Interest Rates: The Federal Reserve is widely expected to hold interest rates steady at 4.25%–4.50%, with a 94% probability of no change.

Market Focus: Attention is centered on Fed Chair Jerome Powell's speech, as his tone could signal future monetary policy directions.

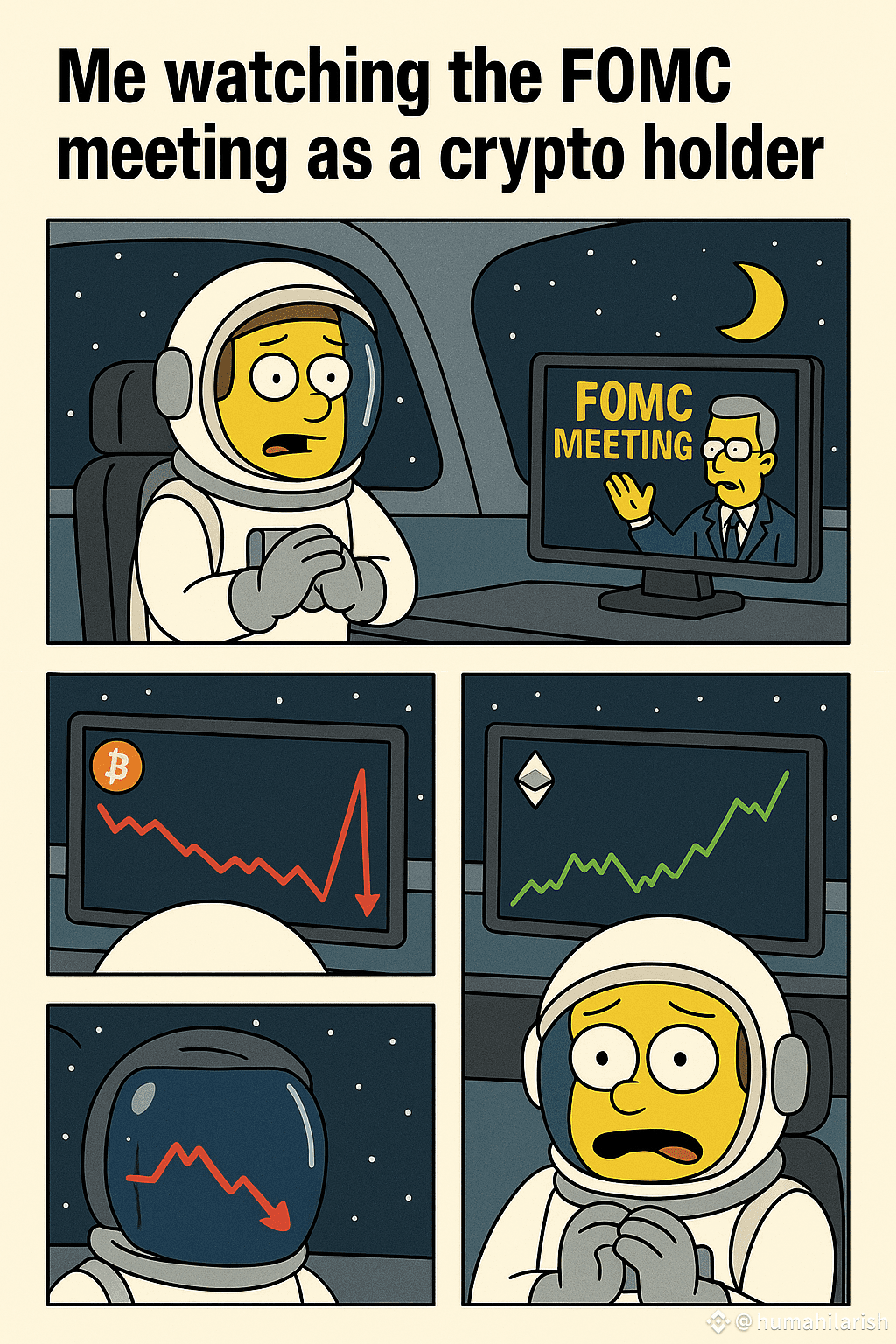

Crypto Market Reaction: Analysts suggest that:

A hawkish tone (emphasizing inflation control) could lead to a Bitcoin price drop to support levels around $91,500–$92,000.

A dovish tone (indicating potential rate cuts) might propel Bitcoin towards the $100,000 mark.

🎯 Crypto Market Sentiment

The crypto market is experiencing heightened volatility ahead of the FOMC meeting:

Bitcoin (BTC): Trading around $94,000, showing consolidation as traders await the Fed's decision.

Altcoins: Major cryptocurrencies like XRP and Cardano's ADA have seen declines, reflecting market caution.

DeFi Tokens: Some decentralized finance tokens are gaining traction, indicating a shift towards projects with strong fundamentals.

🧠 Investor Takeaway

While a rate hold is anticipated, the tone of Powell's speech is crucial. Investors should be prepared for potential market swings and consider risk management strategies accordingly.