In the martial arts world of Jin Yong, anyone who can establish a sect must be a master-level figure. For example, Damo Patriarch for Shaolin, Zhang Sanfeng for Wudang, Wang Chongyang for Quanzhen.

In the crypto world, there are also many projects that lead the trend and usher in an era. For example:

Uniswap is to AMM Dex

Chainlink is to oracles

Axie Infinity is to GameFi

Kaito is to InfoFi

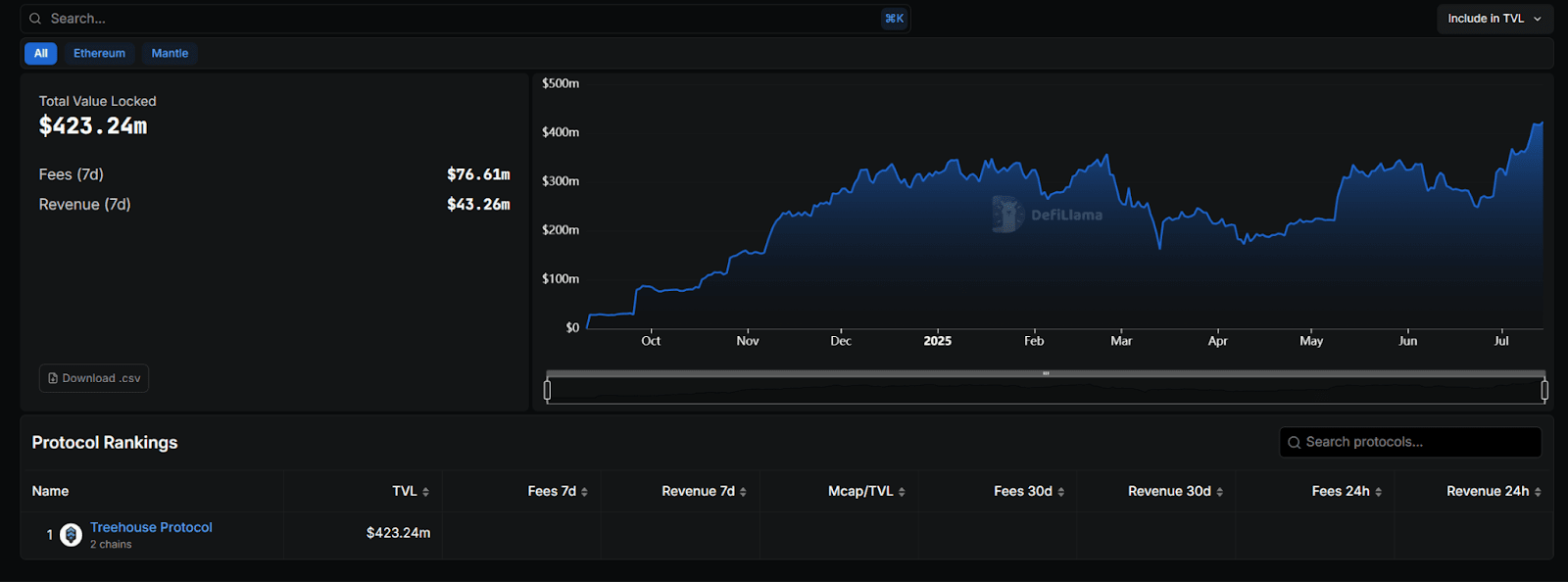

The next project likely to 'establish a sect' is @TreehouseFi. If you open DefiLlama and search for Treehouse, you will find that this project not only has a TVL of up to $420 million but is also the only one in the DOR track.

The question is, what is DOR, and what new path does Treehouse want to take? How to ambush currently?

Let's dive in 👇

1/ Treehouse - Next Generation Fixed Income Infrastructure

Treehouse positions itself as a 'decentralized fixed income layer'. Treehouse aims to bring the fixed income market on-chain through innovative solutions.

What is the fixed income market?

We don't use vague terms; let me give you an example: Imagine you lend money to a company, and they give you an IOU, promising to pay you a fixed interest every year and return the principal at maturity. The fixed income market is a place specifically for trading such 'IOUs'.

The characteristics of the fixed income market are low volatility and stable returns, making it suitable for conservative investors. Data shows that the global fixed income market (including bonds and bank loans) is about three times that of the stock market.

Currently, what obstacles exist in bringing the fixed income market on-chain?

The first barrier: the lack of a unified and reliable benchmark interest rate

The fixed income market relies on reference rates (such as LIBOR, SOFR) to price bonds and derivatives. DeFi interest rates, such as staking yields and borrowing rates, are usually floating, highly decentralized, and lack recognized benchmarks. This makes it very difficult to design fixed income products in DeFi.

The second barrier: insufficient liquidity

The traditional fixed income market is vast, and fixed income products (such as bonds and interest rate derivatives) require high liquidity to support pricing and trading. If the asset pool is small and the trading depth is insufficient, it can easily lead to price fluctuations and slippage.

