Core Logic:

1. During economic recessions, U.S. stocks (S&P 500) typically decline, but they do not always fall continuously.

2. Historical data shows that a 20% drop is a relatively safe entry signal (in extreme cases, it could drop another 20%-30%), but risk must be controlled to avoid one-time all-in.

Step 1: Set Key Levels

Current S&P 500 Level (Closing Price on April 29, 2025): 5,560 points

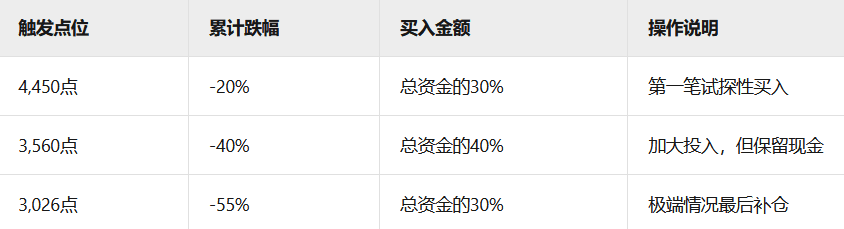

First Bottom Trigger Point:

1. Drop of 20% → 5,560 × (1-20%) = 4,450 points

2. In extreme cases, drop another 20% → 4,450 × (1-20%) = 3,560 points

3. In extreme cases, drop another 15% → 3,560 × (1-15%) = 3,026 points

Note: According to historical data, the maximum drop in 2008 was 57%, but in the last 20 years, extreme drops have mostly been between 30%-40%.

Step 2: Buy in Batches to Reduce Risk

Step 3: Key Indicators to Assist Decision-Making

1. Valuation Signal:

The price-to-earnings ratio (PE) of the S&P 500 becomes safer when it drops to 18-20 times (PE was 25.19 times in April 2025).

2. Sentiment Indicator:

The fear index (VIX) rising above 40 and then falling back may indicate that the bottom is near.

3. Policy Signal:

The Federal Reserve starts to cut interest rates, or there is a easing of U.S.-China tariff policies.

Step 4: Risk Control

1. Maximum Loss Limit Per Trade:

After each purchase, if it continues to drop by 10%, consider stopping loss on part of the position (e.g., reduce holdings by half).

2. Total Loss Bottom Line:

If it drops another 20% after full investment, assess whether to continue holding (to avoid being 'deeply stuck').

Step 5: The Specificity of Bottom Fishing Bitcoin

Correlation: Bitcoin's correlation with U.S. stocks has increased in recent years, but its volatility is greater.

Recommendation:

After the S&P hits bottom, observe if Bitcoin stabilizes in sync (e.g., if the weekly chart no longer sets new lows).

Buy in batches to avoid one-time investments (e.g., buy Bitcoin every time the S&P falls by 10%).

Historical Case Reference

2020 Pandemic Crash:

The S&P rebounded after falling 34% from its peak to 2,191 points, with bottom-fishers making over 50% profit within six months.

2008 Financial Crisis:

The S&P fell 57% to 666 points, but it took 2 years of patience to break even.

Summary

Simple Mnemonic: "Buy a little when the S&P drops 20%, add more when it drops 40%, and finally gamble when it drops 55%"

Key Actions: Set key levels in advance, buy in batches, and strictly adhere to stop-loss.

(Note: The above strategy is based on historical data and may change due to policies or black swan events, requiring dynamic adjustments.)