#cryptotrading #WeekendWisdom #SundayToMondayEdge

What if your weekend routine held the key to smarter trades? For many crypto traders, Sunday nights may be the most overlooked opportunity of the week. If you're holding back until Monday, the data says you might already be late.

📊 The Sunday Edge Explained

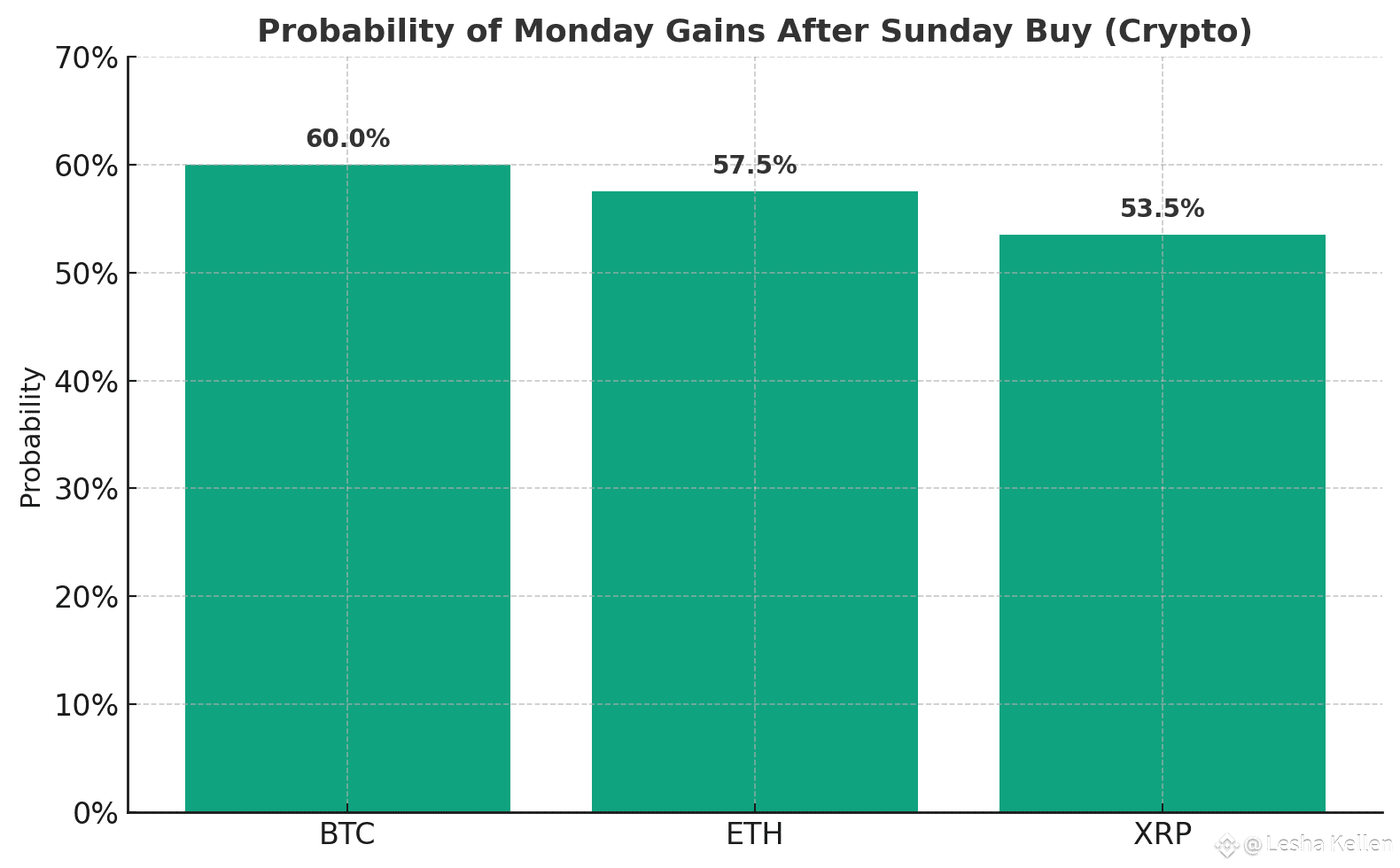

Historical price data reveals a pattern: some top cryptocurrencies tend to perform better on Mondays. Research confirms that Bitcoin $BTC leads this trend, with studies showing a ~60% chance of positive returns when bought on Sunday and sold on Monday.

Ethereum $ETH follows closely, with a Monday win rate between 55% and 60%, especially during active market weeks. Ripple $XRP shows a more modest edge with a 52% to 55% chance of gains.

This insight is not hype. It's based on peer-reviewed research using GARCH models, ANOVA tests, and daily return analysis across years of trading data.

🧠 Why It Works

Crypto markets stay open all weekend, but liquidity often drops and major players wait until Monday. By late Sunday, sentiment builds up. That energy often spills into Monday, leading to fresh buy orders, stronger momentum, and higher prices.

📈 Best Performing Sunday Buys (Monday Sell Strategy)

Token Historical Probability of Monday Gain

✅ How to Use This Strategy

Buy on Sunday evening when market noise is low

Sell on Monday, ideally during peak volume hours

Use volume and sentiment tools to confirm signals

Trade small amounts to test your edge before scaling

Use tight stop-losses and realistic take-profits

This strategy isn't a silver bullet. But when paired with discipline and proper risk management, it offers one of the few statistically supported timing edges in crypto.

🔁 Final Thought

If you’ve been searching for a repeatable, data-backed tactic to trade the week, start watching Sunday nights more closely. It could be the small adjustment that makes a big difference.