So you want to make a covered call option but don’t know how? That's understandable. Options might look intimidating but fortunately this article is here to help.

INTRODUCTION

Options are contracts regarding future price values. If the contract’s stipulated price is higher than current price we refer to those as “call” options, if it’s lower we call those “put” options. Similarly to how “longs” and “shorts” work on spot market.

So far, so good. But what’s this got to do with passive income? Seems like just another method for investing and trading. You make a prediction and hope it will come to fruition. Well yes, but not quite. Options operate under persistent bias, they’re not meant to be efficient . Investors make outlandish wagers sometimes without even believing these predictions will ever come to pass. What they hope for instead is to trade these options when their value changes — long before their expiry date.

As a result the options market can be pretty skewed and present good passive income opportunities for those who are actually willing to wait until aforementioned expiry date. The idea is that we pick such an outlandish wager and without attempting to trade it, patiently wait until it expires. To further reduce risk we should make sure to only buy options for the amount that we actually have, a so called “covered” call (as opposed to a “naked” call).

Lets look at one example.

Here we have a call option with strike price of 7500. Now I am quite bullish on ETH, but 7.5k by the end of March seems pretty bold to say the least.

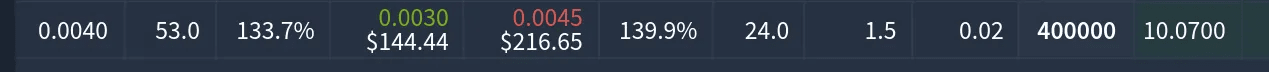

Here is another example, this time from Deribit. We can see the strike price for Bitcoin was 400k which means, Bitcoin would have to reach 400000 for us not to make money on this option.

Return on this particular option is miniscule (around 1% annualized), so we should maybe looks for something that’s financially more attractive but still very unlikely to happen. If you have some familiarity with options, you will know this isn’t an all-or-nothing bet. If by any chance Ether or Bitcoin reach their strike price on 31st of Dec, you do not lose your investment, you simply agree to sell your Bitcoin for 400k. This makes calls a bit easier to wrap your head around than puts. Selling some of your bitcoin after a hypothetical 400k run wouldn’t be a bad idea anyway, so if you’re planning to eventually realize your gains, then call options can be a win — win situation. This is also why covered calls are safer than naked options. You always have full understanding of what the contract is and how much you’re investing.

Another use case which is not related to 'passive' income but can still be an overall win is where, for one reason or another you need liquidity and have to sell Bitcoin at whatever price it currently sits at. Well in this case, since you already made up your mind and are selling anyway, you might instead take a call option at a current price, and grab a nice premium on top.

Let’s look at example above. Here Bitcoin was trading at 24000. Call option with strike price of 24k at that time sold for 0.1955 bitcoin — not bad. That’s almost 20% extra. The downside is, that in order to withdraw all of the money you have to wait until the option expires (in this case until the end of the year). What’s available to you is the amount you sold your options for which in the above example would be around $4725. Depending on one’s personal circumstances, expectations regarding price action and other factors this can be a good solution but it’s not a win-win scenario. Those who need flexibility, or strongly believe in a future uptrend, might be better off simply selling 0.2 bitcoin on the spot market and keeping the remaining amount in their wallets.

TUTORIAL [Step by Step]

Ok so let’s make a call option!

Unfortunately Binance only offers simplified version of options which uses USDT instead of an underlying asset, and (more importantly) only allows users to buy options. You can of course sell back options that you bought earlier, but you cannot short-sell options to others, the way market-makers do. This makes Binance not suitable for for this strategy and we're going to use Deribit instead.

Ok, so you have your Deribit account ready and funded with whatever amount we’re comfortable with.

Next we have to select an expiry date. In general it’s best to select dates that are far away since these are less efficient and offer a sort of “premium for patience”. We’re looking for a wide range of less than realistic scenarios.

Currently we can see expiry dates extend all the way to 27th of September 2024. In periods of prolonged greed we see call options getting extended and in times of prolonged fear it’s put options that become unbalanced. Option generally work best in times of high volatility and conversely, offer less value in times of sideways price action.

For newcomers, I would recommend going with calls and not puts. However unlikely both 100k and 5k by the end of the year might seem, call options offer a peace of mind even as the price goes up, whereas put option on the other hand can be more like a double whammy.

Let’s try this option.

120k by the end of the year. We double-click on the option (anywhere is fine) to bring up the trading menu

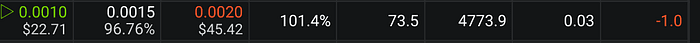

Here’s the tricky part. We have to click “Sell”. That’s because we are selling options using bitcoin as liquidity. We can see there’s 2.7 contracts available @ 0.0025. We put in quantity “1” which means a covered call for one full bitcoin, and press the Sell button.

A confirmation pops up. It’s good idea to review everything before confirming. Mistakes can be costly.

That’s all. Notice -1.0 on the right, which indicates you know have exposure to a full bitcoin call option. All there is to do now is to wait for it to expire so that you can collect your crypto + premium!

RISKS

As with every strategy that offers income, there are risks involved.

First and foremost Deribit is a custodial centralized platform. Not your keys, not your crypto. It is however the biggest platform of this kind. For example this years quaterly expiry event on 29th of Sept 2023 caused around 113,000 Bitcoin contracts to expire together with 1.1 million ETH contracts for a total value of almost $5 billion. If you’re looking for an alternative, Singapore-owned Bit.com offers Options and Futures as well.

Secondly there’s behavioural risk factors. While Deribit doesn’t encourage risk taking (something a lot of trading platforms and exchanges unfortunately do) it also doesn’t have any mechanism that would prevent it. Instead of earning passive income investors can instead decide to pursue quick profit and buy risky options worth hundreds of bitcoin with a risk of losing all funds as soon as the price goes in the wrong direction. That’s because Deribit makes it possible to make naked option calls instead of covered ones as well as leverage your funds. Coupled with ultrashort timeframes in case of weekly or daily options this can very easily lead to bad decisions and loss of the entire stack.

That would be all. Happy earning!