Institutions Scramble for Ethereum: The Logic Behind the Rebound and Responses

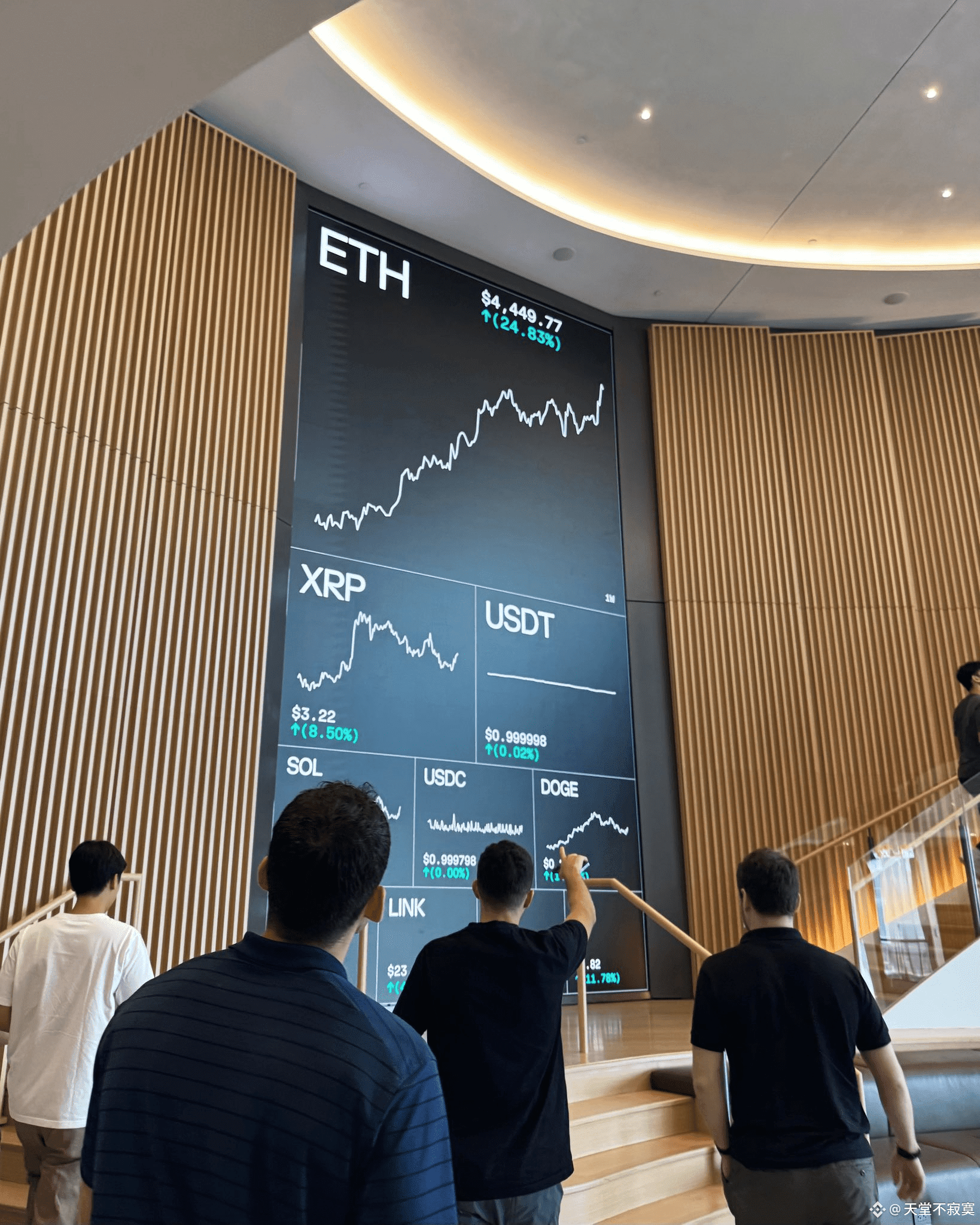

Recently, Ethereum (ETH) has shown a strong rebound in the cryptocurrency market, with its price continuing to climb and becoming the focus of market attention. Behind this rebound, the active deployment of institutional funds is regarded as one of the important driving forces. From the perspective of market dynamics, many traditional financial institutions and professional investment institutions in the crypto field have increased their allocation to ETH. This trend has not only injected strong upward momentum into ETH but also boosted the confidence of the entire crypto market in ETH to a certain extent.

However, when comparing ETH with other mainstream cryptocurrencies such as Bitcoin (BTC) and Binance Coin (BNB), a key difference emerges: ETH has not yet broken through its previous all-time high of $4,868. And this is precisely one of the reasons why it has been able to maintain a strong performance recently. Looking back over the past period, ETH has long been shrouded in negative news. Whether it is the uncertainty of regulatory policies, twists and turns in the technical upgrade process, or fluctuations in the overall market environment, all have continuously suppressed its price. The uncertainty in the market and the panic caused by it have made a large number of investors take a wait-and-see attitude or even sell ETH, which in turn has led to a serious undervaluation of its valuation.

Because of this, when market sentiment gradually stabilizes, institutional and corporate investors turn their attention to ETH. In their view, the undervalued valuation means greater room for growth, and ETH's extensive application in the field of blockchain technology and its potential for continuous upgrading also provide sufficient room for imagination for its future development. This optimistic expectation for the future has further promoted the influx of institutional funds, forming the current situation of ETH's strong rebound.

Although in the long run, it is more likely that ETH will break through its previous high, and we have reason to be optimistic about it, its short-term increase has been quite significant, and the accumulated profit-taking positions in the market are also increasing. Under such circumstances, market volatility may further increase, and the probability of unexpected situations will also rise. Based on this, I personally would choose to reduce some holdings in batches at current prices when the market is high. On the one hand, this can lock in some profits and avoid shrinkage of returns due to market corrections; on the other hand, it can also withdraw funds through reduction to reserve "ammunition" to deal with possible unexpected situations.

It should be noted that the investment market is unpredictable, and any sudden news or event may trigger sharp price fluctuations. Whether it is a sudden shift in policies, major technical vulnerabilities, or unexpected changes in the macroeconomic environment, they may impact the cryptocurrency market. Therefore, if investors want to go steadily and far in investment, they must hold a certain amount of cash or highly liquid assets. These "ammunition" can not only provide opportunities to buy at the bottom when the market pulls back sharply but also ensure the safety of investors' funds in extreme cases, allowing them to stand firm in the stormy market.