---

1. Context analysis 🧩

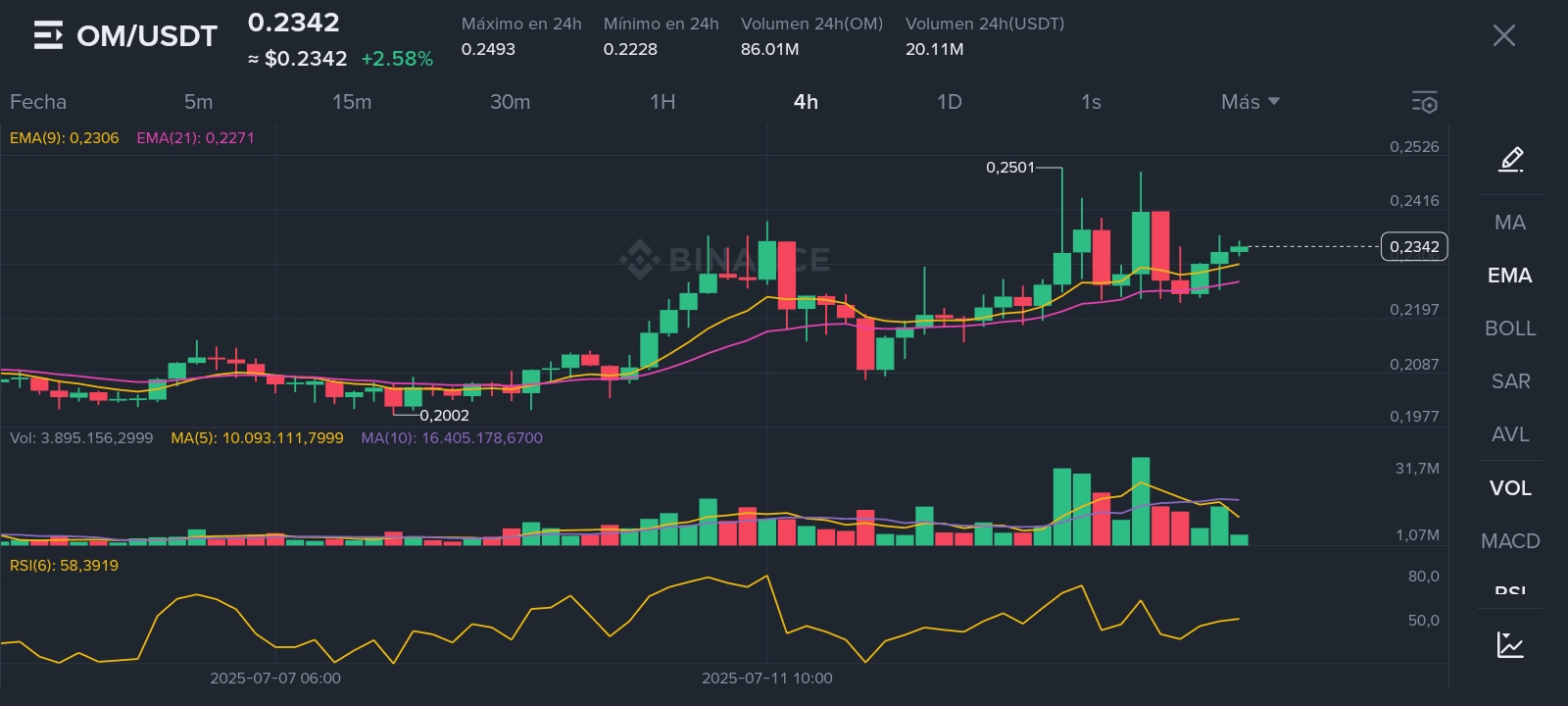

Current price of OM is between $0.22 and $0.24.

In April, it suffered an extreme drop of ~90% —from $6 to $0.4— due to concentrated selling by large holders.

In May, 20% of the supply was bridged to the mainnet, improving liquidity and generating a rally of ~3% and +45% volume.

---

2. Goals and time horizon

Short term (days to weeks): take advantage of technical rebounds around support ($0.20–$0.22).

Medium term (weeks to months): evaluate recovery if greater liquidity and stability post-bridge are confirmed.

---

3. Key levels: support, resistance, and stop-loss

Level Approx. Value Action/Importance

Support $0.20 Entry on rebound, possible buying point

Stop-Loss $0.19 Limit to minimize losses if support falls

Resistance $0.27–$0.30 Possible partial profit taking

Target $0.30–$0.35 Conservative goal if it stabilizes under liquidity

---

4. Entry and positioning strategy

Staggered buying (dollar cost averaging): buy in several tranches between $0.20 and $0.23 to average the price.

Modest sizes: no more than 2–3% of your total portfolio in OM, given the high volatility.

Confirmation: ideally, wait for a rebound after reaching support or signs of rising volume.

---

5. Risk management and monitoring

Stop-Loss: set between $0.19–$0.195. Check liquidity levels and behavior against support daily.

Volatility: OM is very volatile. Do not use leverage.

Daily follow-up: observe changes in volume and in percentage of bridged supply; it can mark the beginning of a bullish cycle.

---

6. Exits and adjustments

Partial profit taking at resistance ($0.27–$0.30): sell 30–50% of the position.

Trailing stop: move stop to breakeven if the price rises more than 20% from entry.

If the price surpasses $0.35 with sustained volume, consider holding the rest for possible continuation.

---

7. Factors to watch

Crypto market sentiment: runs in BTC/altcoins can boost or hinder OM.

On-chain or team events: token burn, new listings, real use of the network (e.g., agricultural tokenization or validators like Google Cloud).

Institutional flows: massive token movements in exchanges (Binance/OKX) have already caused past drops —watch X/On-chainData.

---

8. Summary of plan

1. Staggered entry between $0.20–$0.23.

2. Initial Stop-Loss at $0.19.

3. Partial exit at $0.27–$0.30.

4. Trailing stop if it rises more than 20%.

5. Daily monitoring of volume, large transfers, and news of the project.