Key Takeaways

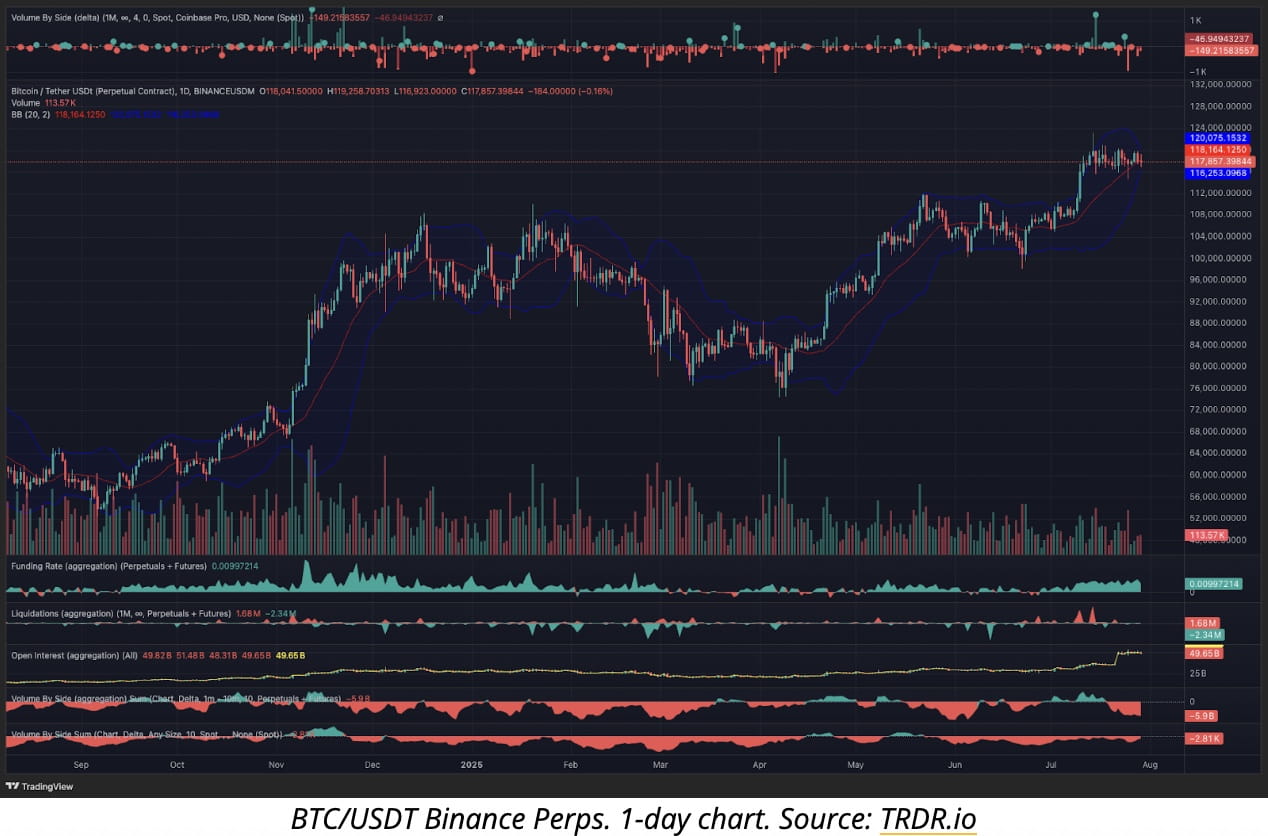

Bitcoin’s price remains stuck between $117K–$120K, with traders trimming exposure before the FOMC decision.

