I have been trading cryptocurrencies for 10 years, starting with a capital of 350,000 saved from my job, and now my assets exceed 80 million. I quit my job and returned home to trade cryptocurrencies full-time, relying solely on trading to support my family. I only do spot trading and occasionally dabble in contracts. Although I haven't turned 10,000 into two small goals like some people, I am very content and feel secure. I dream that by the end of this year, my account will exceed 100 million, and next year I will have more capital to earn even more money.

If you are determined to make cryptocurrency trading your primary profession, this article will be your stepping stone; it's short but profound!

The core trading secret that has allowed me to achieve stable compound interest over 10 years of trading cryptocurrencies.

In addition to strong trading skills, I strictly adhere to the following 20 trading insights!

1. Technique is a tool, not an answer: Any indicator or pattern is a window to observe the market. Do not expect a single tool to solve all problems; the logic of mastering the tools is more important.

2. Survive first, then talk about making money: The primary goal of trading is to control risk. As long as your capital remains, there is always a chance. A single large loss can completely knock you out.

3. Accepting 'imperfection' is normal: There is no 100% correct trade; the core of profitability is 'make more when right, lose less when wrong', not pursuing being right every time.

4. Capital management is the lifeline: The risk of a single trade must not exceed 2%-5% of the capital; position size is always linked to risk tolerance. Do not let a single mistake break your defense line.

5. Don't 'fall in love' with the market: Don't be attached to your judgment; the market is always right. If wrong, admit it and exit. Competing will only enlarge your losses.

6. Don't be greedy when profitable, and don't hold on when losing: Take partial profits when reaching profit targets, and cut losses immediately when hitting stop losses; hesitation is the biggest taboo in trading.

7. Trading is a probability game: Under the premise of adhering to the strategy, accept the possibility of consecutive losses. As long as the long-term probability is on your side, the result will eventually be positive.

8. Mindset is more prone to 'flipping' than technique: Greed will cause you to miss take profit, fear will cause you to miss opportunities, and a stable mindset requires deliberate training, not innate ability.

9. Don't let a single trade affect your emotions: Don't get carried away with a big win, and don't collapse with a big loss. Maintaining stable emotions allows the strategy to be executed continuously.

10. Only trade in markets you 'understand': No matter how enticing the fluctuations are, if you don't understand them, don't touch them. The market is never short on opportunities; what it lacks is patience to wait for opportunities.

11. Strategies must 'adapt to oneself': Others' high-return strategies may not suit you. If you are impatient, don't do long-term trades; if you prefer stability, don't chase high-frequency trades. What fits you is the best.

12. Reviewing trades is more important than watching the market: Spend 10 minutes after the market closes each day to summarize: Where did you go right? Where did you go wrong? How can you improve? Reviewing is the fastest way to grow.

13. Don't believe in the 'holy grail myth': If there truly were a foolproof method, no one would be willing to share it. The truth of trading is 'control + discipline + probability'.

14. The market is always changing; strategies must 'evolve': There is no immutable market; regularly optimize your strategy, but do not frequently overturn it; the core logic must remain stable.

15. Focus less on profit and loss numbers, and more on 'whether it complies': As long as each trade strictly adheres to the strategy, profits are a natural result. Overly focusing on numbers will disrupt your mindset.

16. Don't leverage to gamble on the future: Leverage is an amplifier; it can magnify profits but also accelerate demise. For beginners, using leverage is like giving money to the market.

17. Learn to 'wait empty': When there are no suitable opportunities, staying out is also a strategy; frequent trading will only increase the probability of making mistakes, consuming capital and energy.

18. Don't chase 'quick profits'; pursue 'sustainability': Doubling in a year may rely on luck, but achieving 20% annualized return over five years is true skill. The ultimate goal of trading is long-term compound interest.

19. Seek inward, not outward: Don't always envy others' profits; study your own trading records to find your advantages and flaws, and refine your own system.

20. Trading is a practice; it is a contest with yourself: The real opponent is not the market, but your own greed, fear, and luck. If you can control yourself, the market will naturally reward you.

