The World Liberty Fi DeFi project, linked to the Trump family, has made a bold bet on Ethereum by purchasing more than 250 ETH at a price of $3,895 per token, totaling an investment of $1 million.

📈 This move comes as Ethereum surges to its highest levels in 2025, with its price crossing $3,940 for the first time since January. A purchase at such a high level suggests strong conviction in continued growth and possibly a breakout to new all-time highs.

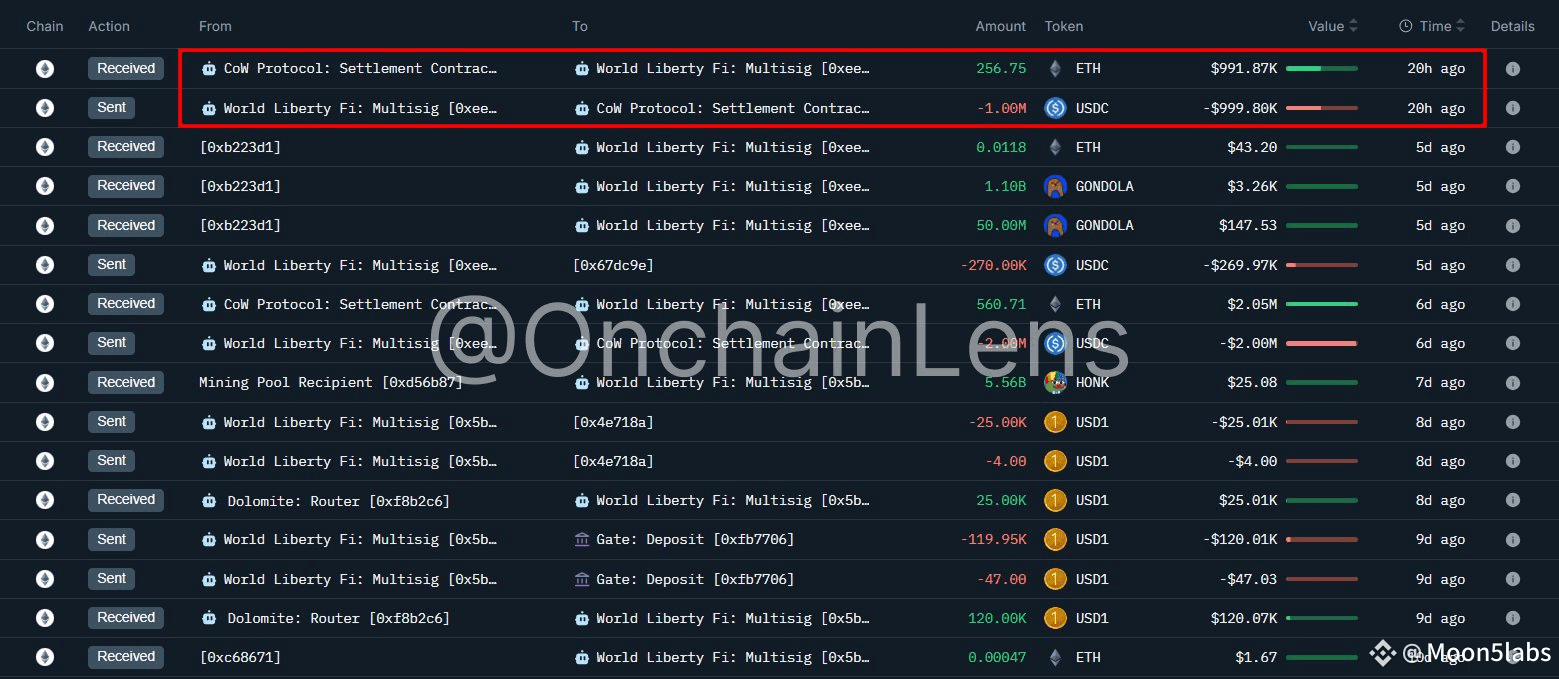

On-Chain Data Confirms: Over 256 ETH Acquired

According to blockchain data, the transaction originated from an address starting with “0xee” and ending with “174dc.” World Liberty Fi acquired 256.75 ETH using USDC worth $1 million. This further strengthens the project’s position in Ethereum.