The third barrier: user education

The traditional fixed income market mainly targets institutional investors, and ordinary users have limited awareness of fixed income, leading to insufficient market acceptance.

How does Treehouse solve the aforementioned issues?

Treehouse addresses the aforementioned issues through core components tAssets and DOR (Decentralized Borrowing Rate).

tAssets

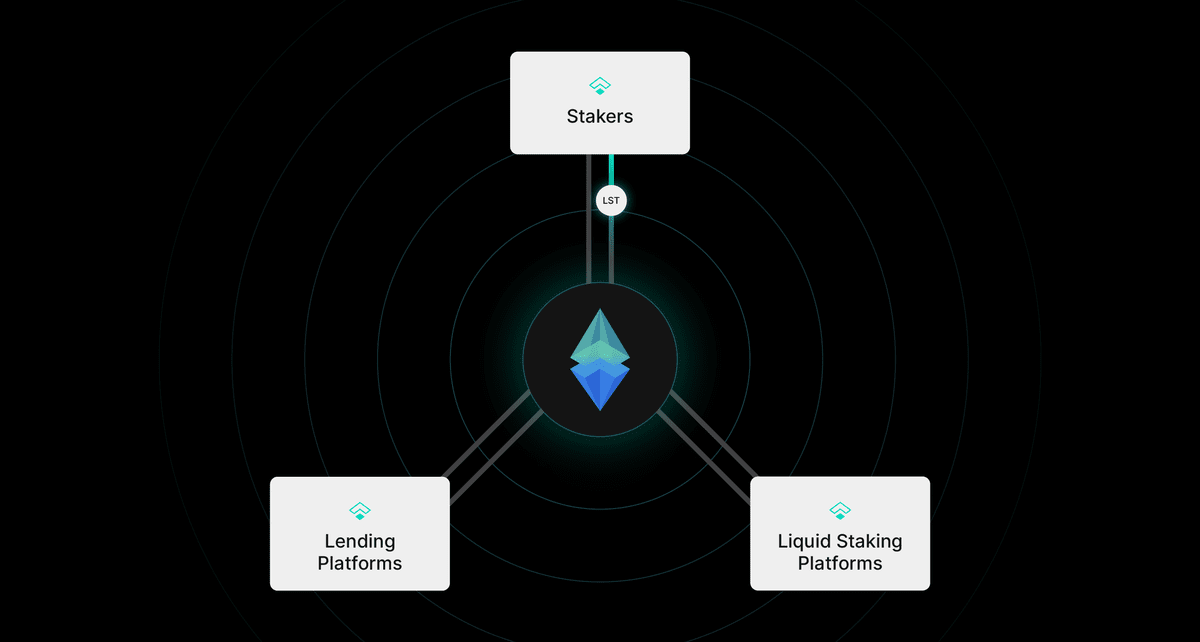

tAssets, as LST, has only two core purposes: first, to provide holders with returns higher than native staking, and second, to integrate on-chain interest rates, aligning staking rates with borrowing rates. The path to achieve this is through on-chain arbitrage.

The operating mechanism is as follows:

Stake native assets (such as ETH) on the LST platform

Provide LST to the lending market to obtain collateral certificate tokens from the lending pool

Borrow more native assets from the lending market to obtain debt tokens

Re-stake the borrowed native assets on the LST platform

Repeat multiple times until the arbitrage opportunity completely disappears

The initial version of tAssets is tETH, and tETH holders can obtain yields exceeding ETH staking through interest rate arbitrage. In the future, tAssets will be deployed on other public chains such as Solana.

DOR

DOR (Decentralized Quoting Rate) is a reference rate derived from the Treehouse protocol, achieving a deterministic on-chain reference rate in a decentralized manner.

Participants include:

Operators: responsible for supervising the DOR data flow, setting its parameters, and coordinating with team members

Team members: use proprietary models, data, and software to provide interest rate forecasts to operators

Referencers: integrate DOR data flows into their products and applications

Delegators: tAssets holders who earn rewards through delegation

End users: use financial products built by referencers

My personal understanding is that Treehouse absorbs market funds through high returns generated by arbitrage mechanisms, thereby achieving the goal of rebalancing on-chain interest rates. Additionally, it establishes a deterministic reference rate through decentralized mechanisms. The ultimate goal is to allow various fixed income products and protocols to operate based on Treehouse, thus enabling the fixed income market to thrive on-chain.

2/ GoNuts Season 2 - the best ambush method currently

Before discussing ambush methods, let's first look at Treehouse's financing situation.

