$XMR/USDT: Privacy Giant Eyes Rebound Amid Regulatory Dust 🛡️ $XMR

$XMR

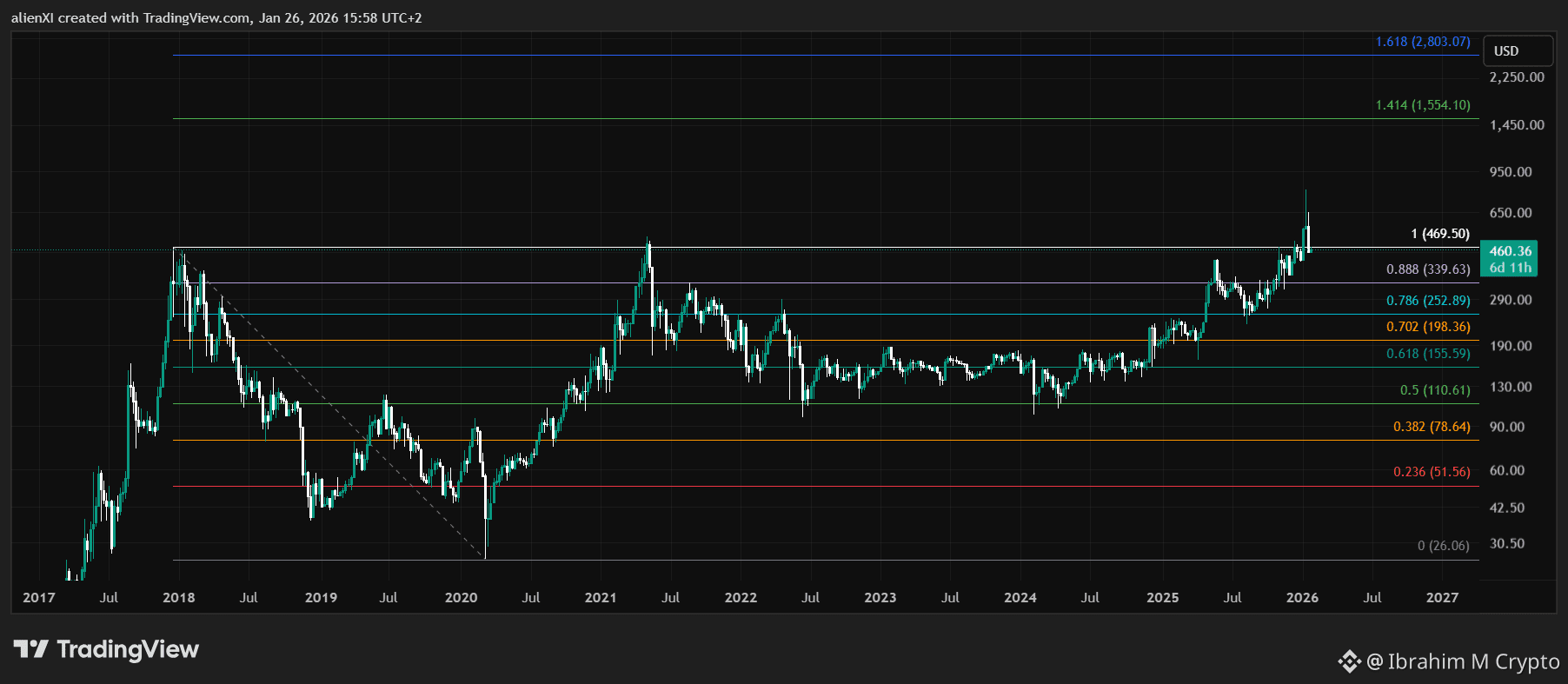

Monero (XMR) is showing signs of a steady recovery today, January 27, 2026, as it attempts to reclaim lost ground following a heavy sell-off earlier in the week. Despite facing recent regulatory hurdles in India, the price is showing resilience, currently trading around $472.20 with a gain of +2.44% in the early morning sessions.

📊 Technical Snapshot:

* Trend: XMR recently hit an all-time high of $798.91 on January 14 before a sharp correction. It is currently holding above the critical 50-day EMA ($488), which is providing dynamic support for the broader uptrend.

* Momentum: The daily chart remains bullish as XMR sustains above $500, though shorter timeframes (4H) have shown some bearish bias during the recent profit-taking phase.

* Support & Resistance: Immediate support is solid at $450 – $460, while the next major resistance levels to flip are $500 and $623.

* Open Interest: A surge in XMR futures Open Interest and a buildup of long positions suggest traders are positioning for a rebound in the privacy coin narrative.

🎯 Trade Setup:

* Entry Zone: $465 – $475 (Look for entries as price stabilizes above the morning's low of $457).

* Take Profit 1: $500 (Psychological resistance and 50-day EMA reclaim).

* Take Profit 2: $623 (Targeting the local peak from earlier this month).

* Stop Loss: Below $445 (Invalidation point below recent support tests).

💡 Fundamental Catalysts:

* Regulatory Shakeup: India's recent suspension of XMR trading on January 24 initially pressured the price, but the market's quick 3.5% bounce post-announcement indicates the news may have already been priced in.

* Development Progress: Continued progress on FCMP++ and CARROT developments (announced Jan 22) reinforces Monero's lead in the privacy sector.

* Institutional Interest: Analysts suggest the current accumulation pattern points toward a long-term target of $1,000 if the privacy sector resurgence continues.

> ⚠️ Risk Note: Monero is experiencing high volatility (~17.86% over 30 days). Be aware that Binance is delisting the DASH/ETH pair today (Jan 27), which can occasionally cause spillover volatility in other privacy-centric assets like XMR.

>

#XMR #Monero #USIranStandoff #StrategyBTCPurchase #FedWatch #PrivacyCoins #BinanceSquare #CryptoAnalysis #TradingSignals

Would you like me to analyze the XMR/BTC pair for a relative strength check or set a price alert for the $500 breakout level?