The expert trading signal for DUSK is currently bullish, with an opportunity zone for scalping and swing. The indicators show a 21% recovery amid a bearish market, supported by technical patterns and fundamentals such as the launch of DuskEVM in November 2025, which generates speculative potential in the short and medium term.

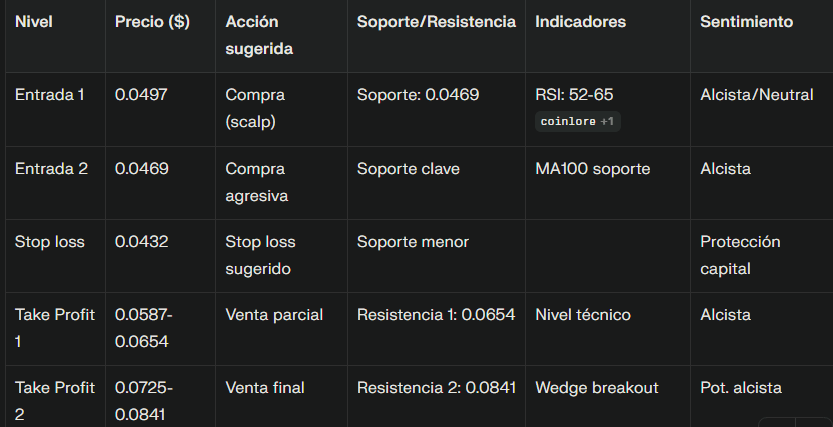

Professional signal table $DUSK

Current financial analysis

DUSK broke an 8-month bearish trend and shows technical reversal signals with bullish MACD and RSI above 50.

The key support is at 0.0469, with recent bounces consolidating momentum; if that level is lost, the price could target 0.0432.

The launch of DuskEVM fundamentally promises to add institutional value, so any strong pullback could be a buying opportunity for holding.

The daily RSI moves between 52 and 65, indicating buyer strength, but without overbought conditions.

High volatility projection: likely range for November between 0.048 and 0.065, with extended targets in case of a breakout at 0.0725 and 0.0841.

Suggested operational summary

Preferred strategy: Gradual buying on pullbacks towards 0.0497 and 0.0469, stop at 0.0432. Take progressive profits at 0.0587-0.0654 and 0.0725-0.0841 if there is a breakout.

Positive fundamentals (DuskEVM, institutional accumulation).

Adjust stops according to intraday volatility and use strict risk management.

This signal is suitable for both scalping and swing trading with a professional approach, combining high-quality technical and fundamental analysis.