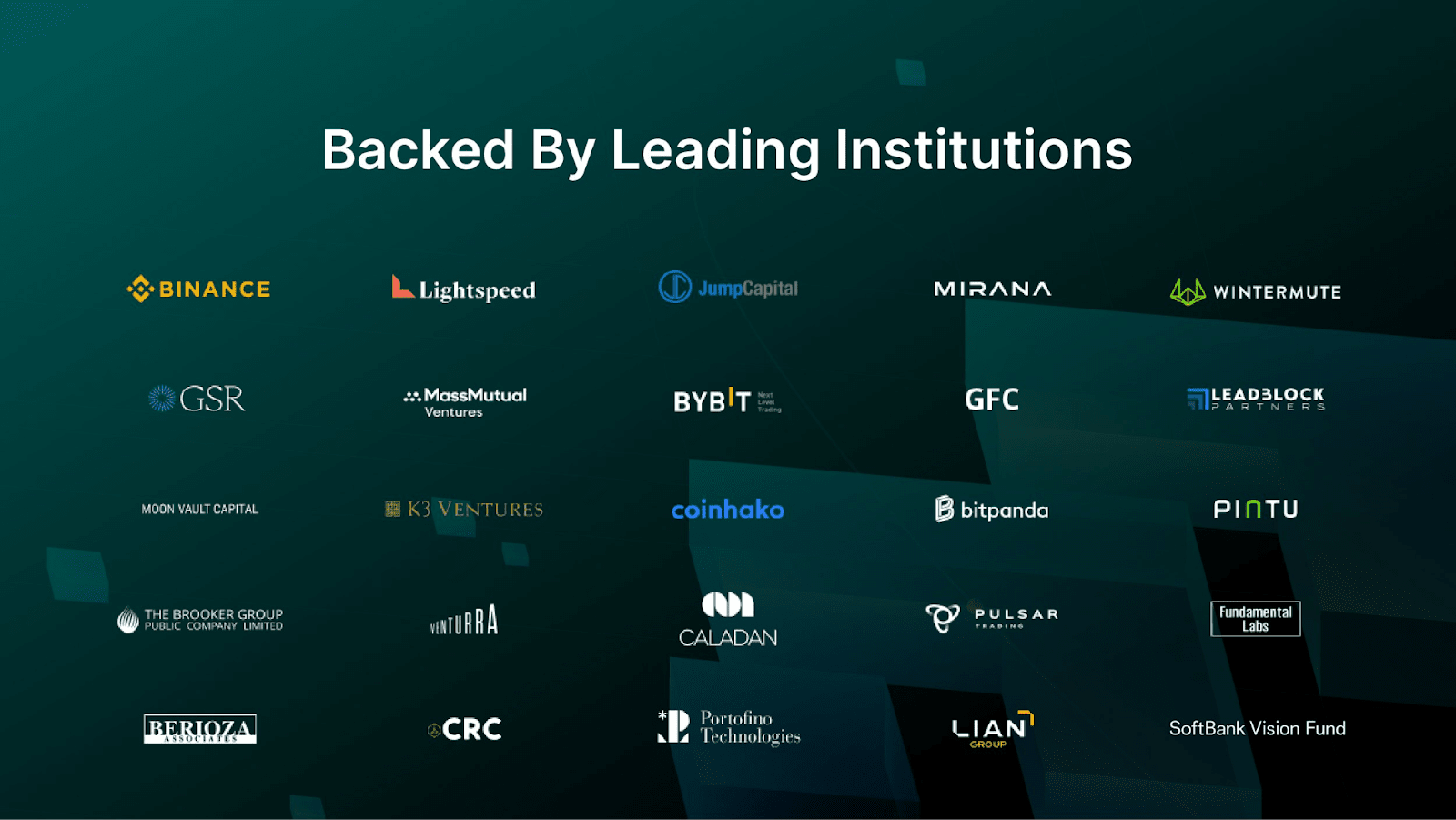

March 16, 2022: Completed $18 million seed round financing.

April 15, 2025: Completed a new round of financing with a token valuation of up to $400 million, with participants including Jump Capital, Lightspeed Venture, Binance Labs, Wintermute, GSR, etc.

The lineup of investors is very luxurious, no doubt.

Currently, the Treehouse points activity GoNuts is ongoing, and it is already the second season of the activity. The best ambush method, of course, is to accumulate points.

How to earn nuts (ecosystem points)?

Holding tAssets: earn 1 nut per day for every 0.1 tETH held

Liquidity support: earn 1 nut for every 0.1 tETH of LP value

Using integrated assets: in addition to tETH, gtETH, cmETH, etc. are also supported by the activity

In addition, there are many additional ways to accelerate the accumulation of nuts:

Yield multiplier

Specific Buff: bonuses for specific assets

General Buff: comprehensive bonuses

(These two types of Buffs can be stacked)

Badge

Earn unique badges by participating in activities hosted by Treehouse, which can provide additional rewards or points.

Task and level system

Coming soon, completing designated tasks each week can earn points and experience, which will be used to level up for hidden rewards and additional bonuses

Participation link: https://app.treehouse.finance

Detailed participation guide: https://www.treehouse.finance/blog/s2-nuts-guide

Finally, according to rumors, the Treehouse TGE should not be far off. Hurry up.