⚠️ What is Momentum?

Momentum is a native ve(3,3) model DEX deployed in the Move ecosystem, dedicated to building a core liquidity infrastructure on Sui.

Official X account: @MMTFinance

Funding progress: A total of $10 million has been raised, with subsequent rounds to be announced soon.

Strong backing:

Leading investor: Varys Capital supported by the Qatari royal family office

Received dual endorsement: Sui Foundation + Mysten Labs co-founder Adeniyi Abiodun

The investment lineup also includes top institutions like Coinbase Ventures and Circle Ventures

Token mechanism:

Protocol token: $MMT

Governance token: $veMMT

⚠️ ve(3,3) mechanism: How to achieve a win-win-win?

ve(3,3) is a mechanism that combines the veToken model with the '(3,3)' cooperative game theory proposed by OlympusDAO, aiming to achieve deep incentive alignment among token holders, LPs, and the protocol.

Momentum ve(3,3) mechanism breakdown

Locking for governance rights

Users lock $MMT to receive governance token $veMMT; the longer the lock, the higher the weight.

Locking 1 $MMT for four years = 1 $veMMT

Locking 1 $MMT for one year = 0.25 $veMMT

Locking for a week is approximately 1/208 of $veMMT

After locking, the $veMMT weight will linearly decrease, and can be extended at any time to maintain governance rights.

Voting determines the direction of incentives

$veMMT holders vote once a week to decide which pools will receive liquidity incentives. Where you vote, rewards will follow.

The incentive mechanism activates the governance market

Liquidity providers can attract $veMMT holders to vote for a certain pool by providing incentives, forming a market-oriented voting game mechanism.

Yield distribution mechanism

All transaction fees are 100% allocated to actively voting $veMMT holders

LPs do not directly receive fees unless:

Locking and voting, or

Providing incentives to guide $veMMT voters to support, driving incentives

⚠️ ve(3,3) flywheel: An efficient cooperative multilateral game

Under the ve(3,3) model, the three roles push each other, forming a flywheel effect of liquidity and yield:

For LPs:

The better the liquidity → the lower the slippage → the higher the trading volume → the more fees → more $veMMT voting → more incentives → back to liquidity pools

For project parties:

Provide incentives → Attract votes → Gain incentives → Improve pool performance → Drive token price up

For $veMMT holders:

Voting → Earn fees + incentive income → Guide incentives towards quality pools → Increase $MMT value → Enhance personal earnings

This is a cooperative game of win-win for three parties.

⚠️ The core logic of the token economy of ve(3,3)

1. Deep liquidity = true price discovery

Sufficient depth is the premise for true price reflection, which is the foundation for DEX to truly compete against CEX.

2. Governance voting + incentives = precise incentives

No 'sprinkling pepper', only incentivizing pools with real demand, leading to higher efficiency and more stable capital use.

3. veToken model = long-term cooperation mechanism

Locking means long-term binding; the motivations of governors, project parties, and LPs are inherently aligned.

Sui × Momentum: Co-building a native liquidity engine

Sui is one of the most advanced next-generation public chains, but still lacks a DEX engine with native deep liquidity. Momentum is the ideal candidate to fill this vacancy.

Advantages of Sui include:

TPS theoretical value surpasses Solana, confirming faster

Stable architecture with minimal downtime

Low and predictable gas costs

Strong security for user assets

Native integration of USDC, no cross-chain bridge risk

Supports asset types such as DeFi, RWA, BTCFi, GameFi, AI, etc.

But there are still issues:

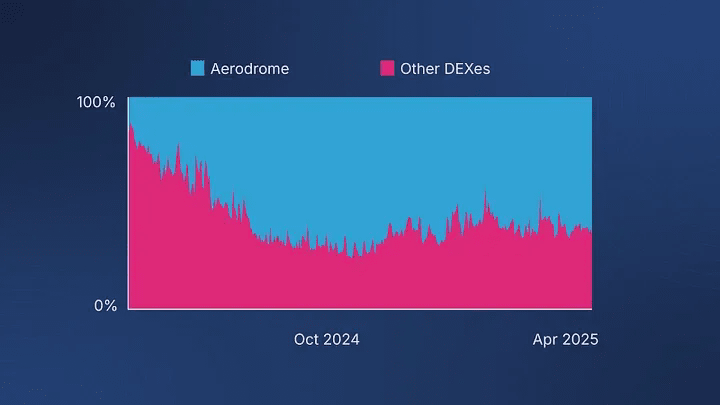

Large transaction slippage still reaches ~0.25%, while Aerodrome on Base has achieved ~0.05%

Lacking a DEX with governance-efficient ve(3,3) model

The value of Momentum lies in:

Provide deep pools

Support high-frequency trading

Enhance protocol TVL and revenue

Support true price discovery

Drive the positive cycle of Sui native asset ecosystem

One-sentence summary:

Sui × Momentum = Base × Aerodrome

Current stage data performance

Momentum has only been online for 5 weeks, and the data has already shown explosive potential:

1️⃣ TVL exceeds $32 million

2️⃣ Cumulative trading volume exceeds $720 million

⚠️ Conclusion

Sui needs a native liquidity engine, and Momentum is the project that fills this gap at a critical moment. Looking back at the paths of Base and Aerodrome, we can see that the combination of Sui and Momentum is heading towards a promising future.

If you are interested in the Move ecosystem or looking for the next DeFi project worth long-term participation, Momentum is worth exploring!

The article is for sharing and communication only, not investment advice.