Price action trading relies entirely on price charts to make trading decisions. Price fluctuations are the purest indicators that traders have. Price determines profit and loss, and nothing else.

Price action traders believe: Price has told you all the information you need. Indeed, you will not make money because of fundamentals, technical indicators, or statistics. The only source of your profits is the actual price fluctuations.

If you buy and the price rises, you will have potential profits. No matter how all indicators, fundamentals, and economic data 'show' that the price should rise, if the price does not actually rise and you have already bought, then you have no profit.

Price action is the king.

Supplementary explanation: Major news can cause prices to spike or plummet instantly, and simply looking at the candlestick chart cannot predict the content of the news. Therefore, my principle is: before news events that may trigger drastic fluctuations, I will close all intraday trades and never hold on stubbornly. Similarly, before a listed company releases its earnings report, I will sell all short positions and never participate in earnings season.

How to analyze price action.

The most basic concept of price action is to wait for the price to move in a certain direction before taking action.

◔ If the price is falling, then it is falling—regardless of whether you think it 'should' rise or fall. Falling is falling, rising is rising, and consolidating is consolidating, until the price breaks out upwards or downwards.

Price action traders typically need price confirmation before taking action. If they want to buy, they will wait for some signs indicating that the price is starting to turn upward. Note that this does not mean waiting for a massive rally; just seeing some evidence of price turning is sufficient.

Next, we need to understand trends.

