Today’s crypto market is brimming with institutional moves, whale activity, token dominance shifts, and key legal updates. Here’s a detailed breakdown of the developments that could shape the week ahead.

---

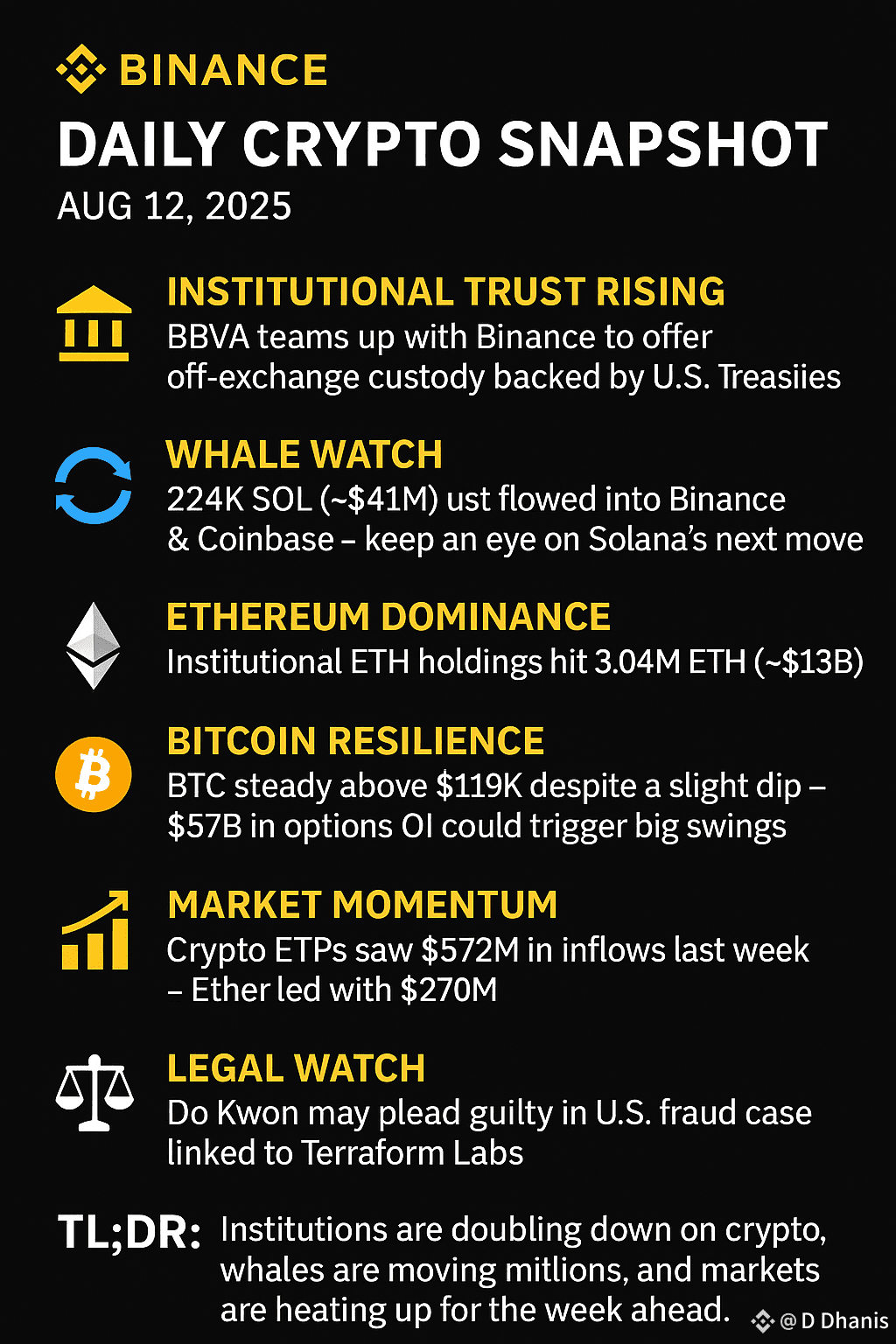

🪙 Institutional Trust on the Rise

Binance has strengthened its institutional appeal by partnering with BBVA to offer off-exchange custody for user assets. Backed by U.S. Treasuries, this arrangement provides greater security, transparency, and compliance for large-scale investors — a move that could attract more traditional financial players into the crypto ecosystem.

---

📉 Whale Activity Signals Potential Market Moves

A massive transfer of 224,000 SOL (worth about $41 million) from Galaxy Digital to Binance and Coinbase has caught trader attention. Such large inflows to exchanges often precede significant market volatility, as whales may be positioning for profit-taking or major trades in Solana (SOL).

---

🧾 Ethereum’s Institutional Dominance

Ethereum has broken above $4,300, buoyed by institutional accumulation. Corporate holdings now stand at 3.04 million ETH (about $13 billion). This trend highlights growing confidence in Ethereum’s future as the backbone of decentralized finance, NFT infrastructure, and smart contract platforms.

---

📊 Bitcoin Maintains Stability Above $119K

Despite minor corrections, Bitcoin (BTC) is holding steady above $119,000. Analysts note that the market is currently supported by $57 billion in open interest on BTC options — a sign of high investor engagement. However, this also means upcoming macroeconomic events, such as U.S. CPI data releases, could trigger large price swings.

---

📮 Crypto ETPs See Strong Recovery

Investor confidence in regulated crypto products is rebounding. Last week, crypto exchange-traded products (ETPs) recorded $572 million in net inflows, with Ether (ETH) accounting for nearly $270 million. This resurgence in demand points toward a renewed appetite for crypto exposure in traditional investment portfolios.

---

📑 Legal Spotlight on Terraform Labs

Terraform Labs co-founder Do Kwon, tied to the infamous TerraUSD collapse, is expected to change his plea to guilty in a U.S. fraud case. This marks a turning point in one of the most significant legal sagas in crypto history and may influence ongoing regulatory discussions around stablecoins and project accountability.

---

💸 Market Outlook

With institutional adoption increasing, whale activity heating up, and regulated investment products gaining traction, the crypto market is showing signs of strength. However, the combination of large on-chain transfers and heavy derivatives interest suggests traders should prepare for potential short-term volatility.

#BTCOvertakesAmazon #ETH4500Next? #BTCReclaims120K #crypto #news $BTC