Solana ( $SOL ) is showing strong bullish momentum, currently trading around $162 and making another push to break the key $157 resistance level. 📈 Here’s why SOL could be poised for a significant upward move:

Technical Analysis:

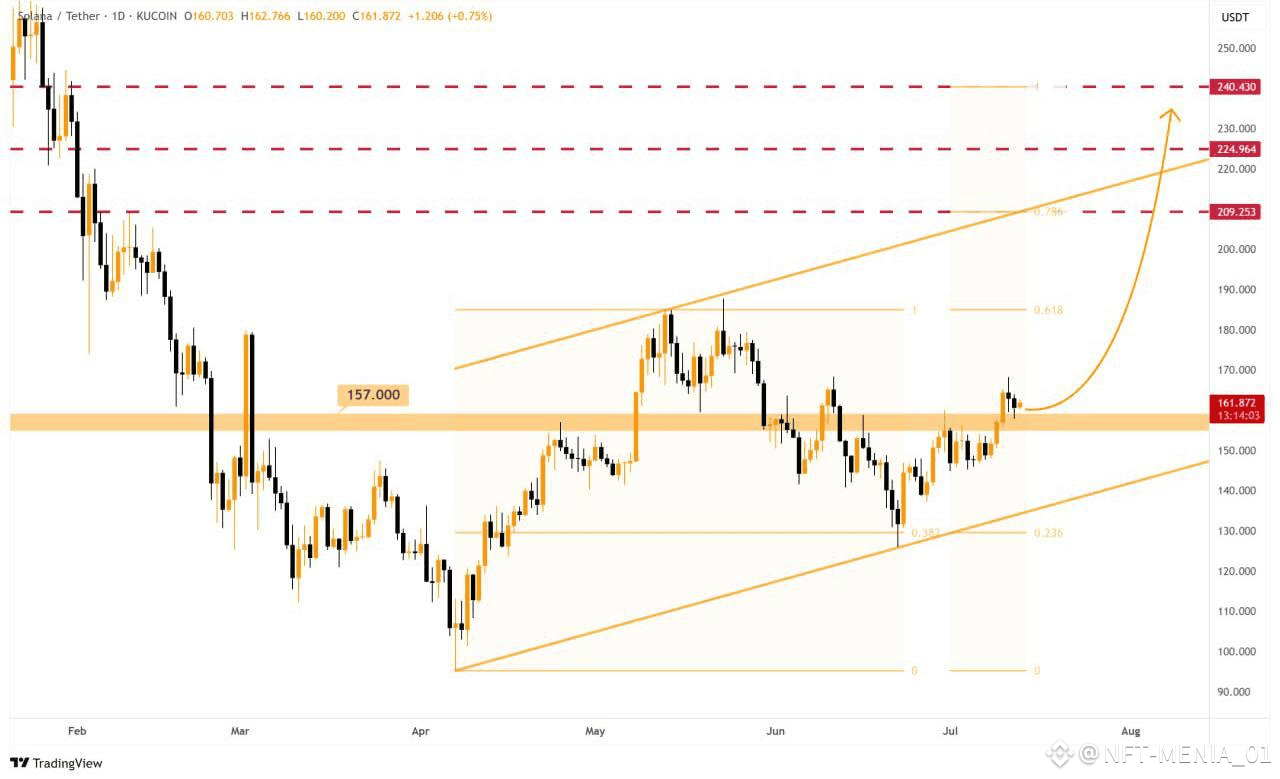

- Ascending Channel: Solana remains within a multi-year ascending channel, a bullish pattern that has consistently supported higher lows and higher highs. The price is currently testing the upper resistance around $162-$167, with strong support at $152-$157 holding firm. A decisive break above $165 could propel SOL toward the next major target at $180, with $210 as a realistic medium-term goal.

- Bullish Indicators: The RSI (currently ~61) shows growing strength without being overbought, indicating room for further upside. The breakout above the 200-day EMA and a symmetrical triangle pattern signals strong bullish conviction. Increased trading volume (+36% recently) further confirms renewed investor interest.

- Key Levels: Support at $152.95 (0.618 Fibonacci retracement) has flipped from resistance, reinforcing price stability. A breakout above $167 could target $180-$200, while $210 aligns with the 1.618 Fibonacci extension and historical resistance.

Fundamental Drivers:

- Institutional Interest: Solana’s ecosystem is thriving, with $92.6M in weekly inflows and firms like DeFi Dev Corp and Upexi increasing their SOL holdings. The REX-Osprey Solana Staking ETF launch saw $12M in day-one inflows, boosting confidence.

- Network Strength: Solana’s DeFi and NFT ecosystems are booming, with TVL rising from $6B to $8.61B since April. The Pump.Fun ICO raised $500M, and Solana’s stablecoin supply hit $10B, with 191M transactions in the last 30 days.

- Market Sentiment: Posts on X highlight optimism, with analysts noting SOL’s potential to hit $222-$300 if it clears $170. Bitcoin’s ATH is suppressing alts, but an altcoin season could propel SOL closer to its all-time high of $294.33.

Why It’s Moving Up:

The combination of bullish technical patterns (cup-and-handle, inverse head-and-shoulders), strong institutional backing, and robust network activity creates a perfect storm for SOL’s upward trajectory. The $150-$160 zone remains a solid entry point for accumulation, as a breakout above $167 could ignite a rally toward $210 and beyond.

Risks: A failure to break $165-$167 could lead to a pullback toward $140-$145. However, the overall trend remains bullish as long as $152 holds.

Conclusion: SOL is coiling for a potential breakout. With strong fundamentals and technicals aligning, buying in the $150-$160 range could offer a great opportunity before the next leg up to $210 or higher. Keep an eye on volume and the $167 resistance for confirmation! 👀

Disclaimer ⚠️: It's not a financial advice, always conduct your own research and practice proper risk management.