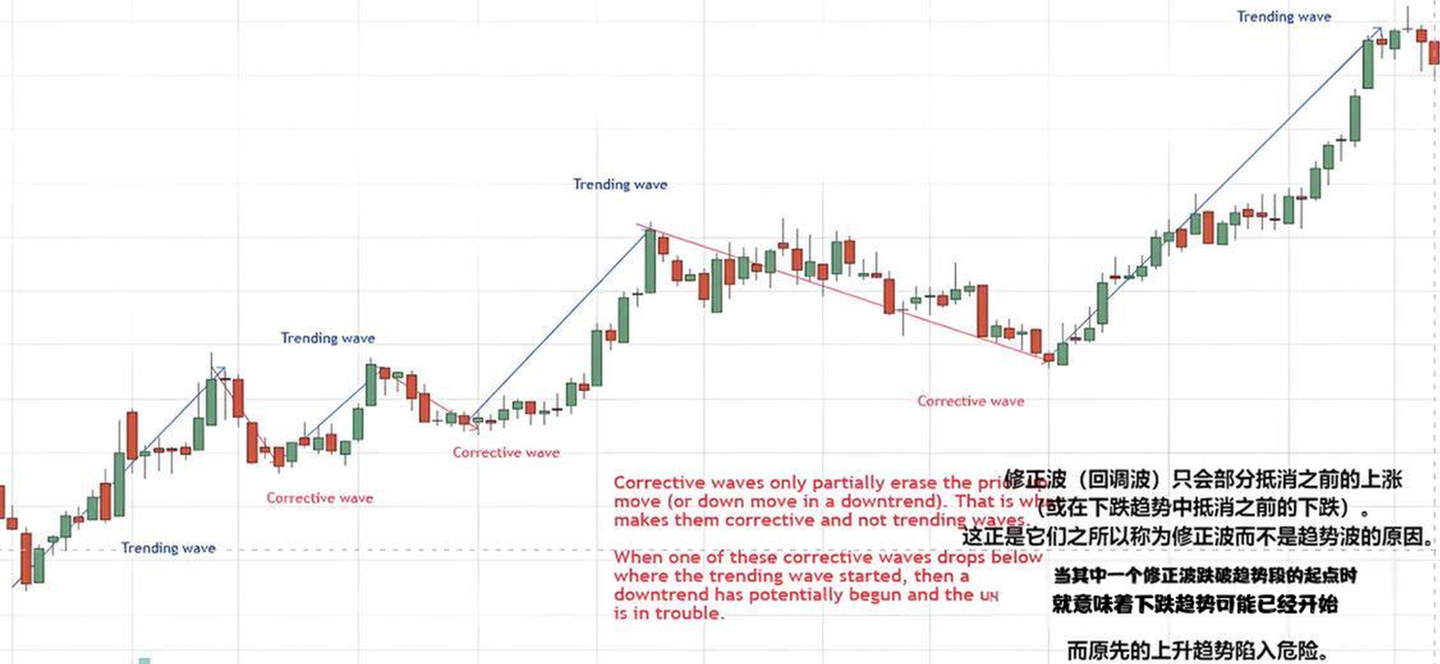

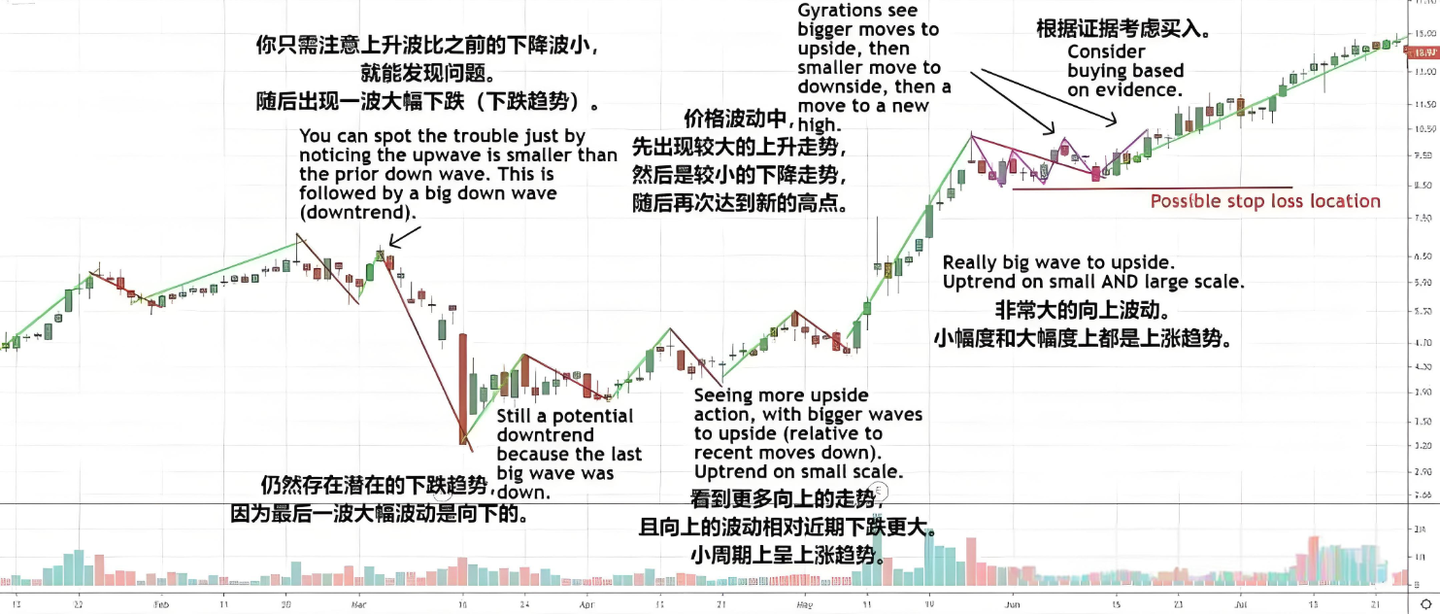

◔ Trends form because trend waves are greater than retracement waves. So, how do we distinguish between trend waves and retracement waves? Look at their relative amplitudes.

