Below is the current price of Bitcoin (BTC) along with short-term trends:

---

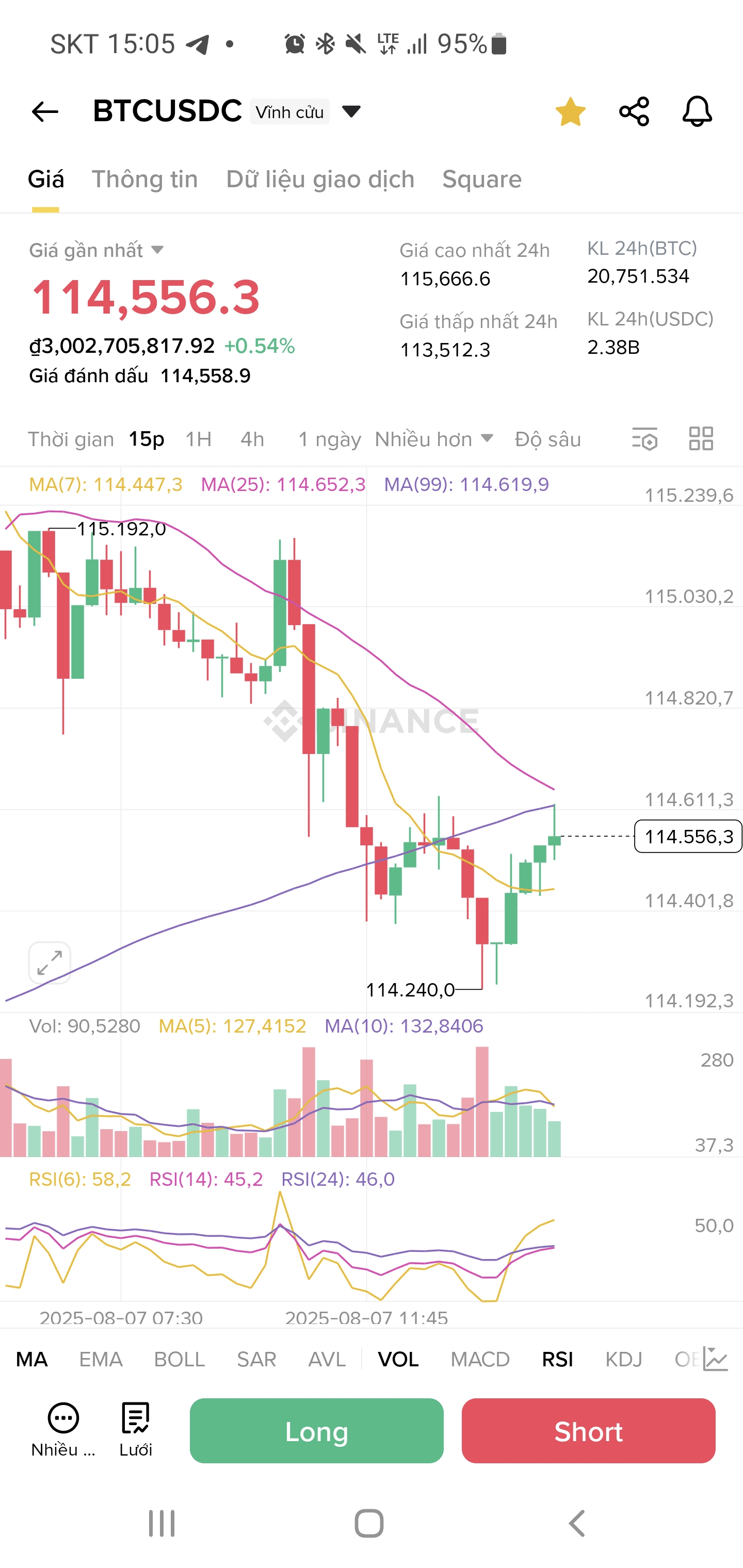

Analysis of the current trend

BTC is trading around $114,500, with a daily range from about $113,775 to $115,678.

In the past 24 hours, the price has slightly increased around 0.2–1%, but is still down about 3% compared to a week ago.

Technically, BTC is stuck in a narrow range, with support around $114,000 and resistance between $115,500–$116,000.

Some analysts point to strong accumulation signals and seller exhaustion, which could set the stage for upcoming volatility.

---

News that could impact the day

Net outflow from Bitcoin ETFs: Continuous outflows keep BTC under pressure and diminish demand.

Limited institutional supply at OTC: Corporate funds could 'quench' demand, pushing prices up if supply is scarce.

U.S. policy leans towards crypto: Favorable developments in the Bitcoin reserve strategy bill could bolster market sentiment.

If resistance is successfully broken: BTC could target a new high, especially if macro accumulation (like M2 increase…) supports it.

Warning from Robert Kiyosaki: He predicts BTC could drop to $90,000 in August, but sees it as a buying opportunity.

---

Quick summary

Factor Potential impact

Resistance at the $115–116k range If breached, it could create short-term upward momentum

Outflow from Bitcoin ETF Pressuring the price level downwards

Khan OTC/institutional supply If supply is lacking, BTC may surge

U.S. policy supports crypto Facilitating long-term growth

Bearish forecast from Kiyosaki May make investors cautious, but also create opportunities for lower prices

---

If you want to delve into technical analysis (like RSI, MA indicators), please comment for specific details.