The race to accumulate Ethereum (ETH) as a treasury reserve asset is heating up. In the last 30 days alone, over 10 companies purchased more than 550,000 ETH, worth $1.65 billion. Crypto entrepreneur Kyle Reidhead brought attention to this growing trend on X (formerly Twitter), comparing it to MicroStrategy’s Bitcoin strategy.

🏦 ETH as Treasury Asset? The Trend Gains Momentum

Reidhead, co-founder of the Milk Road crypto newsletter, highlighted the rise of ETH Treasury Management — the idea of using Ethereum as a long-term corporate reserve. According to him, this is just the beginning, but company interest is accelerating quickly. Some firms are reportedly buying more ETH each week than the week before.

“If $1.65 billion was accumulated over the last 30 days, what’s next? Two billion? Three billion in the coming month?” Reidhead asked.

He also acknowledged that demand would eventually slow down — but not anytime soon. Most firms are currently holding, not selling, unlike exchange-traded funds (ETFs), which tend to trade actively.

🧠 Sharplink Gaming Emerges as ETH’s Top Whale

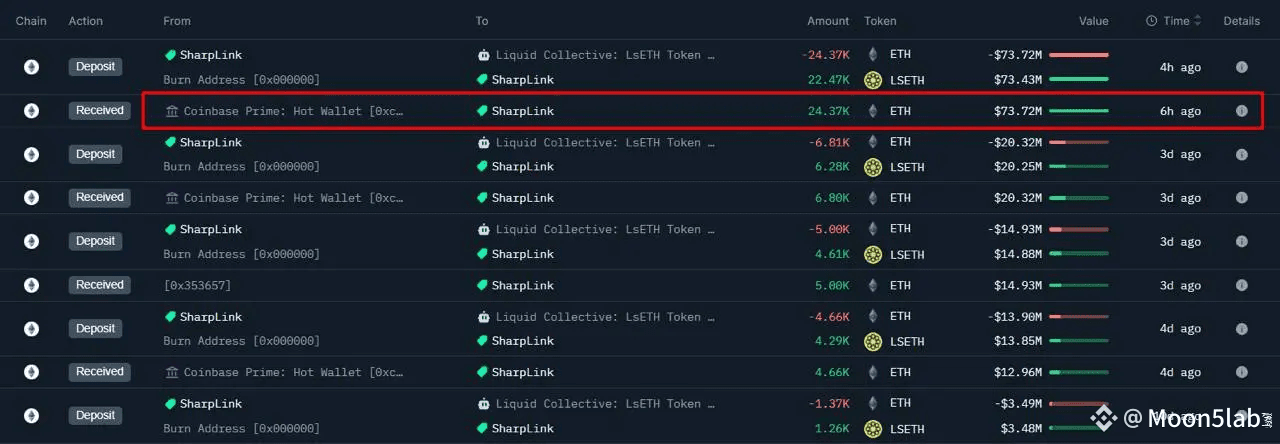

Leading the charge is Sharplink Gaming, which has rapidly become the largest known ETH holder. In just the last five days, the firm bought 75,000 ETH, cementing its leadership position.

In under two months, Sharplink has invested over $700 million, and now holds more than 290,000 ETH. That’s more than the Ethereum Foundation, which reportedly holds around 242,000 ETH.

Interestingly, the Ethereum Foundation itself sold 10,000 ETH to Sharplink, a sign of trust and possibly strategic collaboration.

🏁 Bitmine, BitDigital, and Others Join the ETH Accumulation League

Sharplink isn’t alone. Other firms are also building massive ETH reserves:

🔹 Bitmine Immersion – holds over 163,000 ETH

🔹 BitDigital – converted part of its BTC holdings and now owns 100,000+ ETH

🔹 BTCS – also actively participating

Sharplink chairman Joe Lubin dubbed this emerging coalition “The League of Extraordinary ETH Gentlemen,” praising peers like Tom Lee (Bitmine), San Tabara (BitDigital), and Charles Allen (BTCS). He emphasized how collaboration and healthy competition among these firms are driving Ethereum forward.

📉 ETH Temporarily Dips Below $3,000 — Recovery in Sight?

Despite the positive sentiment, ETH dropped below $3,000 twice recently, most recently falling by 2% to $2,972. Still, analysts believe Ethereum is poised to find strong support above this key level.

In the last 7 days, ETH is up over 16%, and over the past 3 months, it’s seen a massive 90% surge. Yet it still trades about 11% below its price at the start of the year — which may offer a compelling opportunity for accumulating investors.

#Ethereum , #ETH , #CryptoInvesting , #CryptoNews , #CryptoWhales

Stay one step ahead – follow our profile and stay informed about everything important in the world of cryptocurrencies!

Notice:

,,The information and views presented in this article are intended solely for educational purposes and should not be taken as investment advice in any situation. The content of these pages should not be regarded as financial, investment, or any other form of advice. We caution that investing in cryptocurrencies can be risky and may lead to financial losses.“