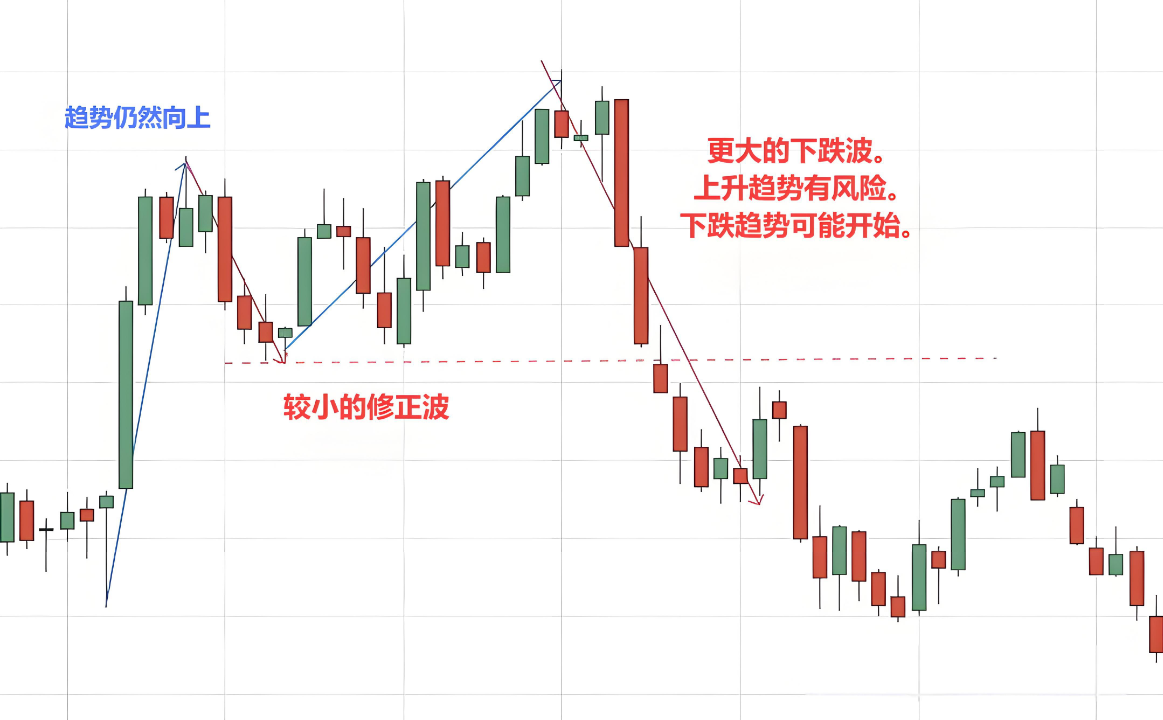

Trend waves must be larger than retracement waves; otherwise, the price will not 'advance'. When a retracement wave becomes as large as the previous trend wave, it usually means the trend may be reversing or the market may be entering a consolidation phase. The reason is that to form a trend, the retracement wave must be smaller than the trend wave; once the retracement wave is too large, the trend becomes questionable.

In the upper chart (and all charts), the waves contain smaller waves inside. For example, an extended retracement wave will contain many small upward and downward movements. Therefore, this retracement wave will also form smaller trend waves and retracement waves than the previous large trend waves. More details will be discussed further below.

