I was born in 1987, turning 300,000 principal into 42 million.

I can talk about how to conduct systematic reviews in the crypto space, how much time daily reviews take, how to select coins, and more. Today, I will clarify everything at once.

Professional players will spend two hours daily, first recording data for half an hour, then emptying their minds to forget various subjective anchors from the market.

Then, through review, correct one's subjectivity and reach an open conclusion about intra-day trends.

This requires forgetting subjectivity, forgetting positions, and forgetting profits and losses. At night, re-examine the market.

This process is essential.

Because after finishing the review at night, I often deny some of my views from the day.

One, Multi-timeframe Review System (layered by frequency)

1. Real-time intra-day review (every hour)

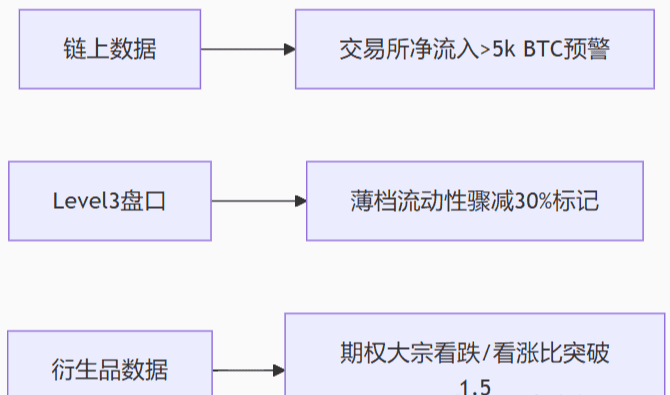

Market Pulse Monitoring

Volatility Scan: Record abnormal periods when BTC/ETH 1-hour ATR changes >5%

Multi-exchange price difference: Monitor the rapid expansion of premium for Binance/OKX/Bybit main contracts (>0.3% warning)

Liquidation Heatmap: Focus on concentrated liquidation price levels >$5 million within an hour on CoinGlass

Position Emergency Check

Leverage Health: Calculate the price drop needed to reach the liquidation price

Hedging Efficiency: Check changes in the arbitrage space between perpetual contract funding rates and spot market

2. End-of-day in-depth review (1-2 hours daily)

Key Decision Audit

Open and close trigger: Compare planned technical levels (e.g., EMA50) with actual execution deviations

Slippage Cost Statistics: Record actual transaction price of large orders (>10 BTC) compared to expected price difference

Emotion Thermometer

Long/Short Ratio Extreme Values: Mark when Deribit's position PCR is <0.7 or >1.3

Greed and Fear Index: Match candlestick patterns when it breaks above 75 or below 25

3. Weekly strategic review (3-4 hours per week)

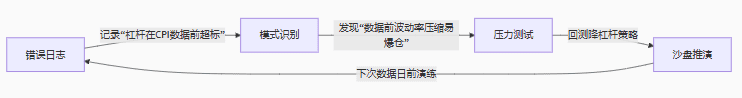

Three, Cognitive Upgrade Closed-loop System

Sandbox Simulation Checklist

Black Swan Rehearsal: How to respond if Binance suddenly suspends withdrawals?

Liquidity Crisis Test: If USDC decouples, are hedging plans effective?

Four, Practical Case Demonstration (reviewing the Silicon Valley Bank incident in March 2023)

Data Capture

On-chain: USDC net outflow of $4.2 billion in a single day (Arkham data)

Price difference: USDC/USDT OTC trading discount reaches -8%

Decision Backtesting

Correct: Buy arbitrage when DAI shows a 0.98 discount

Mistake: Failure to set limit orders for stablecoin exchanges in advance, leading to slippage losses

Strategy Optimization

New rule: Automatically trigger multi-exchange arbitrage script when stablecoin OTC discount >3%

Establish 'Bank Risk Exposure' monitoring table: Track Circle's government bond holdings ratio

Five, Self-discipline Management Tips

Energy Allocation Principle

Intra-day review ≤ 20% of total daily trading time (to avoid analysis paralysis)

Set physical barriers: Use a kitchen timer to strictly limit review duration

Data Desensitization Training

Weekly selection of 1 day to review hidden profit and loss columns to avoid result-oriented bias

Cross-market verification

Monthly comparison of gold/U.S. stock volatility with BTC correlation changes

Top traders' review creed: It's not about finding more trading opportunities, but eliminating the root causes of losses. True progress happens when your error log has no new entries for three consecutive weeks.

Only share content that is valuable to retail investors in the crypto space! With a soulful approach and skillful trading, the above content is derived from my over ten years of experience in the market. It may seem simple, but achieving unity of knowledge and action is not easy. I hope to help fellow crypto enthusiasts avoid detours and get rich together! $BTC $ETH