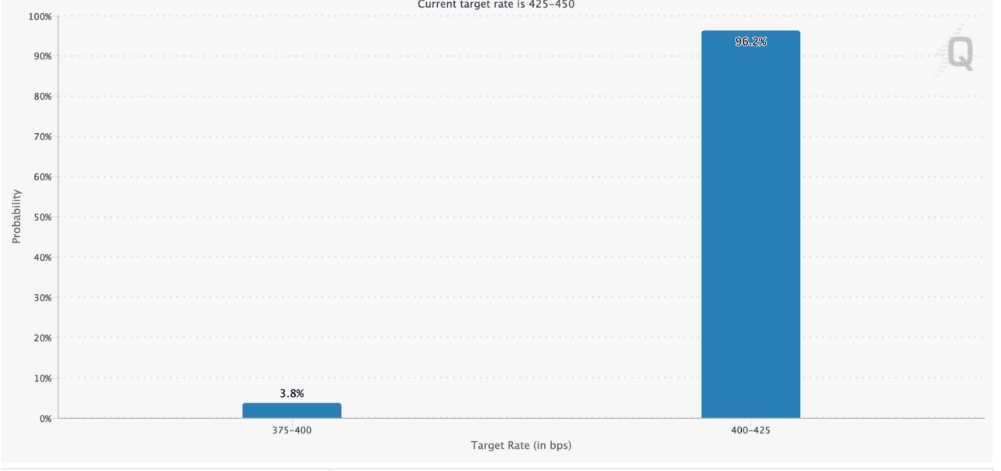

The cryptocurrency market stands at a critical moment in September 2025 with anticipation of the Federal Reserve's decision on interest rates.

• Expectations indicate a 25 basis point cut at 96.2%, but its impact on the market may be limited unless followed by clear guidance or a larger cut of 50 basis points.

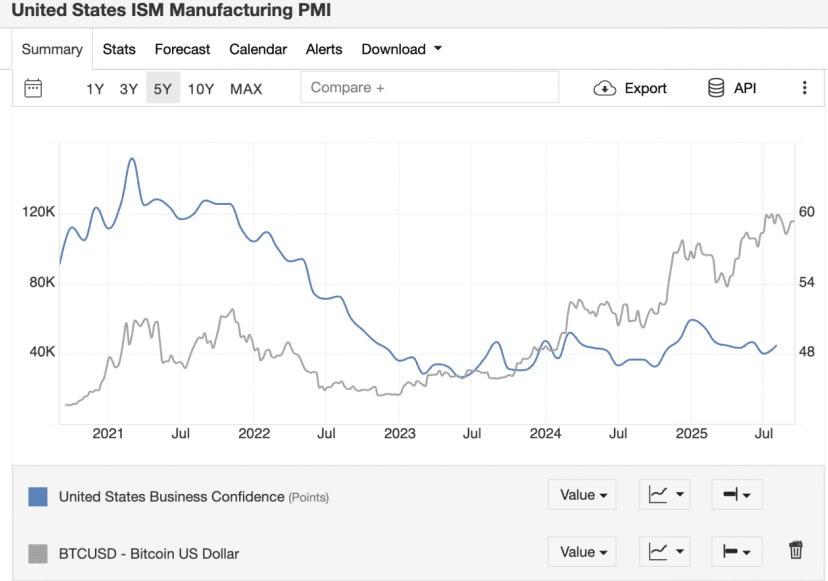

• The Purchasing Managers' Index (PMI) recorded 48.7 (contraction), which enhances the likelihood of further cuts in the future and a supportive environment for high-risk assets like Bitcoin.

• Bitcoin may benefit from monetary easing, but it also faces risks related to recession or weak market confidence.

• There are strong indicators of the beginning of an altcoin season:

• Bitcoin's dominance has decreased from 64% → 57%.

• The Altseason index is approaching 75.

• The market capitalization of alternative currencies reached 1.88 trillion dollars (the highest level in two years).

• This season is different, driven by institutions thanks to regulatory clarity (SEC, MiCA) and regulated instruments like ETFs.

• Projects like SOL, XRP, BNB are attracting increasing interest.

• However, risks remain: Federal tightening, dollar strength (DXY), geopolitical tensions, and regulatory risks.

🎯 Summary:

The Federal's decision in September will be a critical factor for Bitcoin and the rest of the market. With a monetary environment leaning towards easing and an altcoin season supported by major institutions, opportunities look promising — but investors need a disciplined approach and conscious risk management.