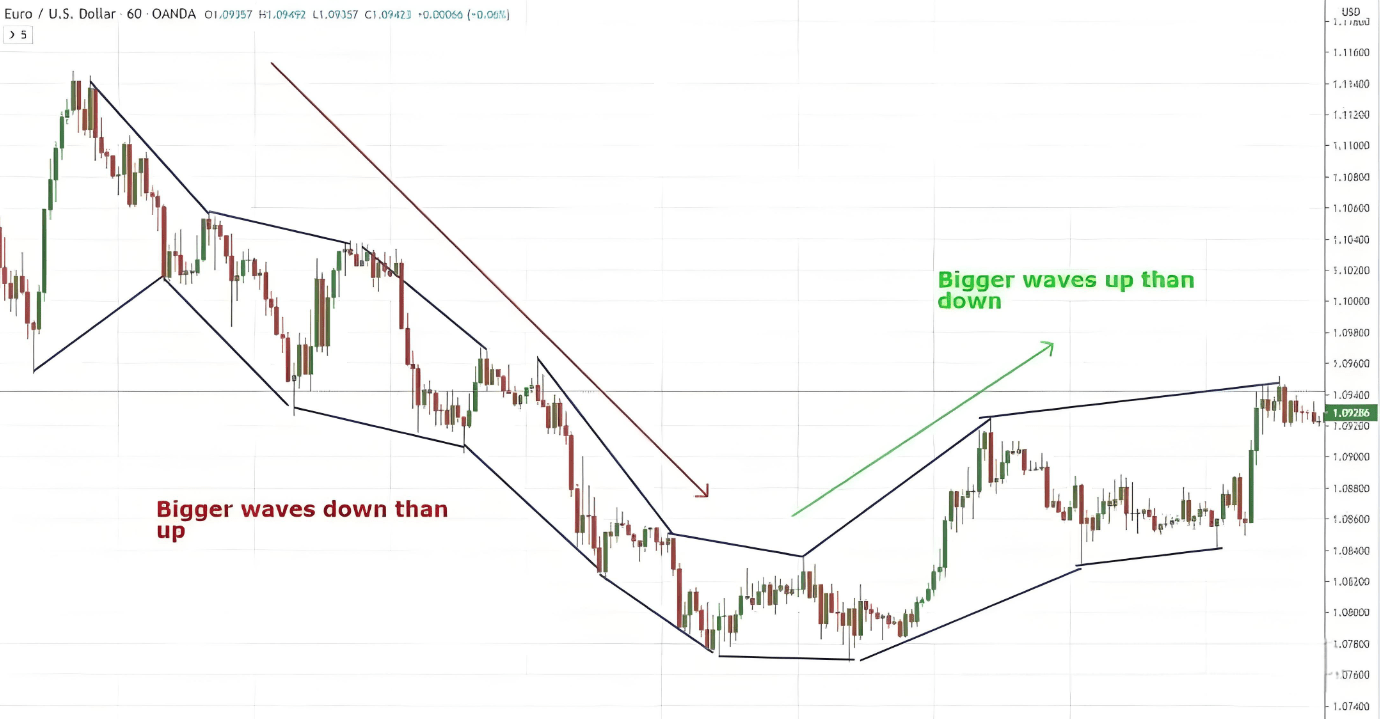

As the price chart progresses, trends can reverse as the downward waves begin to become larger than the upward waves.

We continuously analyze the amplitude of price fluctuations to help determine the strength of the trend, whether the trend is in question, and when the trend is reversing.

◔ Waves can also be further broken down into structures I call 'micro-waves'. They are small oscillations within trend waves and retracement waves. These micro-waves will also form trend waves and retracement waves, but at smaller levels. Each trader needs to determine their own 'level' (which differs from chart time frames), that is, to find out which fluctuation scales are important to them. Those occurring within these major fluctuations are micro-waves.

These micro-waves can also be analyzed based on the scale of fluctuations.

◔ If the trend is downward (the most recent trend wave is downward) and the price is retracing upwards, we can observe the larger downward wave and smaller upward waves within the micro-waves. This helps assess that the retracement is exhausting, and the downward trend may soon resume. Once the price begins to fall, the analysis is validated.

◔ If the trend is upward (the most recent trend wave is upward) and the price is retracing downward, observe the larger upward waves and smaller downward waves within the micro-waves. This indicates that the downward retracement is losing strength, and the upward trend may soon resume. The price must move upward to confirm the analysis.

To better understand these, we can connect swing highs to other swing highs and connect swing lows to other swing lows. By connecting highs to highs and lows to lows, we can see how the trend angle changes and be able to see the changes in the trend more clearly and intuitively.

