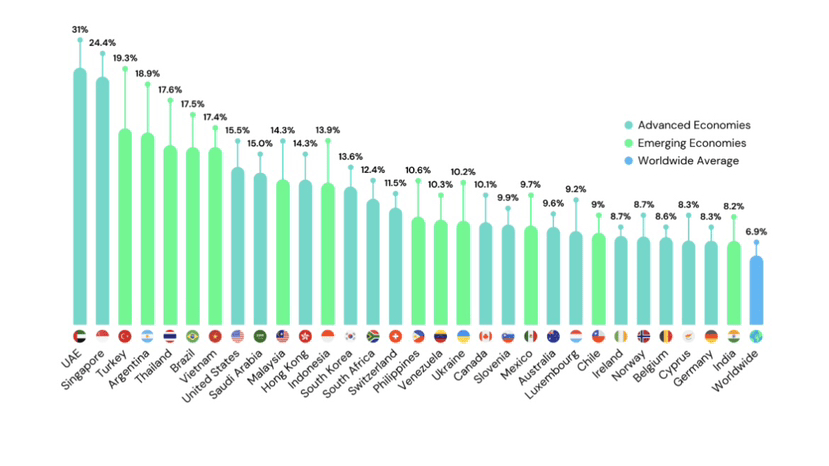

According to Triple-A’s 2024 report, Vietnam’s crypto adoption rate stands at 21.19%, representing around 20.9 million users — one of the highest rates globally.

🔗 Source: Triple-A

More tellingly, a recent study titled “Stablecoins as Vietnam’s Parallel Financial System” shows Vietnamese investors now treat stablecoins — primarily USDT — as a liquidity tool and safe haven, often preferring them over converting back to VND after trading.

🔗 reports.tiger-research.com

Earlier today, I was browsing the news when I came across a story on how stablecoins are quietly becoming essential amid inflation and currency instability. It hit home immediately.

The Vietnamese đồng has been under pressure for years, and banks enforce strict rules and delays on fund transfers.

It’s no surprise that more people are using stablecoins to:

store value,

move money peer-to-peer,

and even pay for assets like used cars or property — all outside of the traditional financial system.

📊 The Stablecoins as Parallel Financial System study explains how USDT on P2P platforms often carries a 3–5% premium over the official VND/USD rate.

That premium isn’t a bug — it’s proof:

Stablecoins are being viewed as independent stores of value, not just trading tools.

I’ve personally heard of:

a couple in Da Nang who paid part of a land deal with USDT,

a friend working remotely for a Singapore-based startup who now receives his salary in stablecoins — and spends it via a crypto card.

What once seemed futuristic is happening now — supported by platforms like Binance and pilot projects from companies like Volante, which push for blockchain salary solutions.

🖼️ Image: Volante’s new payment card and CEO @Joey Bertschler

Crypto has long been used informally — for gaming, speculation, even underground transfers.

But today, it’s taking root as a lifeline: freelancers, expats, and remittance-dependent families are all seeking shelter from inflation and slow banks.

As someone navigating these same economic dynamics, I’m hopeful.

Having access to stablecoins means I’m not solely at the mercy of monetary policy or financial red tape.

It’s not just speculation — it’s survival, stability, and real alternative infrastructure for daily life.