In the trading world — whether in crypto, stocks, or forex — success depends on timing, analysis, and discipline. One of the most powerful tools in a trader's toolkit is the recognition of chart patterns.

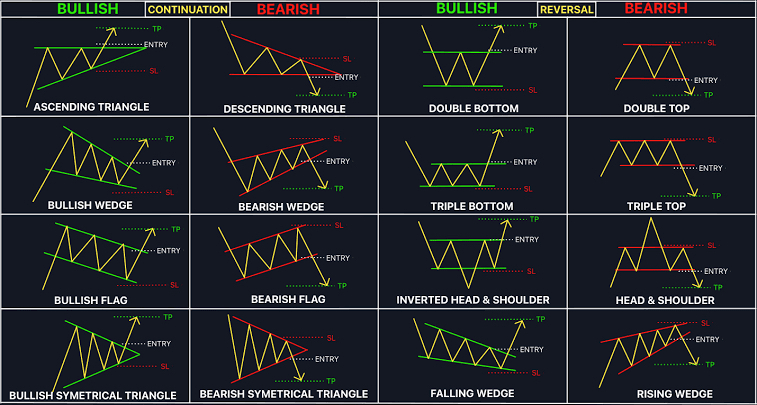

The chart you provided shows 16 powerful chart patterns — categorized as Bullish, Bearish, and Reversal Patterns. If you understand and apply this correctly, they can significantly increase your profit potential while minimizing losses.

🔍 What Are Chart Patterns?

Chart patterns are visual representations of market psychology — showing how buyers and sellers are behaving. These patterns repeat over time and help traders predict future price movements.

🚀 Bullish Patterns – Buy on Breakout!

Bullish patterns signal a potential upward movement. Traders should look to enter long positions (buy) as soon as the pattern is confirmed.

Chart examples:

Ascending Triangle

Bullish Wedge

Bullish Flag

Bullish Symmetrical Triangle

Double Bottom

Triple Bottom

Inverted Head and Shoulders

Falling Wedge

🛠 Strategy:

Entry: After a breakout above the resistance

Stop-Loss (SL): Below the last bottom or recent structure

Take-Profit (TP): Use the previous high or the projection of the pattern's target

📉 Bearish Patterns – Get Ready to Sell

Bearish patterns indicate a potential downward movement. You should look to enter short positions (sell) when the breakout is confirmed.

Chart examples:

Descending Triangle

Bearish Wedge

Bearish Flag

Bearish Symmetrical Triangle

Double Top

Triple Top

Head and Shoulders

Ascending Wedge

🛠 Strategy:

Entry: After a confirmed breakout below the support

Stop-Loss (SL): Above the last top or recent structure

Take-Profit (TP): Use previous low or measured move

♻️ Reversal Patterns – Capture Trend Changes

Reversal patterns form when the market changes direction — from bullish to bearish or vice versa. Identifying them early can help you enter at the beginning of a new trend.

Examples:

Double Bottom → Bullish Reversal

Double Top → Bearish Reversal

Inverted Head and Shoulders → Bullish Reversal

Head and Shoulders → Bearish Reversal

📈 How to Maximize Profits Using These Patterns

Here are 7 essential tips:

1. Wait for Confirmation

Never trade just by "guessing" a pattern. Always wait for a breakout or clear break with good volume.

2. Define Your Entry, SL, and TP in Advance

Each pattern on the chart shows:

Entry point (after the breakout)

SL (red dotted line — stop loss)

TP (green dotted line — take profit)

This ensures risk management and profit definition.

3. Use the Risk-Reward Ratio (RRR)

Always look for trades with a minimum RRR of 1:2, meaning if you risk $10, aim for a profit of $20.

4. Combine with Volume & Indicators

Confirm breakouts with increased volume, RSI, MACD, or moving averages.

5. Conduct Tests Before Real Trades

Practice these patterns on historical charts or demo accounts before risking real money.

6. Stick to Higher Timeframes

Patterns on higher timeframes (1H, 4H, Daily) are more reliable than on 5M or 15M.

7. Don't Overtrade

Trade only high probability setups. Quality over quantity.

💡 Final Considerations

Chart patterns give you a technical edge in the market. When combined with discipline and proper risk management, they help you:

Identify trades early

Avoid bad entries

Ensure larger profits

Minimize losses

Successful traders do not trade everything — they wait for patterns, plan their trades, and stick to the strategy.