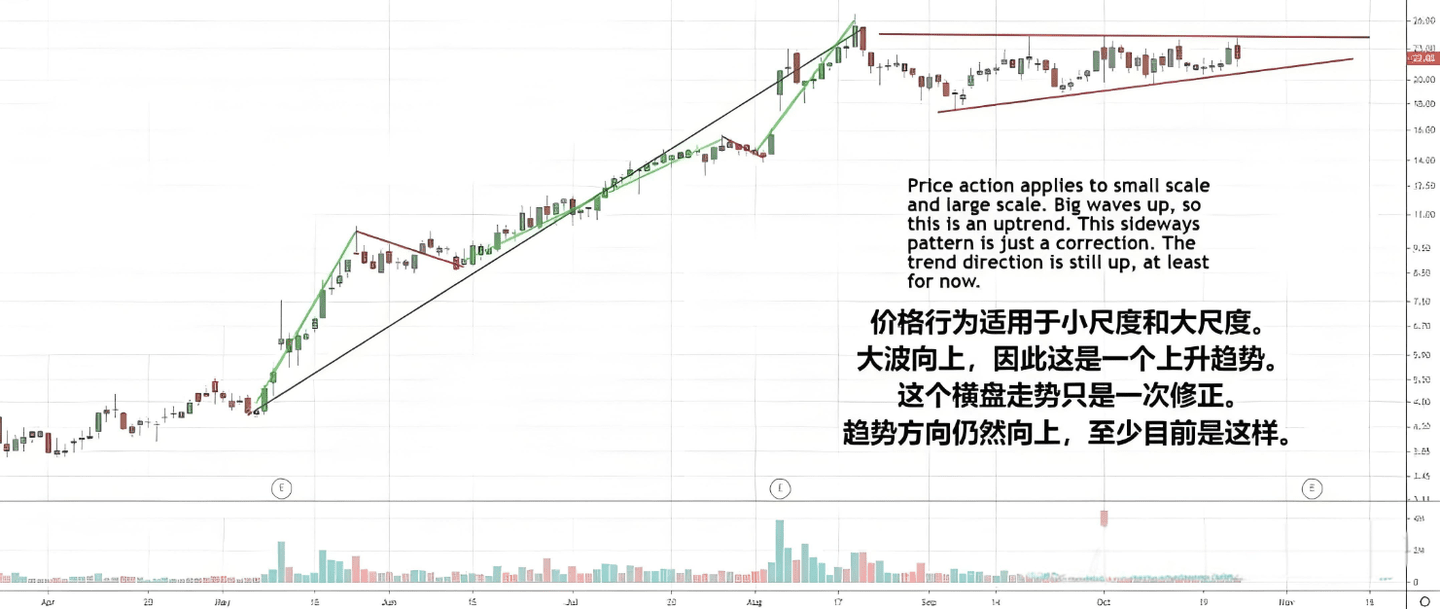

We must also remember that the concept of price action can be applied on a large scale (observing overall price fluctuations) or on a small scale (observing each minor movement). The chart below shows the overall concept from a large scale perspective.

The above chart shows the larger green 'trend upward fluctuation' and the smaller red 'retracement fluctuation'. The triangle pattern on the right may seem confusing: the price does not appear to be creating higher swing highs, making it look like the trend has ended. However, all fluctuations within the triangle are smaller than the previous upward fluctuations. Thus, the entire triangle is still just a retracement fluctuation.

If small upward fluctuations within a triangle begin to grow, it may indicate that buying pressure is increasing (which will lead to a breakout upwards). Conversely, if downward fluctuations begin to grow, it may indicate that selling pressure is increasing (leading to a breakout downwards).

Apply the concept of price action to trading.

Typically, we want to trade in the direction of the trend waves, which is the trend direction. Trading in the direction of the largest fluctuations can bring the greatest profit potential... because those fluctuations are larger. The amplitude of the retracement wave is smaller, leaving less room for profits.

If the price is very volatile, with severe, large movements in both directions, I might also trade both ways. Trend waves may still be larger, but in such an environment, retracement waves may also offer considerable profit potential.

Once the trend direction is determined, this is usually the direction we want to trade. The trend direction does not mean that a nice, easily recognizable uptrend or downtrend appears on the chart; rather, most people's understanding of 'trend' is quite the opposite. But the true meaning of the trend direction is that at least one 'trend wave' (larger fluctuation) has occurred in a certain direction. Then, based on our strategy, we can observe entry opportunities in that direction.

Next, we will closely observe the retracement waves. Once the small fluctuations during the retracement provide clues indicating that the retracement is losing momentum, we will prepare to strike. Once the price moves again in the direction of the trend, we will enter trades in the direction of the trend wave. This concept is difficult to present and explain with just one chart. Additionally, these concepts can have various different applications.

Here is an example on a trading chart.

Stop losses should be set outside the retracement low/high or according to the position specified by the strategy used.

