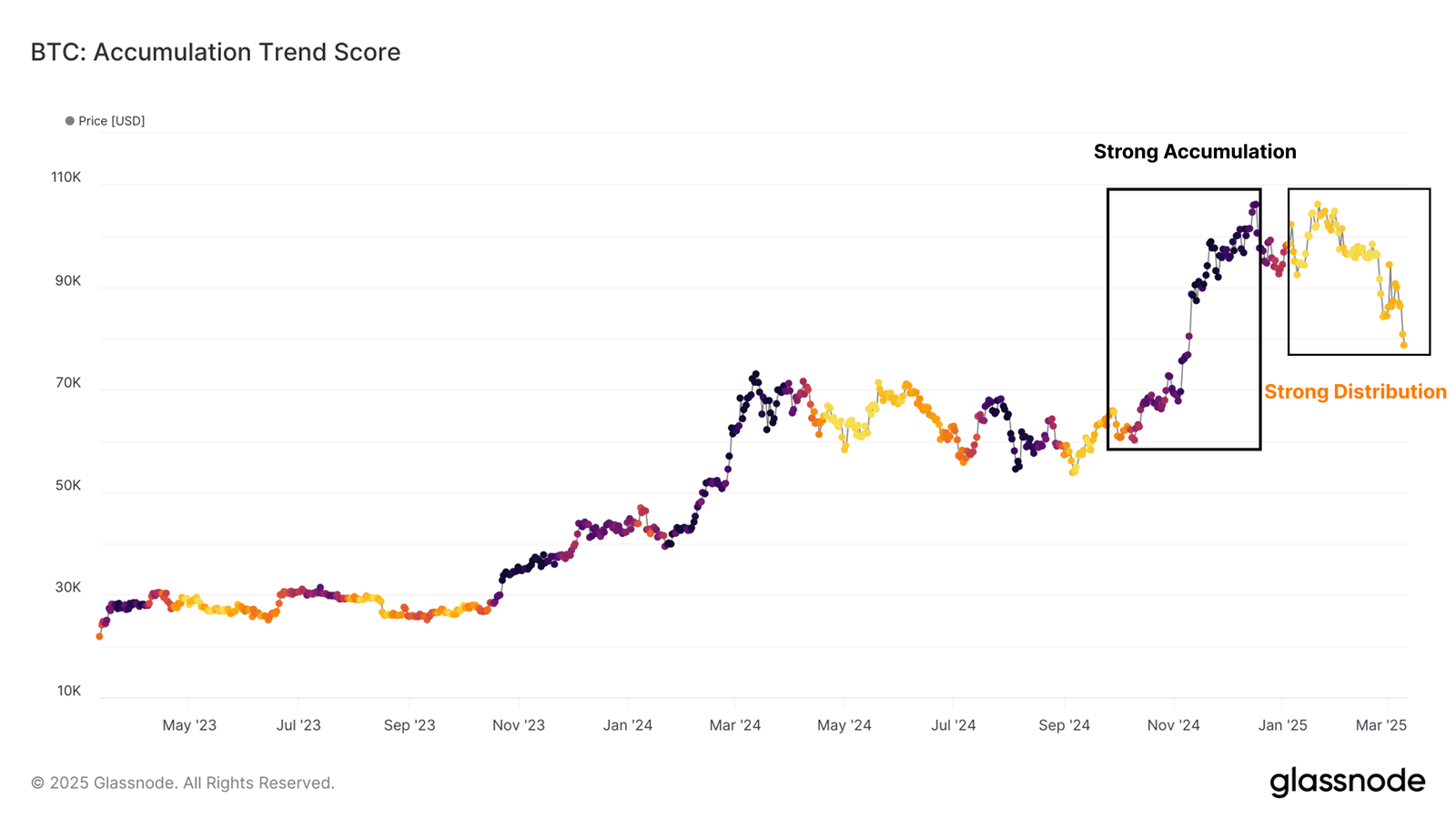

Bitcoin traditionally moves in cycles: accumulation phases 🔄 are followed by distribution phases 📉, when capital flows from one investor to another.

🔍 The assessment of the accumulation trend shows that:

✅ Values around 1 (purple) — investors are actively accumulating BTC 💰🔒

⚠️ Values around 0 (yellow) — distribution (sales) predominates 🏃💸

📉 What is happening now?

Since January 2025, BTC has entered the distribution phase! This coincided with a sharp correction from $108K to $93K 😱📉, and the cumulative trend indicator fell below 0.1 — sellers continue to press the market!

