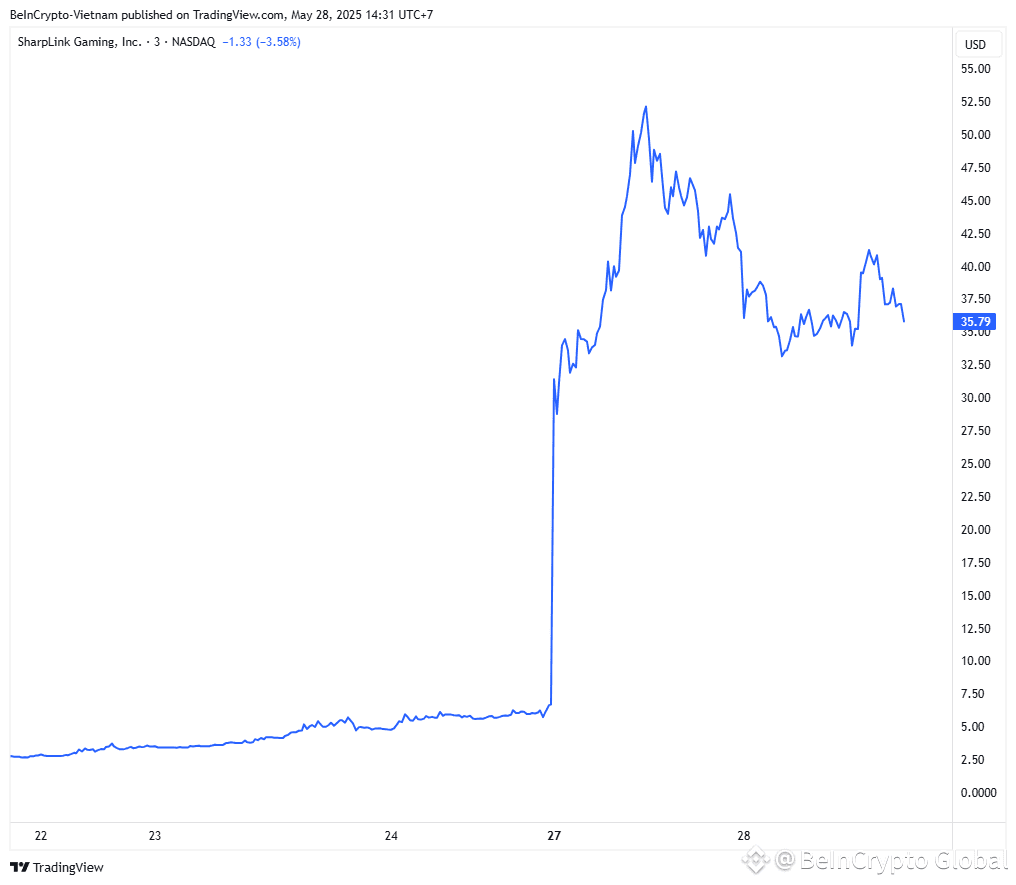

Following the announcement, SBET stock soared over 85% in a single day. It exceeded $53 at one point, marking a staggering 1,800% increase within three trading days. SharpLink appears to be positioning itself as the “MicroStrategy of Ethereum,” acting as a public proxy for funds that cannot directly hold crypto.

SharpLink Gaming Stock Price Performance. Source: TradingView

SharpLink Gaming Stock Price Performance. Source: TradingView

According to Eric Conner, a former Ethereum core developer, SharpLink’s plan to purchase and potentially stake 120,000 ETH could cause a “supply compression.” This would reduce circulating ETH and potentially boost its value.

Conner emphasized that this move positions ETH as a “digital reserve asset” and advances Ethereum’s acceptance in mainstream finance.

“Upshot for ETH holders: supply compression, new narrative fuel, potential leverage via an equity wrapper. A bullish milestone in ETH’s march to mainstream balance sheets,” Conner noted.

More Companies Are Adding ETH to Reserves

SharpLink isn’t the first company to adopt ETH as a treasury asset. In March 2025, BioNexus Gene Lab (BGLC), a healthcare company, announced plans to add ETH to its reserves.

Similarly, BTCS, a Nasdaq-listed blockchain company, bought $8.42 million worth of ETH last week, raising its total holdings to 12,500 ETH. In May, Abraxas Capital — a $3 billion investment firm — also accumulated 350,703 ETH worth $837 million at an average purchase price of $2,386.

These moves by companies like SharpLink, BioNexus, and BTCS reflect growing confidence in Ethereum’s long-term potential. Data from CryptoQuant shows this trend has pushed ETH balances in accumulation wallets to new highs — nearly 21 million ETH, or 17.5% of the circulating supply.

ETH Balance on Accumulation Addresses. Source: CryptoQuant.

ETH Balance on Accumulation Addresses. Source: CryptoQuant.

Meanwhile, Bitcoin’s price has hit new highs and appears expensive. In contrast, Ethereum is down 50% from its all-time high, making it more attractive.

As publicly traded companies like SharpLink adopt ETH, they could trigger a domino effect that encourages more institutions to follow suit. This would not only support ETH’s price but also strengthen Ethereum’s role in the global financial ecosystem.

At the time of writing, ETH was trading around $2,640. Many analysts predict that ETH could outperform BTC in this market cycle.