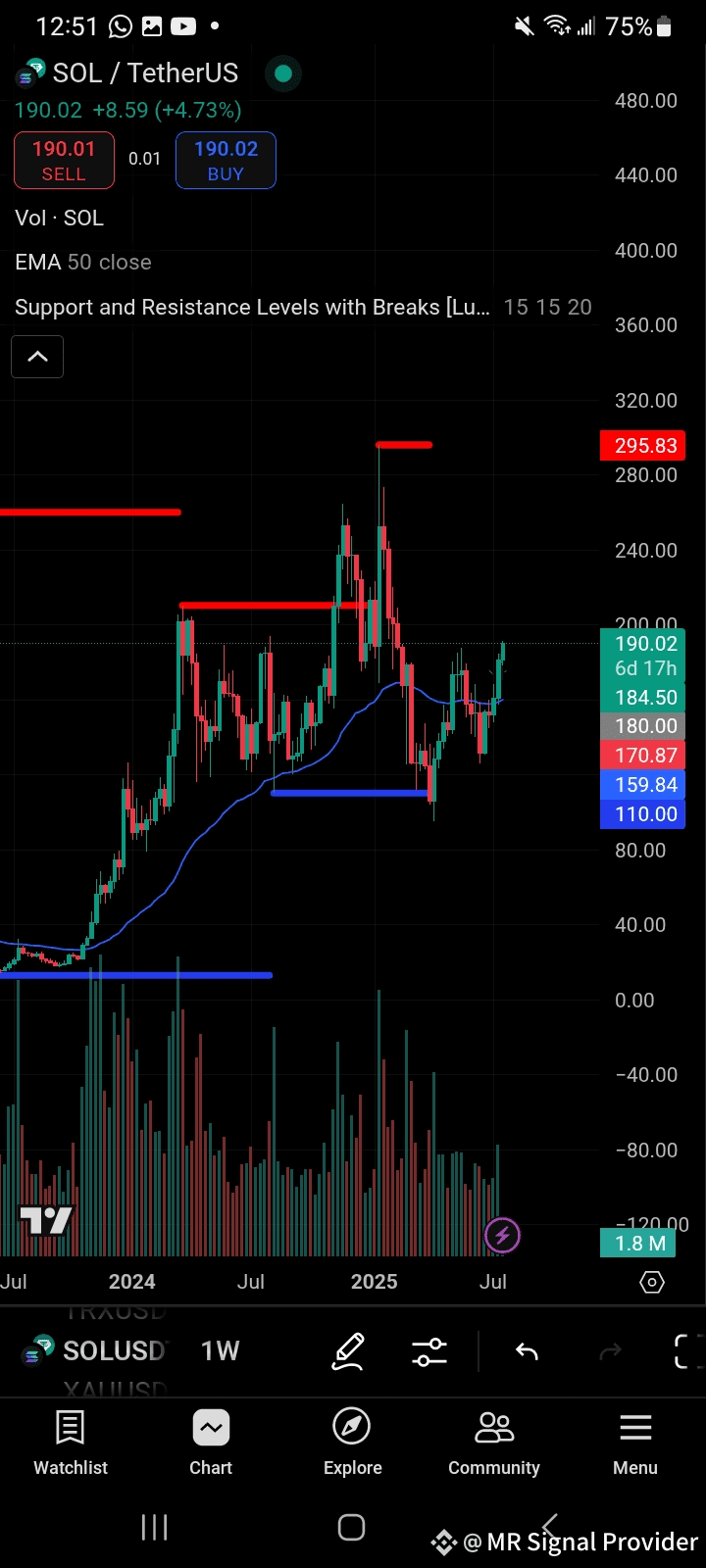

🔍 Chart Overview$SOL USDT

Current Price: $190.02 (+4.73%)

EMA 50 (Blue Line): Acting as a dynamic guide /resistance.

Support & Resistance Levels: Auto-plotted (thick red = resistance, thick blue = guide ).

🟢 Bullish Signs

Price Trading Above EMA 50:

Price has reclaimed the EMA 50 line, suggesting bullish momentum.

Historically, this has supported in addition upward motion in uptrends.

Higher Low Formation:

After the drop round $ one hundred ten –$120, SOL has revealed a better low (~$140), a signal of fashion reversal.

Breakout Attempt:$SOL

Price is nearing a resistance quarter at $200–$210. If broken, the subsequent key resistance is round $295–$ three hundred .

🔴 Resistance Levels

$200–$210: Local resistance quarter ( preceding highs).

$295.83: Major resistance (highlighted in red), from preceding marketplace cycle highs.

🔵 Support Levels$SOL

$ a hundred and seventy .87: Nearest guide if fee retraces.

$159.84: Stronger guide close to EMA and former consolidation quarter .

$ one hundred ten .00: Long- time period guide , backside of ultimate predominant correction.

📊 Volume Analysis

Volume appears steady; spikes round fee swings display hobby in the ones fee levels.

However, modern-day rally could preferably want growing quantity to affirm strength.

📈 Price Targets (If Bullish Momentum Continues)

Short-Term: $200–$210 ( look ahead to breakout or rejection).

Mid-Term: $240–$250 range.

Long-Term: $295–$ three hundred predominant resistance quarter .

⚠️ Risks / Bearish Considerations

Failure to keep above $180–$ a hundred and seventy quarter may also cause retest of $159–$160.

If macro situations flip risk-off (crypto- huge correction), revisit of $ one hundred ten isn’t impossible.

✅ Summary

Trend: Recovering bullish fashion , better low and breakout attempt.

Watch: $200–$210 quarter closely.

Key Supports: $ a hundred and seventy .87 → $159.84 → $ one hundred ten

Key Resistances: $200 → $240 → $295.83

Let me realize if you would like a short- time period (4H/1D) chart evaluation or a buying and selling approach primarily based totally in this setup. #BTCvsETH