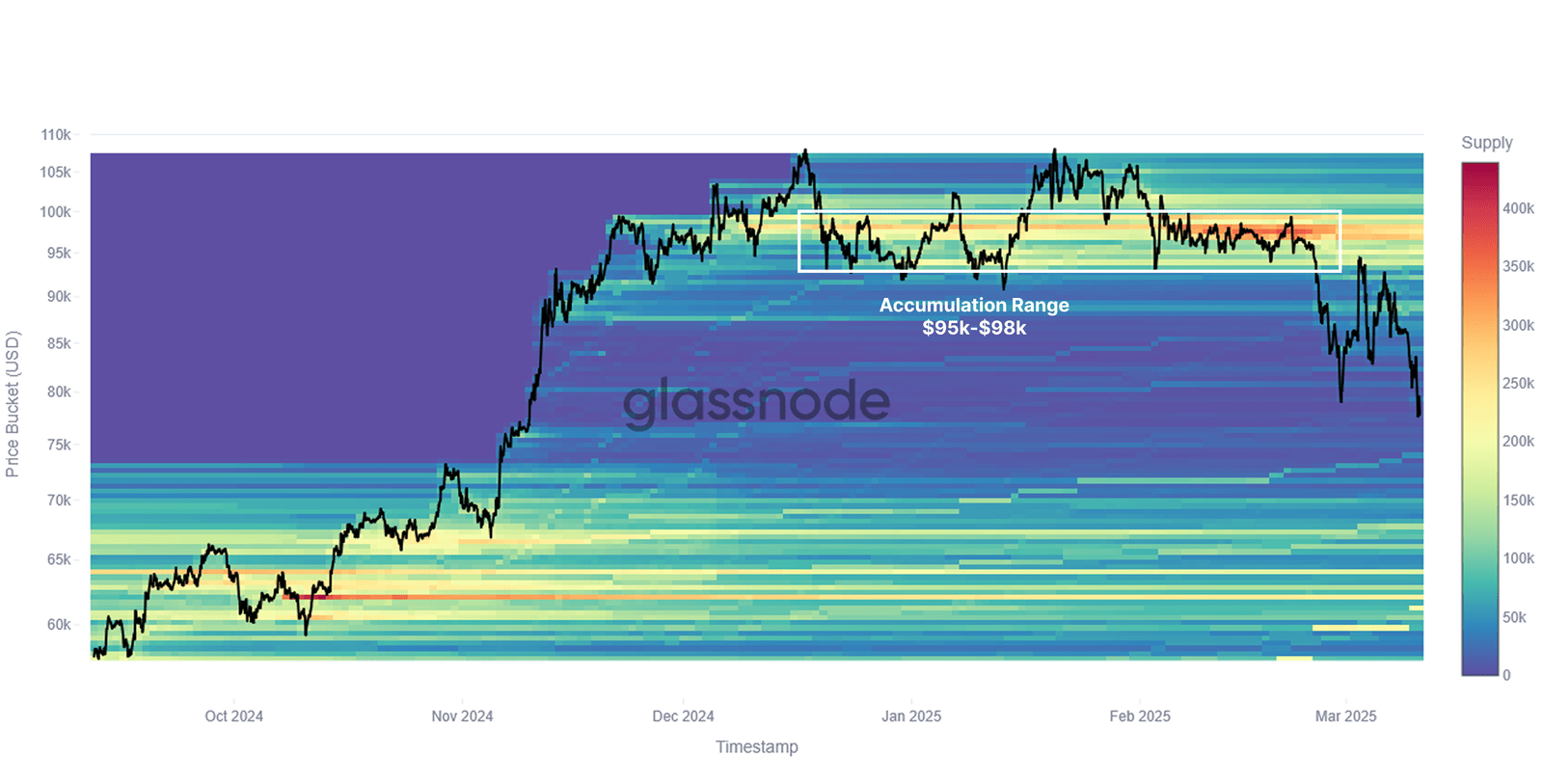

📊 Where are the key levels?

🔥 The heat map of basis cost distribution (CBD) shows that:

💎 In December–February, investors actively bought on dips in the range of $95K–$98K.

💡 This indicates a strong support zone where bulls are ready to buy BTC on dips 🐂💪

📢 What to do next?

🔵 If BTC holds above $95K–$98K — a new rise is possible! 🚀💎

🔴 If the level breaks — a deeper pullback is possible 😬📉

💡 Strategy:

🛒 Buying (DCA) while holding the $95K–$98K zone for long-term investors! 💰

⛔ Stop-losses below $93K for active traders to minimize risks! 🚨

🔥 Conclusion: while the market remains under pressure, major players still believe in growth! Be careful and trade wisely! 💹💪

