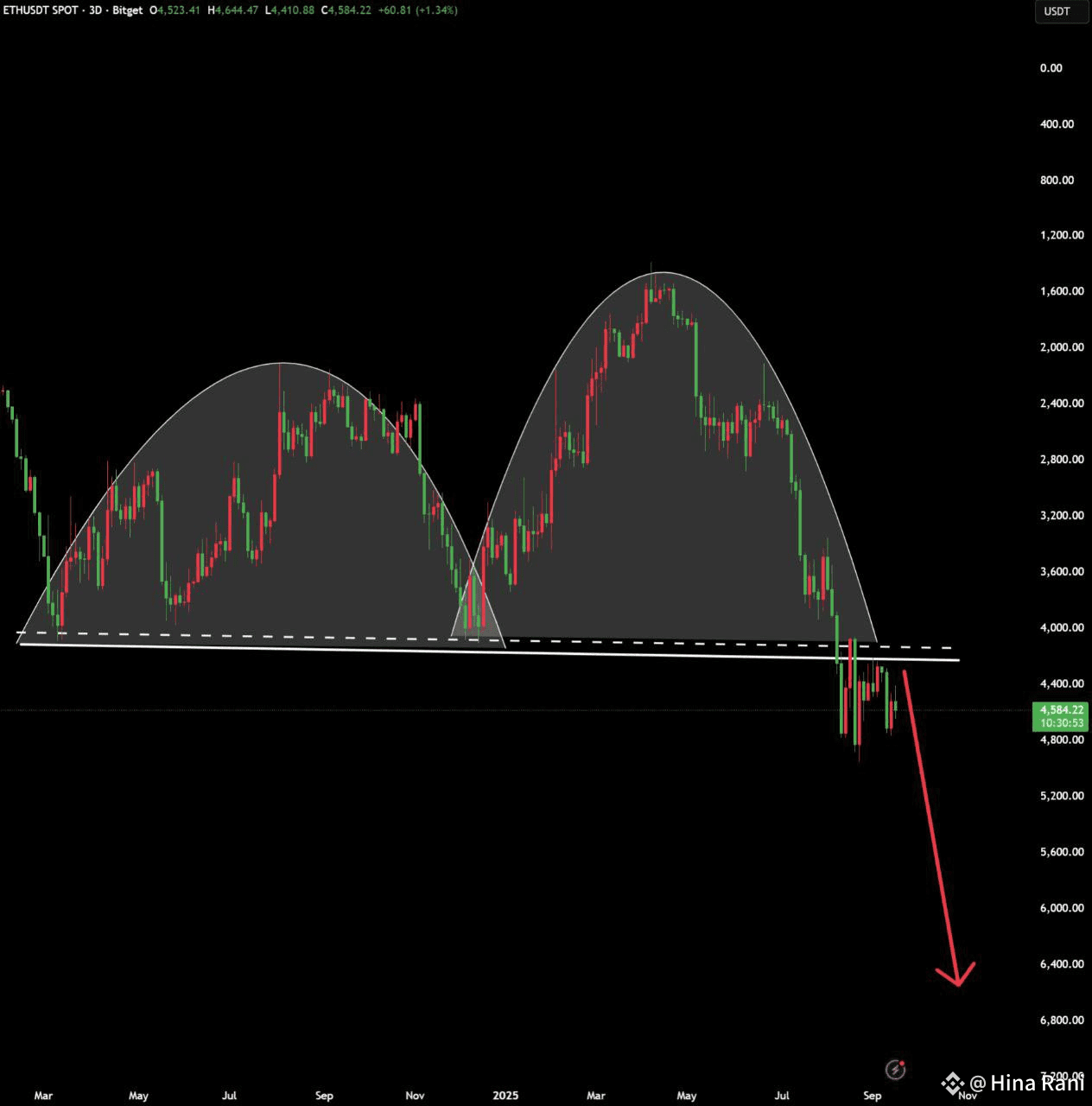

After weeks of excitement in the markets, it looks like Ethereum’s much-anticipated exit pump has finally played out. With ETH$ETH showing signs of exhaustion, analysts are now warning that the next phase could be a sharp correction — one that might trigger the biggest crash of this cycle.

🔍 What Happened?

Ethereum surged recently, fueled by strong liquidity inflows, whale accumulation, and heightened speculation around rate cuts and institutional adoption. This rally was widely viewed as an “exit pump” — a final wave of buying pressure before the market shifts direction.

Now, technical charts and order book data are flashing warnings:

📉 Momentum cooling – $ETH is struggling to hold above key resistance levels.

🐳 Whale activity slowing – Big wallets are reducing exposure after weeks of accumulation.

📊 Market sentiment shifting – Fear and uncertainty are slowly replacing the euphoria.

⚠️ Why a Crash Could Follow

Exit pumps often mark the end of a bullish cycle in the short term. If Ethereum fails to hold crucial support zones, cascading liquidations could accelerate the downside, dragging the broader crypto market with it.

Key ETH support: $4,200–$4,300

If broken, the next zone: $3,800–$3,900

🌐 The Bigger Impact

Ethereum is the second-largest crypto asset, and its moves heavily influence altcoins. A deep crash in ETH could spark a broader market correction, shaking out over-leveraged traders and resetting valuations across DeFi, NFTs, and Layer-2 ecosystems.

✅ Key Takeaway

The exit pump is over — and the charts suggest turbulence ahead. Traders should stay cautious, tighten risk management, and watch ETH’s support levels closely. Whether this is just a healthy pullback or the beginning of the biggest crash of the year, one thing is certain: volatility is back.

#BinanceHODLerBARD #USBitcoinReserveDiscussion #USBitcoinReserveDiscussion #BianceSquare #Write2Earn