As the global market braces for upcoming data releases and potential FED policy changes, let’s dive into the latest movements in Bitcoin, Ethereum, and other key crypto assets.

The FED's Reaction Function.Tariffs & April 2nd.Coming Back To The Core Drivers.What We're Watching.Cryptonary's Take.

The FED's Reaction Function.Tariffs & April 2nd.Coming Back To The Core Drivers.What We're Watching.Cryptonary's Take.

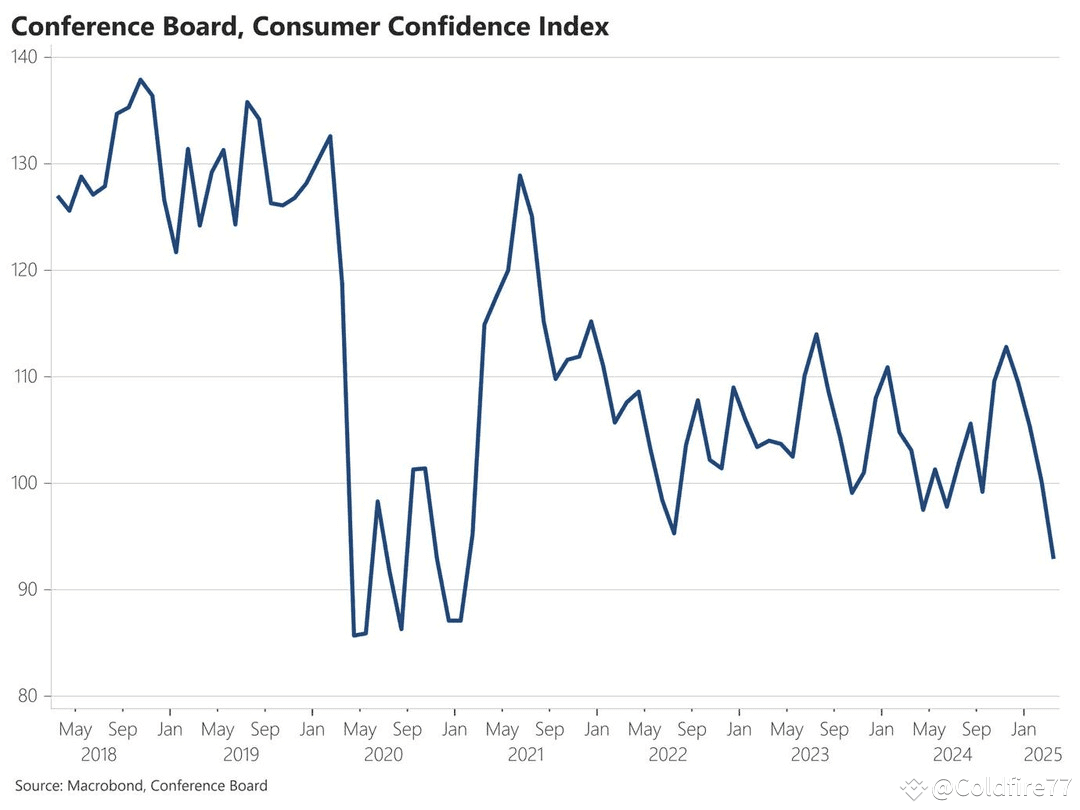

Data this week, The key data this week that we're watching is, and has been so far:Monday: Services PMIs. Tuesday: Consumer Confidence. Thursday, GDP Growth RateFriday: Core PCE, Personal Income and Personal Spending. Alongside, this, we're also seeing a plethora of FED speak this week as well, with Bostic being the stand out so far. So far this week, we've had the Services PMIs, which came out stronger than expected, indicating that this area of the economy remains robust. We've also had the Consumer Confidence data out (which we reported on in our Market Pulse).The Consumer Confidence is a 'soft' data point, but once again it follows the recent string of 'soft' data prints that have shown a consumer that's slowing down, or at least becoming more cautious. For this measure, this was the lowest Consumer Confidence has been since COVID.

Consumer confidence:

Whilst we're on the topic of the consumer, this Friday, we also have Personal Income and Personal Spending data out. It'll be interesting to see how Personal Spending comes out.It is expected to come in at 0.5%, a rebound from its prior reading of -0.2%. This would show a positive rebound and it might highlight that January was just a weak month, as we also saw that reflected in Retail Sales, which also rebounded when we had that data out last week.We're currently playing close attention to this data, because the 'soft' data eg, survey data, has been weak recently. This can take a few months before it's seen in the 'hard' data eg, Retail Sales, Jobs data etc.If this weakness in the 'soft' data spills over to the 'hard' data that would bring the FED to the table to act, and therefore cut interest rates. Hence, we play such close attention to this. We'll cover the FED and its reactiveness further below in this report.Alongside the above, we also have the GDP figures out on Thursday. They're expected to come in at 2.3%, down from 3.1%, but 2.3% is still a healthy and robust growth rate. The risk will be if it comes in substantially below 2.0%, this'll likely see the market sell down on possible growth fears.Now, to finish on this section, we're going to look at the FED speak, which we have a lot of (from multiple members) this week. On Monday, Atlanta FED President Raphael Bostic spoke to Bloomberg. He stated that he sees the risks to inflation as greater than the risks to growth due to tariffs.He therefore was one of the FED members who shifted from expecting 2 interest rate cuts in 2025, to now just 1. We'll be monitoring other FED members' comments this week. We expect many of them to strike a more hawkish tone than Powell did at last week's FOMC Press Conference.The FED's reaction functionFor Crypto, we know it's most responsive to liquidity and risk appetite improving (animal spirits). A decline in interest rates, particularly in the US, would lead to increased risk appetite and an overall improvement in the liquidity picture, hence we pay so much attention to it.When we look back on last weeks' FED Meeting, it was a hawkish SEP and Dot Plot, which saw a number of FED members dial back their projected interest rate cuts in 2025 from 2 cuts to 1 cut (Bostic being one of them).We also note that Powell said that the outlook was 'very uncertain' and therefore 2 interest rate cuts for 2025 were left in the Dot Plot, more out of 'inertia'. This tells us that the FED's reaction function going forward is going to be extremely reactionary. This likely means that interest rate cuts are going to be pushed out, but when they do come, the FED will likely be behind the curve, and they'll have to cut interest rates aggressively. In the immediate term, markets might not like this, but as the FED cuts to being accommodative, risk assets will likely perform extremely well coming out the other side of it. Even Bostic said on Monday that 'they'd rather wait, than cut rates, and have to reverse course'. The result of this might be that we don't see interest rate cuts until July, or maybe even September. However, when cuts come, they'll likely come back to back, and this'll be the time to pile into risk assets again. Ultimately, we continue to watch the 'soft' data to see if it starts being reflected in 'hard' data, and that's what likely catalyzes the FED to act.

Tariffs & April 2nd has been touted as 'liberation day' for the US by President Trump. The Trump administration has seemingly threatened big, and then as event dates have approached, they've softened their stance. It now feels that the market is expecting the same next week on April 2nd.However, the risk here is that reciprocal tariffs are announced and they're strong. If so, the markets likely won't react well to it, however, long-term, the bull case is that these tariffs can be softened, or come off completely. But initially, markets may sell down. Of course, if they're announced, and they're far lighter, then markets will likely rally off the back of this. Ultimately, it's so hard to call here, hence the level of uncertainty is so high. Other than trying to get the US10Y Yield down, we still don't really know what this Trump administration is trying to achieve, other than to balance the deficit, although this is being heavily questioned as to how achievable it is.

Coming back to the core drivers, Ultimately, here the market is really difficult to work out, although we believe we're right in our more conservative stance for now. When we look at the key drivers for Bitcoin's price action, investor risk appetite and global liquidity make up nearly 63% of Bitcoin's price drivers. Currently, global liquidity is slightly increasing, but not in a material way, which is a bearish factor for us. If the US began ramping up their fiscal spend again - at the moment they're trying to reverse it - then that would be a big risk-on signal for us. In terms of investor risk appetite, it's easy to see that it isn't there currently. Once we have the far end of the risk curve (meme's/alts etc) ripping higher again, that's the clearest signal to us that risk appetite is back and up. For now, both of these key drivers for BTC's price, aren't favorable. This keeps us defensive (out of the market) for now.

BTC's price drivers:

What we're watching We see the current rally as being an oversold rally that likely doesn't have huge strength to the upside. In terms of a stalling point, we're looking at 5860 to 5900 on the S&P as it's a possible resistance zone, which is just a few percent away from the current price.For BTC, the horizontal resistance is at $91,700, whilst the Short-Term Holder Cost basis is in the $92k's.We therefore expect the $91,700 to $92,500 to be a huge resistance for BTC, and therefore we don't expect the price to break above this level in the short and medium term.A break above $93k would be an invalidation for us, with $82k as the zone of support we'd look at as being the first target.

SPX:

BTC:

Cryptonary's take Whilst there's a tone going on here, and this makes our job figuring the market out more tricky, we do believe we have a handle on what's going on. The macro is still very uncertain, which has seen risk appetite decline, whilst we're not seeing any new liquidity stimulus from anywhere (in the US).Alongside this, we have an administration that's the cause of a lot of the uncertainty, and bar trying to get the US10Y Yield lower, we still don't know exactly what the Trump administration is trying to achieve. Add to this that April 2nd is more likely a mid-way point in the tariff talk, rather than the end, and it's likely the uncertainty can continue for longer. Therefore, our stance remains to sit on the sidelines until we see more clarity from the Trump administration. The 'hard' data weaken substantially, and the FED react, a new form of stimulus, a significant removal of the overall level of uncertainty. If price does pull back from around the levels we have highlighted in the above, then it may be the case that if the lows are retested or broken, we could be light buyers of that dip. The simple reason for this is that we're further along the 'uncertainty path' than we were 2 months ago. We're keeping a super close eye on everything, as always, and we'll be looking to pull the trigger on buys when we believe the time is right. For now, we don't think that's just yet.