"Cup and handle pattern" is an example of a stock trading strategy based on price action concepts.

The intraday high and low trading strategy for EUR/USD is also a method based on price action.

This is where the strategy works. You can analyze price action, but you need to clearly specify what must happen to trigger a trade (i.e., the specific criteria that prompt you to click the buy or sell button).

If you start trading based on price action but always ask yourself, 'Is this a valid trade?', it indicates that your strategy is still not refined enough, and you need to make it more precise.

Practice price action analysis.

Practicing price action analysis takes time, but it is not difficult. The key is to be able to analyze what is happening in the market instantly. This way, no matter what the price does, you know what you will (or will not) do. You are always thinking ahead.

◎ Open a random chart.

◎ Look back into history.

◎ Draw lines on large fluctuations (trending fluctuations) and small fluctuations (retracement fluctuations).

◎ Connect swing highs to highs and swing lows to lows.

◎ Our main goal is to determine which direction to trade and what needs to happen to prompt us to enter.

◎ Pay attention to trend direction. This is usually the direction of our trade.

◎ Monitor retracements/corrections to find trading opportunities. Small fluctuations often help assess when a retracement is losing momentum. Alternatively, you can simply think: what signs can confirm that the price is returning to the trend direction (thus proving it is worthwhile to trade)?

◎ We do not need to trade every price fluctuation! Only when price action provides evidence that a trade is worthwhile (even if just for practice) should we consider trading.

◎ Small consolidations, also known as contractions or consolidations, are common trading trigger patterns. When the price breaks through the consolidation or contraction area in the direction of the trend wave, opportunities may arise.

◎ Pay attention to both large fluctuations (big waves) and small fluctuations (small waves) at the same time. This does not mean looking at different time frames. I usually do not monitor multiple time frames for trading. Within a single time frame, you can also see large fluctuations and their small oscillations.

◎ You should always be thinking:

What must happen to cause a trend reversal?

What must happen to indicate the end of the retracement?

What must happen to trigger my trade?

◎ Practice on the chart by revealing price actions by scrolling one candlestick to the right each time.

◎ After you improve, try practicing with real-time price data in a demo account.