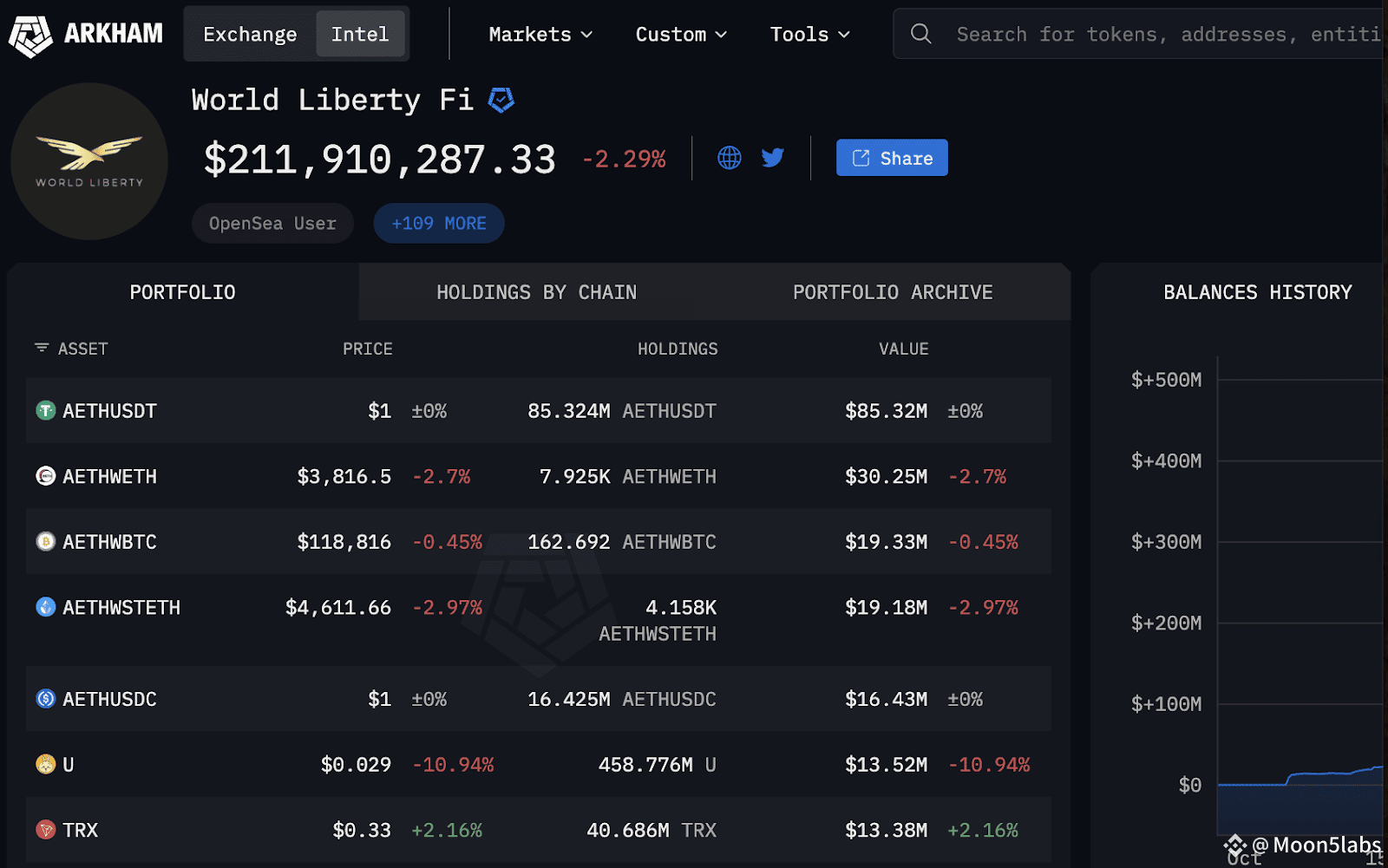

Over $200 Million in Crypto Portfolio

Arkham Intelligence reports that World Liberty Fi currently holds more than $211 million in digital assets. The portfolio is diversified as follows:

🔹 USDT: $85 million

🔹 WETH: $30 million

🔹 WBTC: $19.33 million

🔹 stETH: $19.18 million

🔹 USDC: $16.43 million

The Ethereum purchase likely represents a strategic reallocation of stablecoin reserves in preparation for upcoming internal initiatives such as tokenization or DeFi development.

Trump’s Stake Shrinks, but Influence Remains

While the project increases its crypto exposure, World Liberty Fi’s ownership structure is evolving. Initially, the Trump family held over 75% of the project, but this stake has gradually declined:

🔹 January 24: Dropped to 60%

🔹 Recent days: Further reduced to approximately 40%

According to Forbes, Trump or associated entities may have liquidated up to $190 million worth of WLFI, potentially netting Trump himself around $135 million from the sale.

Bitcoin vs. Ethereum: Diverging Strategies

The Ethereum investment by World Liberty Fi comes at a time when Trump’s other project, Trump Media and Technology Group (TMTG), confirmed it holds $2 billion worth of Bitcoin, accounting for two-thirds of its liquid reserves.

TMTG has also invested $300 million in Bitcoin derivatives and filed for several crypto ETF funds—including one with a 75% Bitcoin and 25% Ethereum allocation.

Politics and Crypto: Ethical Concerns Emerge

Analysts are raising concerns as Trump’s political career becomes increasingly intertwined with direct financial exposure to crypto. His Truth Social posts are known to influence the market, and critics warn that this combination of political influence and financial interest could compromise market fairness.

#TRUMP , #ETH , #Ethereum , #USPolitics , #WLFI

Stay one step ahead – follow our profile and stay informed about everything important in the world of cryptocurrencies!

Notice:

,,The information and views presented in this article are intended solely for educational purposes and should not be taken as investment advice in any situation. The content of these pages should not be regarded as financial, investment, or any other form of advice. We caution that investing in cryptocurrencies can be risky and may lead to financial losses.“