Let's talk about @Huma Finance 🟣

I have been participating in this project and recently studied it in detail from a data perspective. I feel it's quite good, and I will share some insights over the next few days.

Let's first review this project today.

Huma Finance innovates global payment settlement through the PayFi technology stack, compressing the traditional 2-5 day cross-border settlement time to seconds, having processed $4.5 billion in transaction volume to date.

The HUMA token has experienced fluctuations since the TGE on May 26, 2025, with the current price at $0.03967 and a market cap of $68.76M.

The project builds a sustainable token economy through a unique real cash flow yield model and multi-layer staking mechanism, providing a differentiated competitive advantage in the RWA lending space.

The core problems and impacts Huma Finance addresses👇

Breakthrough of traditional finance pain points

Huma Finance provides on-chain solutions for the three core pain points of the global payment system:

1. Excessively long settlement times and capital occupation

Problem scale: Traditional cross-border payments require 2-5 days for settlement, forcing global payment service providers to pre-deposit approximately $4 trillion in funds.

Huma's solution: Directly putting accounts receivable and stablecoins on-chain to achieve final settlement in seconds, allowing merchants to receive payments immediately.

2. High liquidity costs

Traditional costs: Small and medium payment institutions face financing costs of 10%-20%, with T+30 to T+90 payment terms requiring high discount fees.

Innovative model: Through RWA collateralized revolving credit pools, short-term notes are split into on-chain composable assets, compressing financing costs to single digits.

3. High fees for cross-border transfers

Market status: Typical remittance fees are 5-10%, while stablecoins on Solana have a single transaction fee of <0.01 USD.

Technical advantages: The PayFi Stack supports payment institutions for direct on-chain settlement and real-time exchange, significantly reducing transaction fees.

PayFi technology architecture and innovation

The six-layer PayFi Stack built by Huma provides modular upgrades for traditional payment infrastructure:

Actual application data:

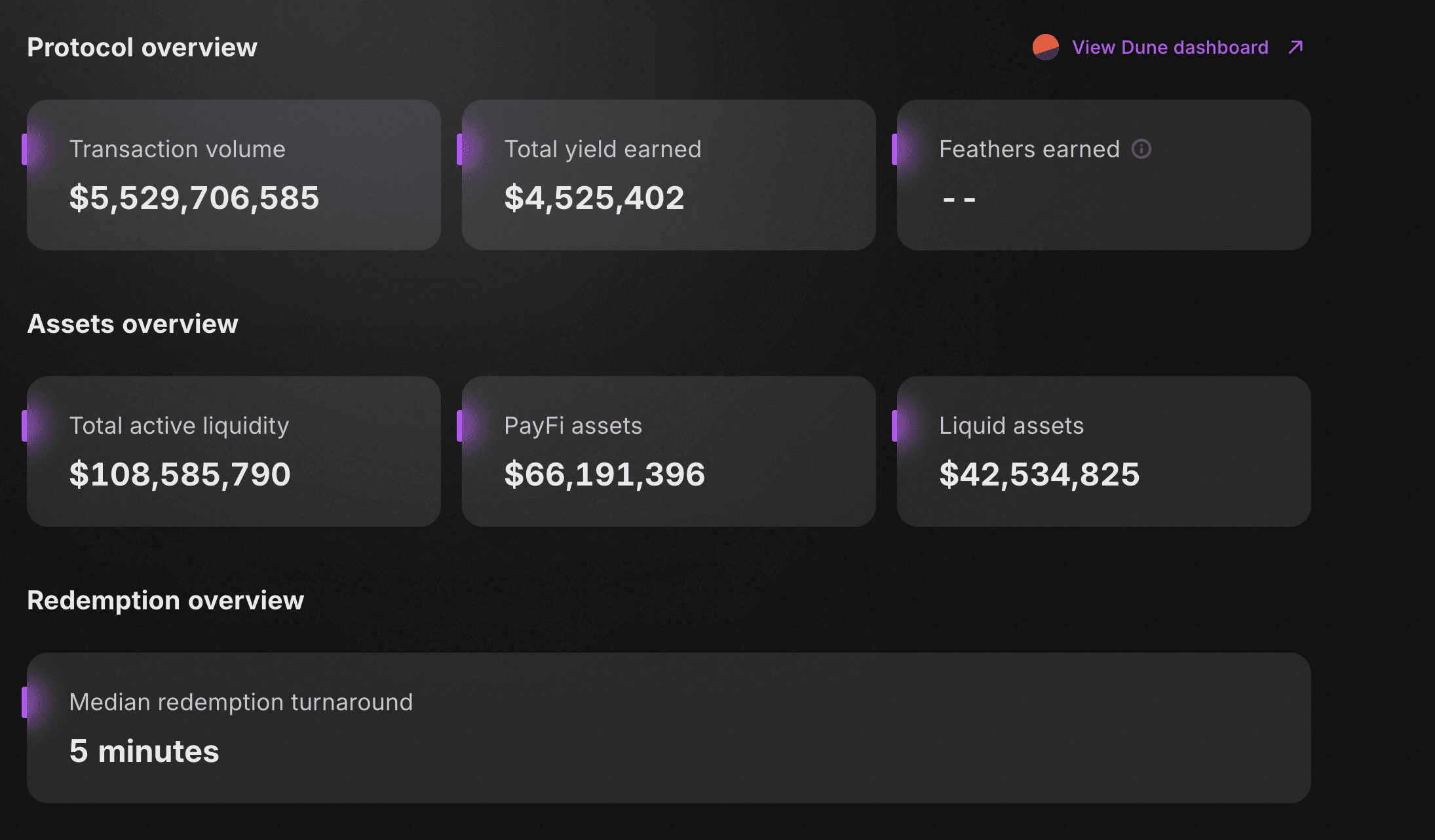

As of the token TGE, 53,400 depositors have deposited $50 million USDC into Huma 2.0.

There is still $108 million in active liquidity, with PayFi assets at $66.19 million and liquid assets at $42.53 million.

Short turnaround notes average a 7-14 day repayment, providing double-digit annualized returns for LPs, currently at 10% return.

Deep integration with traditional institutions

Visa blockchain settlement pilot: In May 2025, Huma and Visa launched a real-time settlement pilot, where funds are credited to merchants in seconds after card swiping on the front end. Considering Visa's annual settlement scale of $3-4 trillion, and Huma having processed $2 billion in transactions in two years, it shows the huge growth potential of on-chain PayFi.

Arf merger case: The merged Arf-Huma provides on-demand liquidity for 60+ remittance institutions, having accumulated $1.8 billion in financing, with a goal to exceed $10 billion by 2026. In typical operations, after the remittance instruction is on-chain, the pool immediately disburses USDC, with repayment within 24-72 hours, saving an average of 30-50 basis points in costs.