🔍 Resolv (RESOLV) – Updated Snapshot (June 2025):

📊 Market Overview

💹 Resolv (ticker: RESOLV) is a cutting-edge cryptocurrency protocol operating within the CRYPTO market.

💵 As of now, its trading price stands at $0.252226 USD, reflecting a slight dip of -0.09 USD (-0.26%) from the previous trading session.

📈 During intraday trading, Resolv has shown significant price movement, reaching a high of $0.33974 USD and a low of $0.236337 USD, indicating a moderately volatile trading range.

⚙️ What is Resolv?

🪙 Resolv is a multi-token DeFi protocol specifically designed to offer delta-neutral yield strategies across Ethereum and several other blockchains.

🏦 Its core mechanism is built around two primary tokens—USR and RLP—with each playing a critical role in balancing risk and yield.

🔐 At the heart of the protocol lies USR, a fully-collateralized, USD-pegged stablecoin, which is backed by ETH but actively hedged via short futures.

📊 This unique architecture enables USR to maintain a stable value while avoiding market volatility.

🧱 Token Architecture and Risk Segmentation

🎯 The protocol’s RLP token acts as the risk-bearing layer, absorbing volatility and counterparty risk while offering superior yield incentives.

💳 Users can mint or redeem USR on a 1:1 basis using stable assets such as USDC.

⚖️ The delta-neutral structure is key: USR holders enjoy price stability, while RLP holders assume strategic risks in exchange for elevated returns.

📐 This dual-token system allows Resolv to segment and distribute risk transparently.

🔐 Security and Infrastructure

🛡️ Security is foundational to Resolv’s design.

📦 The protocol integrates off-exchange custody solutions, reducing exposure to centralized exchange risks.

📜 It also relies on audited smart contracts to execute core functionalities securely.

👁️🗨️ Resolv has partnered with Hypernative, a prominent security platform, to implement real-time monitoring and threat detection.

🚨 This proactive framework helps anticipate and neutralize exploits before they occur.

🚀 Adoption, Growth & Community Engagement

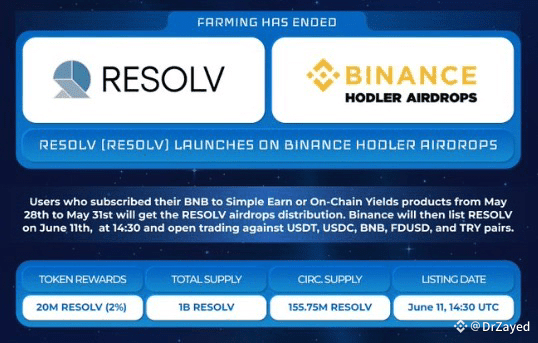

📅 Resolv officially launched in early 2025 and has since expanded across multiple blockchains including Ethereum, Base, and BNB Chain.

💰 By April 2025, Total Value Locked (TVL) stood at approximately $450 million, down from a peak of over $600 million in late 2024—demonstrating strong, albeit fluctuating, market adoption.

🏆 The ongoing Points Program: Season 2, launched on May 9, 2025, has attracted over 50,000 users.

🪙 This campaign incentivizes participation through activities like staking USR/RLP, referring new users, acquiring Blueprint NFTs, and holding or staking $RESOLV tokens.

📈 In addition, Resolv secured a $10 million seed round led by Cyber.Fund, earmarked for expanding into Bitcoin-based strategies and scaling up institutional integration.

🛤️ Roadmap & Strategic Vision

🔭 Looking ahead, Resolv plans to introduce new yield vaults backed by BTC, altcoins, and even real-world assets such as U.S. Treasury bills.

🌉 The long-term vision is to become the DeFi ecosystem’s premier distribution layer for yield—aggregating returns from multiple sources and delivering them via stakers, vault strategies, and institutional partnerships.

💡 Why It Matters

🔍 Resolv’s key innovation is its true delta-neutral structure, providing pure stability to USR holders while offering upside to RLP stakers.

🧠 Through responsible risk delegation, transparent governance, and decentralized yield distribution (via stUSR), Resolv is positioning itself as a next-generation DeFi yield protocol aimed at both conservative and yield-seeking users.