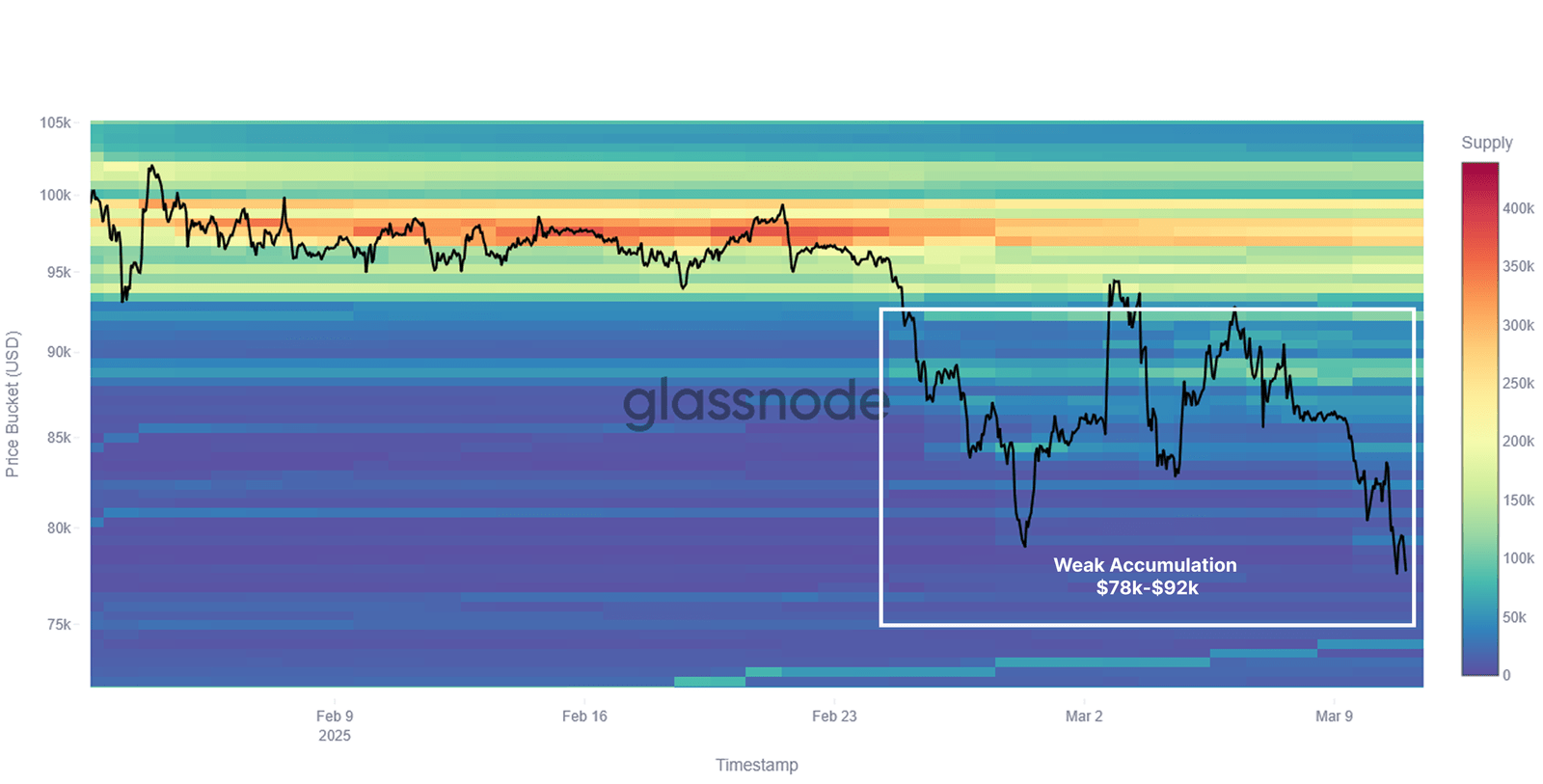

📉 The BTC market is under pressure: what’s next? 🔥

Since the end of February, the bitcoin market has faced increased external risks 🌍⚠️:

🔺 Tightening liquidity — investors are becoming more cautious 💰🔒

💥 Bybit hack — triggered a wave of concerns in the industry 🛑

🇺🇸 Escalation of tariff tensions in the USA — an additional factor of uncertainty 🌐

📊 BTC broke $92K: what does it mean?

The price fell below $92K, which is critical as this level is below the cost basis of short-term holders 🧐📉.

⛔ The main difference from past pullbacks is the lack of strong buying on the decline!

📉 Previously, investors actively bought BTC in the range of $95K–$98K 💎

😬 The reaction is weak now — buyers are in no rush to enter the market

🔥 What does the heat map of basis cost distribution (CBD) say?

💡 As macroeconomic uncertainty rises 📉, demand for BTC is weakening

📊 Investor confidence is a key factor — and it is currently declining 📉

🔄 The rotation of capital into other assets continues, which may lead to long consolidation or deep correction

🎯 Action strategy

✅ Long-term investors — waiting for confirmation of bottom formation 💎

🚨 Traders should be cautious — the market may enter a *

* prolonged sideways movement or

#BinanceAlphaAlert #solana #analisis #render #StablecoinGoldRush