In recent years, meme coins like Shiba Inu (SHIB), Dogecoin (DOGE), and Pepe (PEPE) have gained massive popularity in the crypto market. Originally created as jokes or internet memes, these tokens have surprised many by achieving massive market capitalizations, community backing, and even some real-world use cases. But the big question remains: Do meme coins have a future?

Why So Many Coins Exist

There are thousands of cryptocurrencies in existence, each created with different intentions:

Some are designed for specific use cases (e.g., smart contracts, DeFi, NFTs).

Others are for experimentation, community engagement, or even satire (like meme coins).

Some are simply created to capitalize on market hype.

Most coins are not actively used or adopted widely, and many fade away after short-lived hype. However, a handful gain traction due to strong communities or unique tech features.

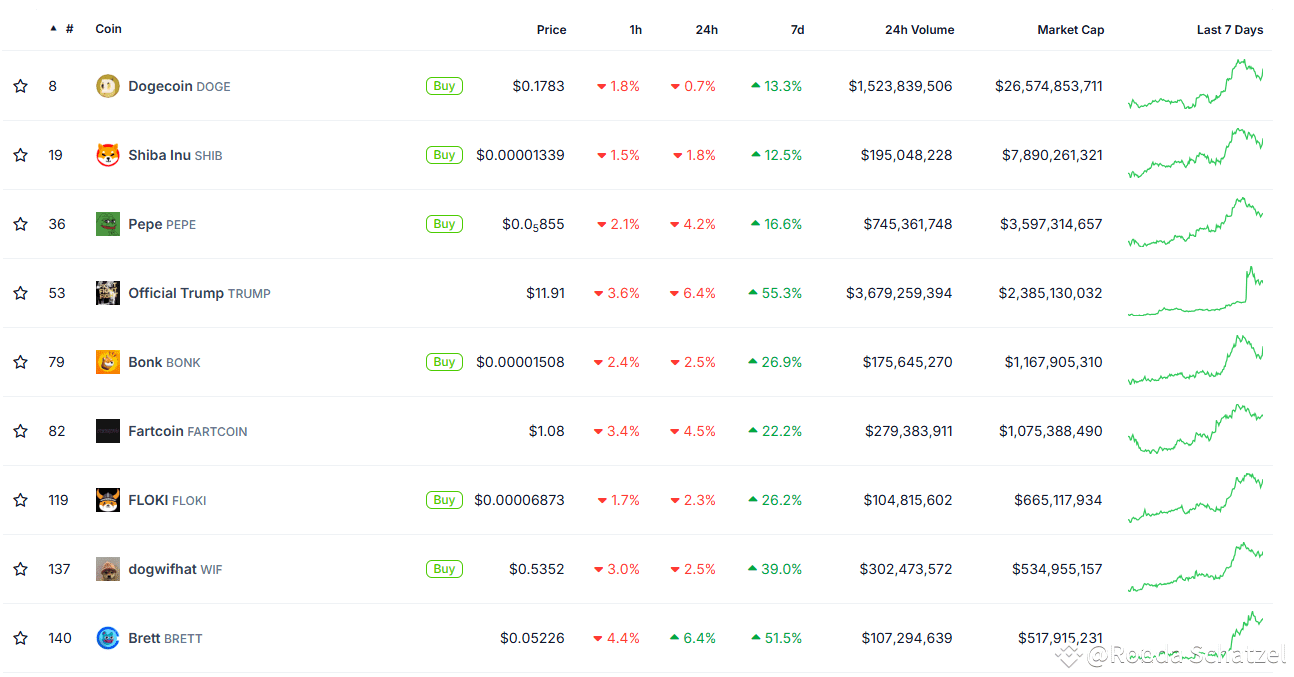

Top Meme Coins by Market Cap

Source : https://www.coingecko.com/

Top Coins Likely to Survive and Grow Long-Term

Looking ahead 20–30 years, the most likely cryptocurrencies to survive and become widely used are those with:

Strong technological foundations

Developer activity and real-world applications

Widespread institutional and retail adoption

Some likely long-term winners include:

Bitcoin (BTC) – Digital gold; store of value

Ethereum (ETH) – Smart contracts and decentralized apps

Solana (SOL) – Fast, low-cost blockchain for dApps and NFTs

Chainlink (LINK) – Decentralized oracle network

Polygon (MATIC) – Ethereum scaling solution

Avalanche (AVAX) – Smart contracts and DeFi platform

Render (RNDR) – GPU-based rendering network

Hedera (HBAR) – Enterprise-grade public ledger

Arbitrum (ARB) – Ethereum Layer 2 scaling

Sui / Aptos – New-gen, scalable blockchains

Bitcoin Supply and Scarcity

Total Bitcoin supply is capped at 21 million.

Over 19.5 million have already been mined.

Less than 1.5 million BTC are left to be mined over the next 100+ years.

If everyone were to try buying Bitcoin at once, demand would vastly outpace supply, likely causing the price to surge. Bitcoin's scarcity is a core reason why it's viewed as a "digital gold."

What Could Cause Crypto Prices to Crash?

Crypto markets are volatile and could crash under scenarios like:

Government regulation or bans

Major exchange hacks or protocol failures

Loss of investor confidence

Global financial crises

Central Bank Digital Currencies (CBDCs) replacing or reducing the need for decentralized tokens

Long-Term Investment Potential

If you were to invest $20,000 across top coins today and held them for 25 years, you could see tremendous growth. For example, assuming 15%–22% annual growth:

BTC: $5,000 → $164,595

ETH: $5,000 → $313,343

SOL: $2,000 → $190,792

Others (LINK, MATIC, AVAX, RNDR, HBAR, ARB, SUI/APT) could collectively grow into a six-figure portfolio.

Estimated total value: Over $1.25 million

However, these projections are based on historical data and trends, not guaranteed outcomes. Cryptocurrencies are high-risk, high-reward investments.

Conclusion: Are Meme Coins Worth It?

Meme coins can offer short-term hype and community-driven price pumps, but they lack the technological depth and long-term adoption potential of coins like BTC, ETH, and SOL.

If you’re serious about building a long-term crypto portfolio, consider balancing a small portion in meme coins with a majority in established, utility-driven projects. Always research thoroughly, diversify, and invest only what you can afford to lose.