Bitcoin Dominance Finally Breaks – Altcoin Season May Be Real This Time

Since late 2022, Bitcoin Dominance has been on a steady rise — and during this time, the vast majority of altcoins have bled heavily, losing value both in USD and BTC terms.

The long-awaited “altcoin season” became a meme more than a market event.

Every rally was short-lived, and rotation never truly materialized.

Until now...

________________________________________

📉 A Technical Break That Matters

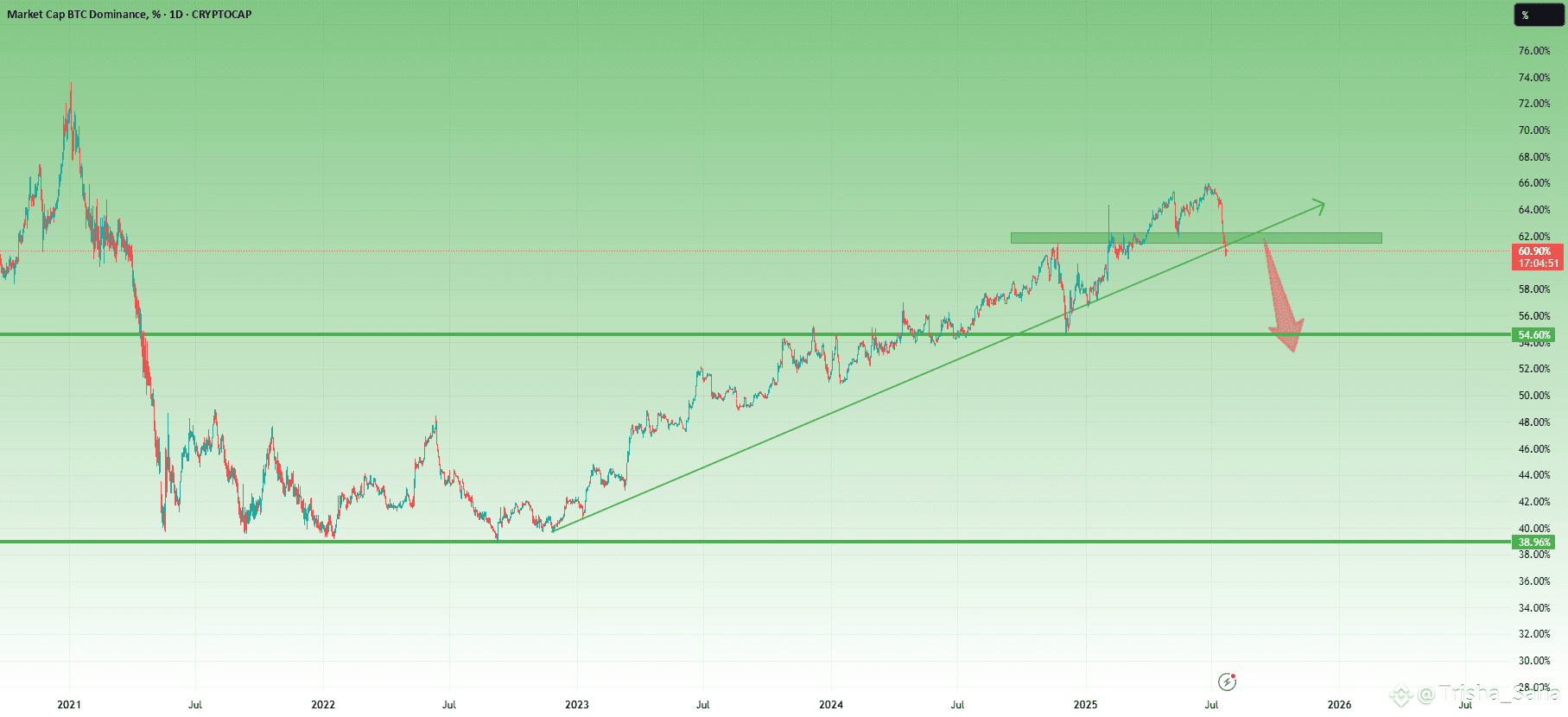

Looking at the BTC.D chart, we finally see something meaningful:

➡️ A clear technical breakdown under confluence support given by the horizontal one and the rising trend line, which held for months and provided the structure for BTC outperformance.

At the same time, Bitcoin is stable around the 120k zone, and the price action suggests strength — not mania, not collapse — just solid consolidation at high levels, and most probably preparing for new ATHs.

This environment historically tends to be favorable for alts.

________________________________________

USDT Dominance (USDT.D) Also Pointing Lower

The USDT.D chart adds even more confluence to the idea:

• It's now pointing towards support

• The structure suggests there’s room for a further drop, which historically means more money flowing into risk assets — particularly altcoins

When stablecoins dominance drops, it usually reflects increased market participation and risk-on behavior — exactly what altcoins need to finally shine.

________________________________________

🔍 What Am I Doing?

I’ve already started buying selected altcoins and I'm looking to add more on dips.

This technical shift is meaningful. It’s not about catching hype, it’s about recognizing a real potential rotation.

In conclusion, I’ll be looking for strong altcoin setups to buy on pullbacks,

as I believe the next weeks and months could offer the kind of upside that can at least double my investment (yeah, yeah, I'm not "to the mooner, hoping for 100x).

#CryptoClarityAct #BNBBreaksATH #TrumpBitcoinEmpire #BTCvsETH #ETHBreaks3700