👉Let’s be brutally honest.

✳️BlackRock. ✳️Strategy. ✳️Early OGs. Even the mythical ✳️Satoshi wallets.

Whoever controls the largest share of Bitcoin will sell eventually.

Not because they are evil.

Not because they hate Bitcoin.

But because capital never dies with ideology.

No one takes Bitcoin to the grave.

🧠 The Lie Retail Is Being Sold

Retail is being brainwashed into believing:

“Bitcoin will never be sold”

“Institutions are permanent holders”

“BTC is the only crypto that matters”

This is dangerous nonsense.

Institutions don’t worship narratives.

They harvest liquidity.

When:

Portfolio rebalancing happens

ETFs face redemptions

Risk models change

Or a better yield opportunity appears

👉 Bitcoin becomes inventory, not religion.

🩸 What Happens When the Big Holders Sell?

Let’s be clear about the power imbalance.

A retail holder selling 0.1 BTC = nothing

An institution moving thousands of BTC = market shock

When concentrated supply starts exiting:

Liquidity dries up

Volatility explodes

Retail panic accelerates losses

And who gets trapped?

The late buyers who believed BTC is the only future of crypto.

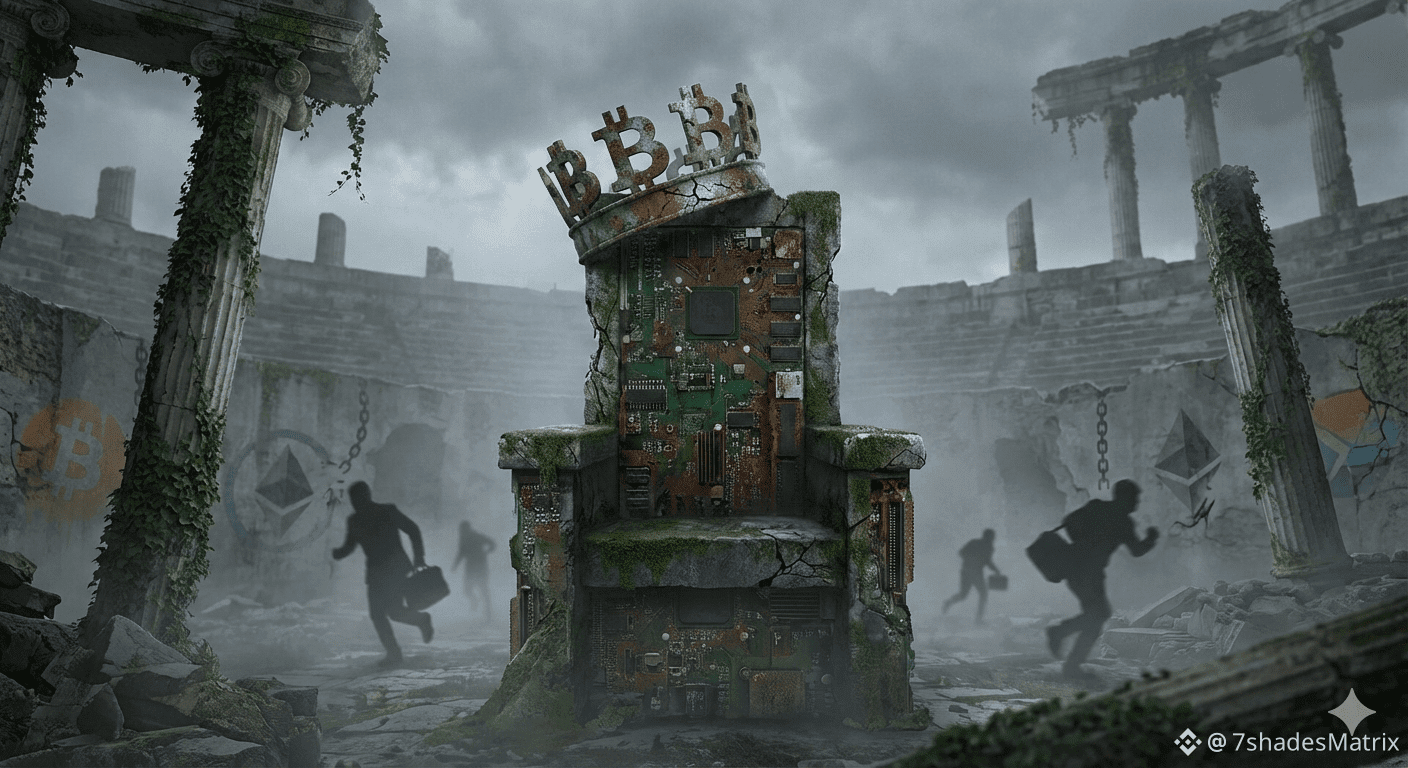

⚠️ Bitcoin Maximalism Is Not Decentralization

If Bitcoin were truly decentralized in ownership:

A few entities wouldn’t dominate supply

One narrative wouldn’t control the market psyche

Today’s Bitcoin is:

Highly concentrated

Financialized

ETF-driven

Narrative-dependent

That’s not freedom.

That’s a liquidity cage.

🔄 Capital Will Rotate — Always Has, Always Will

Crypto is not Bitcoin alone.

Innovation, yield, real usage, and infrastructure do not stop at BTC.

When capital rotates:

BTC dominance cracks

New leaders emerge

And those who diversified survive

Those who didn’t?

They learn the lesson the hard way.

🧩 Final Reality Check

Bitcoin won’t die.

But the belief that Bitcoin alone will make everyone rich already should.

If you’re still chasing BTC at any price because “institutions will never sell” — you’re not investing.

You’re providing exit liquidity.