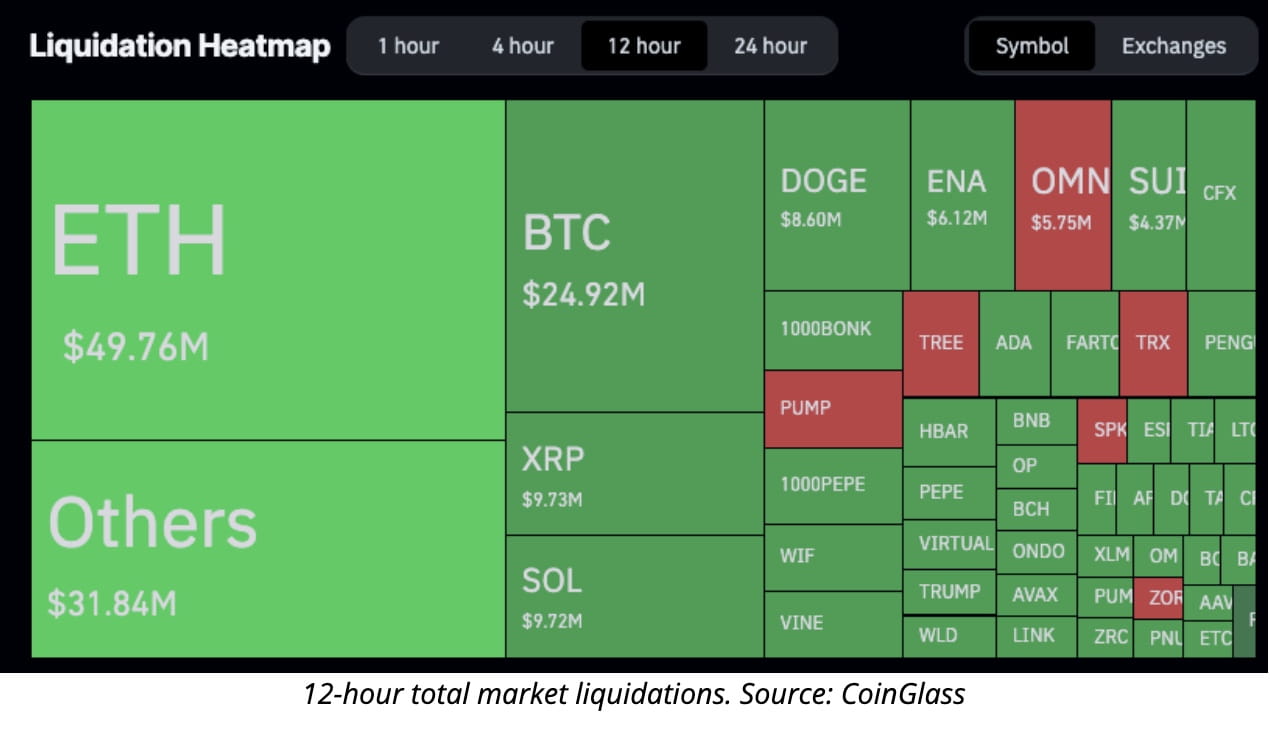

Futures open interest fell by $1B, with $173.8M in long liquidations in 12 hours.

Price compression and near-pinched Bollinger Bands hint at an imminent range expansion.

Bitcoin is showing signs of fatigue ahead of this week’s critical macro events, but analysts say the pullback is pre-FOMC derisking — not a structural trend change.

Bitcoin (BTC) traded around $117,693 on Tuesday, poised for a daily close below $118K after slipping within its $117K–$120K range. While some analysts warn of a potential retest of $114K–$110K support, traders are watching two catalysts that could shift momentum:

Wednesday’s Federal Reserve interest rate decision

The White House’s long-awaited crypto policy report — which could include details of a strategic Bitcoin reserve.

Traders Cut Risk Ahead of Key Events

The pre-FOMC caution is clear. Data from TRDR shows Bitcoin’s aggregate open interest dropped to $49.58B from $50.58B at Tuesday’s Wall Street open, while Coinglass reported $173.8M in long positions liquidated in the past 12 hours.

“Typical pre-FOMC behavior — traders cut leverage, reduce risk, and wait for Powell,” one market analyst wrote on X.

This echoes previous patterns: traders exit risk before major Fed announcements, only to reenter positions aggressively if news aligns with market expectations.

Why This Isn’t a Trend Change — Yet

Bitcoin’s price has entered a tight compression phase, with its intraday range shrinking by nearly 45% in three weeks — from $4,200 on July 14 to just $2,300.

Such compression often signals a powerful breakout ahead. Bollinger Bands are now pinching tightly, historically a precursor to range expansion.

“Bitcoin’s consolidation is brewing energy for a major move,” an options trader told Cointelegraph. “FOMC guidance or the White House announcement could be the trigger.”

Fed, Trump, and the ‘Bitcoin Reserve’ Narrative

CME FedWatch shows a 98% probability the Fed will hold rates steady at 4.25–4.50%, despite Trump’s pressure for immediate cuts.

But traders are laser-focused on Powell’s tone and the White House crypto report, which could outline:

The government’s exact Bitcoin holdings

Whether a strategic Bitcoin reserve is in play

If the report confirms bullish policy signals, analysts say Bitcoin could snap out of its range quickly.

What’s Next for BTC Price?

For now, $117K–$120K remains the battleground. Analysts flag:

Upside trigger: A clean break above $120K could see BTC chase liquidity toward $122K–$125K.

Downside risk: A break below $114K could open a quick move to $110K.

But with volatility compressed and key events looming, traders expect a decisive breakout soon.