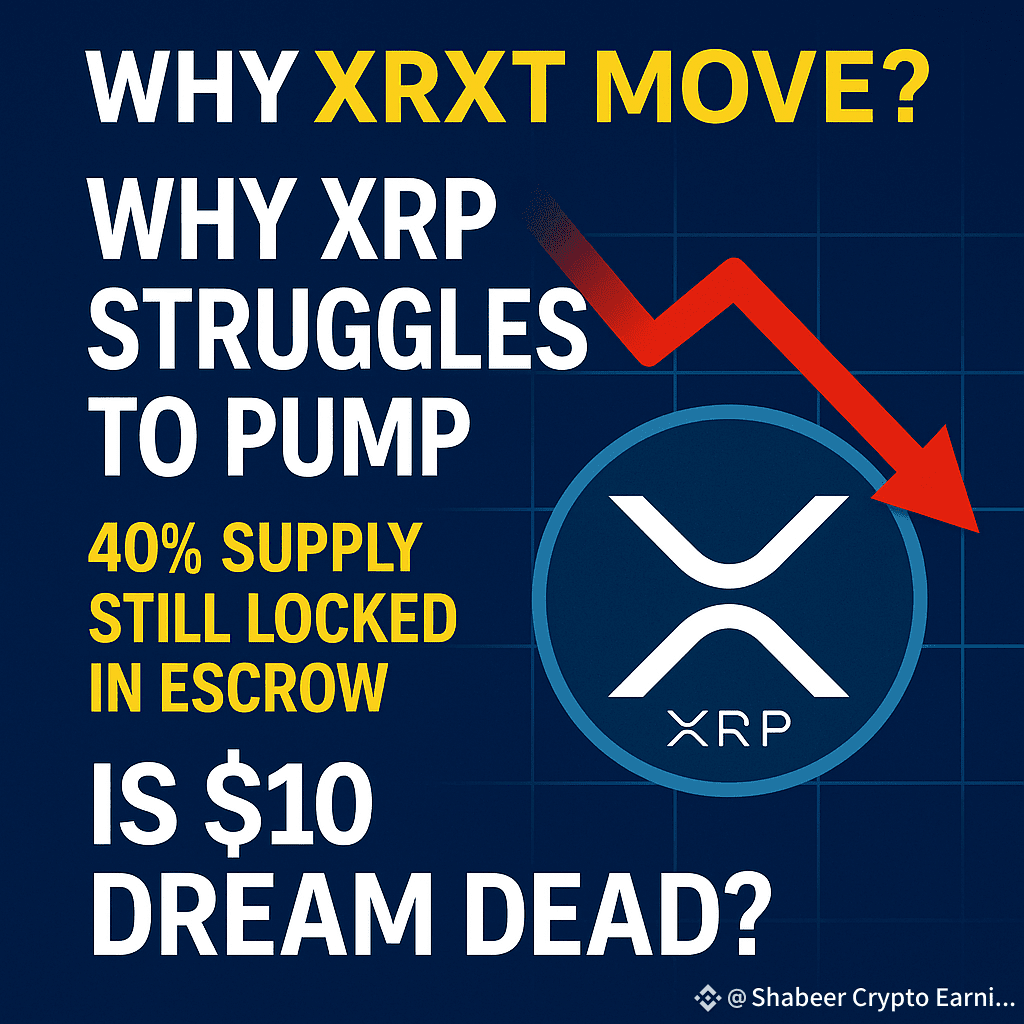

While the crypto market rallies, is stuck under pressure—and the tokenomic reality is clearer than most realize. Here’s why the hype around $10 $XRP remains risky:

1️⃣ Big Supply Still Locked

Ripple still holds ~35–36 billion XRP (about 40% of total supply) in escrow—slowly releasing ~1 billion XRP each month. This controlled but continuous supply growth makes major rallies hard.

2️⃣ Unlock ≠ Immediate Sell

Yes, tokens are unlocked, but Ripple often re-locks 60–70%, using some for operations and ecosystem growth. Only 300–400 million actually hits the market monthly.

3️⃣ Supply Still Overshadows Demand

Basic economics: growing supply without equal demand exerts downward pressure. Despite marketing and partnerships, long-term price growth needs real buying power—not dreams.

4️⃣ Legal Defense & Supportive Strategy

Lawyer Bill Morgan and even SEC filings have acknowledged Ripple’s escrow strategy as a price-stability mechanism—not a manipulative dump. It’s a deliberate model to ensure predictability and trust.

5️⃣ Smart Investors Bet on Facts, Not Hype

$XRP can still flash short-term spikes on market rallies—but expecting life-changing returns this year? That’s wishful thinking unless demand catches up with supply. Study token dynamics, not just dreams.

6️⃣ Engage with the Post

Question for you: Do you think XRP can maintain gains if Ripple continues monthly releases? Drop your thoughts & targets below