False breakout

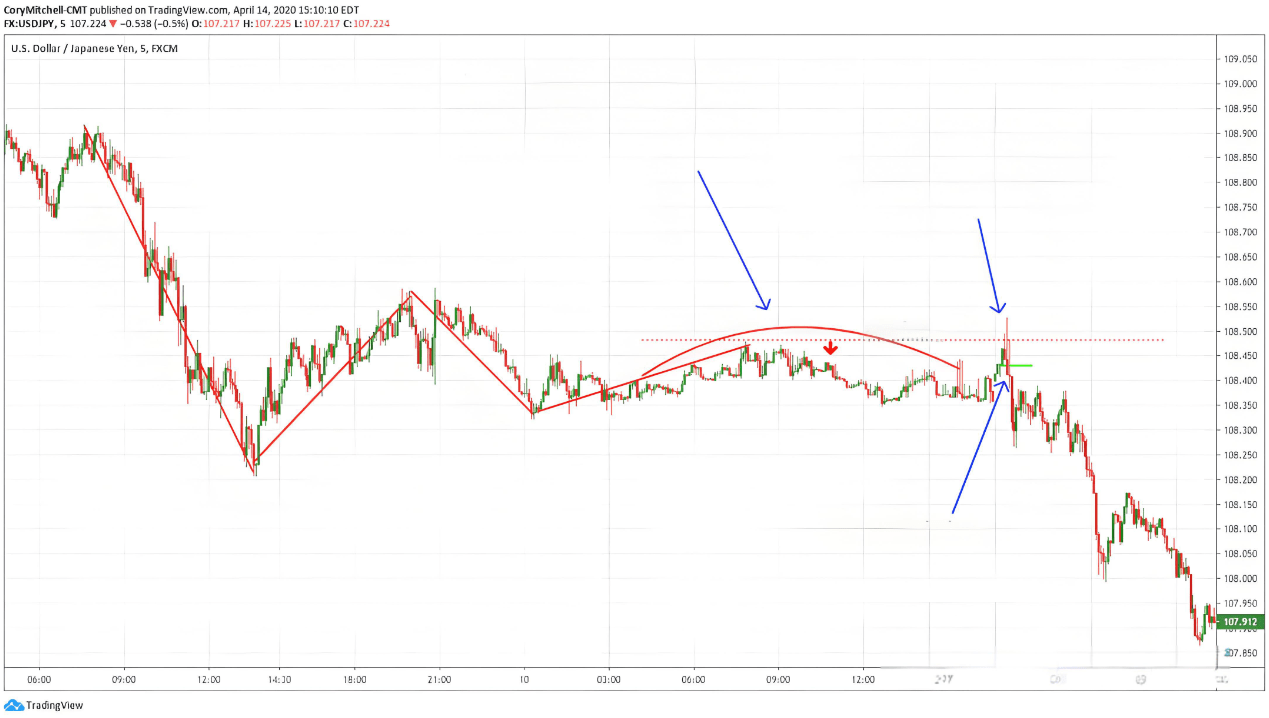

False breakouts are very important for price action traders. Sometimes, you will monitor a retracement wave. For example: the trend is downward, and currently in an upward retracement wave. Small fluctuations begin to show that the upward retracement is nearing its peak: we see larger downward fluctuations and smaller upward fluctuations, and the price begins to fall again. Our strategy tells us to set a stop loss above the high of the retracement and short.

The price suddenly spikes up, triggering our stop loss, but then quickly drops. At this point, you can choose to short again.

USD/JPY 5-minute chart

False breakouts can happen. Sometimes the price will make a brief, rapid surge in the opposite direction, but if this surge fails quickly and all signs still point to lower prices, we hope to re-enter this trade. Price action still shows downward potential. The concept associated with false breakouts is false reversals. This refers to trends that seem to be reversing but then quickly return to the original trend direction.

Price action will still produce losing trades.

Trading based on price action does not mean we are always right. In fact, trading is not about right or wrong. The core of trading is to follow a set of strategies to achieve profitability over multiple trades. The outcome of any single trade is insignificant. Like any strategy, we are just waiting for signals that can provide a profitable edge in a large number of trades.

We cannot control what the market will do. All we can do is trade what is happening in front of us. Sometimes we encounter very perfect shapes, but the price moves in the opposite direction. This does not mean our analysis is wrong. This is why we set stop losses. Prices never 'should' behave a certain way; they only operate in their own manner. We incorporate new price changes into our analysis and keep moving forward. Observe its performance, and act accordingly.

Price action trading emphasizes adaptability. Price movements may show a downward trend, but then a sharp rally may occur. This is unpredictable—and we do not need to predict. Profits come from timely stop losses and allowing those trades that are developing smoothly to continue running (for bigger profit targets or moving stop losses).

When the price turns, it is telling us something. Think objectively about what it is telling you. Do not think about winning or losing; focus only on the direction of price fluctuations. Plan what you should do (or not do) based on what happens.

Most importantly, if you want to master price action trading, you must practice continuously!

This is the trading experience that Yan An shared with everyone today. Many times, you lose many opportunities to make money due to your doubts. If you don't dare to try boldly, to engage, to understand, how will you know the pros and cons? You will only know how to proceed with the next step after taking the first step. A cup of warm tea, a piece of advice, I am both a teacher and a good friend who loves to chat.

Meeting is fate, knowing is parting. I firmly believe that fate can bring us together across thousands of miles, while parting is determined by heaven. The journey of investment is long; momentary gains and losses are just the tip of the iceberg along the way. Remember that even the wisest may overlook something, while the foolish may gain. No matter how emotions fluctuate, time will not pause for you. Put aside your worries and stand up to continue moving forward.

The martial arts secret has been given to you all; whether you can make a name for yourself in the world depends on yourself.

These methods must be saved and reviewed multiple times. If you find them useful, please share them with more people around you who are trading cryptocurrencies. Follow me for more practical insights in the crypto world. Having been through the rain, I am willing to hold an umbrella for the retail investors! Follow me, and let us walk together on this crypto journey!