(Analysis based on data from 13.08.2025)

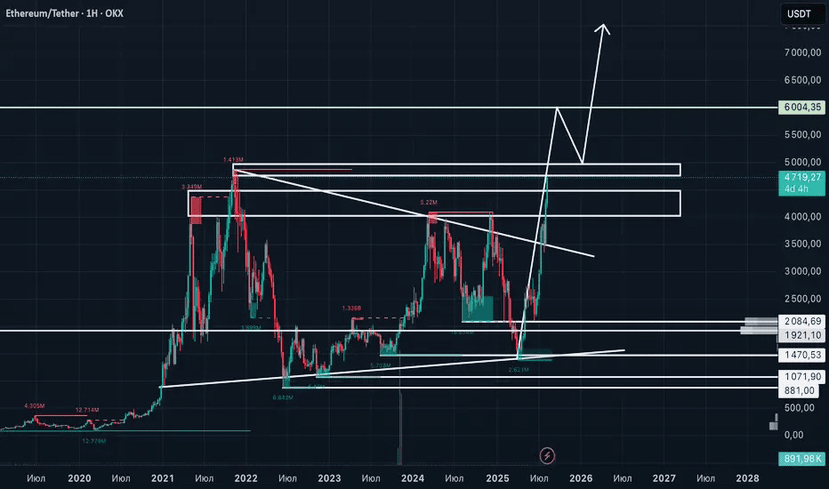

1. Technical analysis: symmetrical triangle and fractals

- Pattern: ETH broke the symmetrical triangle on the weekly chart — similar to the situation in 2020 before a +1,200% rise.

- Fibonacci targets:

- Conservative: $5,600 (161.8% of the height of the triangle).

- Optimistic: $7,800 (261.8%).

- Fractal similarity:

- In 2020, after the breakout, ETH rose by 300% in 3 months. The market is now repeating the structure, but considering institutional demand (ETFs, corporate reserves).

2. Fundamental growth drivers

- Institutional demand:

- Companies like SharpLink (analogous to MicroStrategy for ETH) are buying Ether through OTC deals, creating a shortage.

- Inflow into ETH-ETF: $2.12 billion for July 2025.

- Supply shortage:

- After the transition to PoS and the burning of fees, the annual issuance of ETH decreased by 90%.

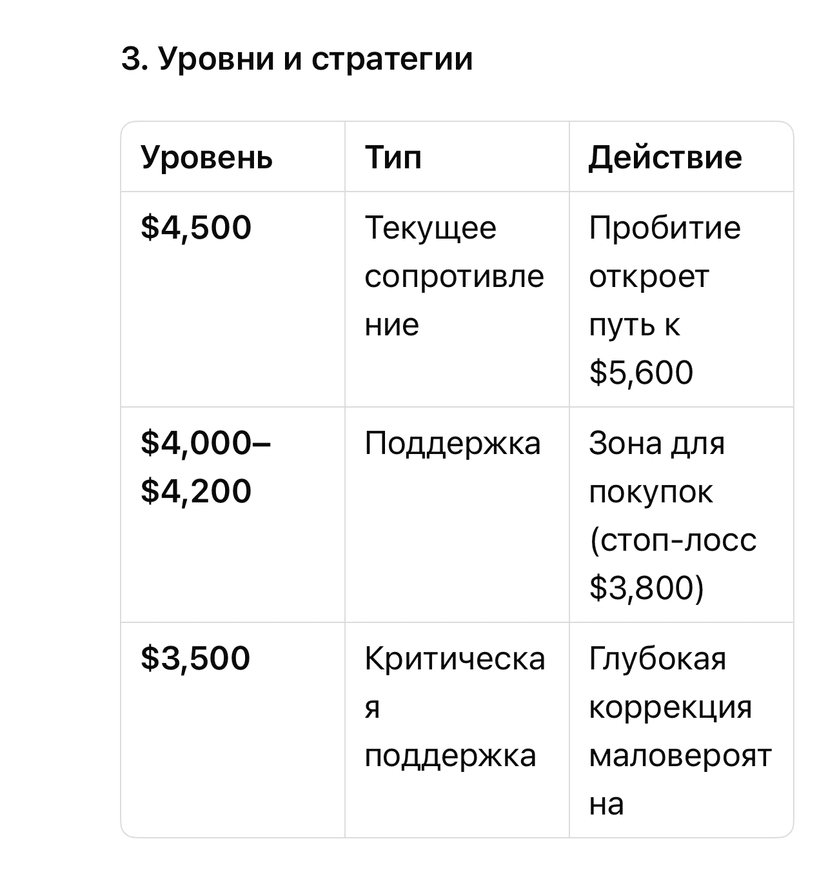

Scenarios:

- Basic (70%): Growth to $5,600–$7,800 by October with corrections of 15–20%.

- Alternative (30%): Consolidation at $4,000–$4,800 until September before a breakout.

4. Risks

- Macroeconomics: Inflation data (CPI) on 12.08 may increase volatility.

- BTC correction: If Bitcoin falls below $110K, ETH could pull back to $3,800.

💡 Conclusion

- September-October is the optimal time to enter before the final phase of growth.

- Main trigger: Break above $4,500 with volume >$5 billion per day.

- Strategy: Accumulate on pullbacks to $4,200 with targets of $5,600+.

> Remember: Markets move in waves. Even in a bull trend, corrections are part of the game.